Audit Exemption In Malaysia

Issued pursuant to section 20c of the companies commission of malaysia act 2001 and subsection 267 2 of the companies act 2016 ca 2016 this practice directive rolls out the qualifying criteria for private companies from having to appoint an auditor in a financial year i e.

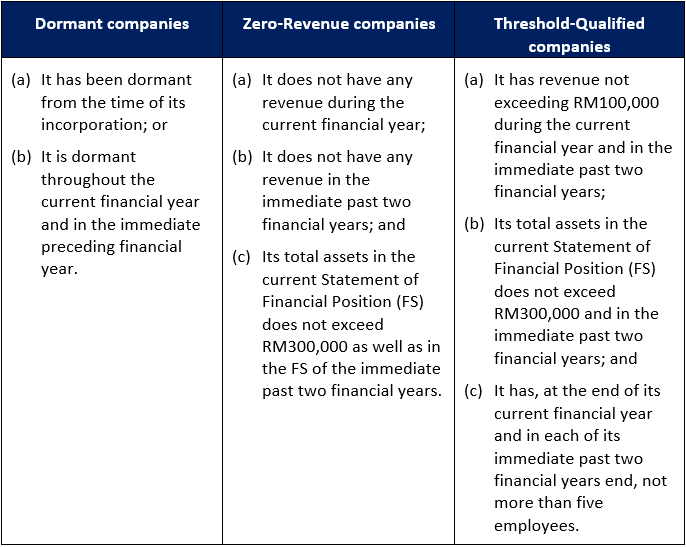

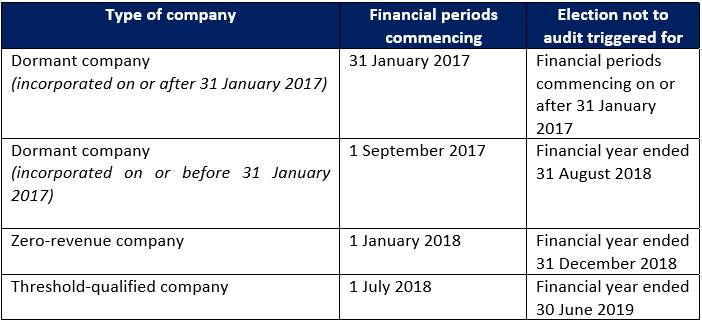

Audit exemption in malaysia. Audit exemption of malaysia private companies print ready version on 4 august 2017 the registrar of companies in malaysia ccm or the registrar issued a practice directive setting out the qualifying criteria for private companies incorporated in malaysia from having to appoint an auditor in a financial year practice directive. Qualifying criteria for audit exemption for certain categories of private companies 1. The practice directive entitled qualifying criteria for audit exemption for certain categories of private companies revealed that dormant companies zero revenue companies and threshold qualified companies would be eligible for audit exemption. Currently a company is exempted from having its accounts audited if it is an exempt private company with annual revenue of 5 million or less.

The companies commission of malaysia ccm has released a directive setting out the category and criteria for audit exemption. We foresee three major problem with audit exemption in malaysia amongst other smaller problems with not having an audited account. Malaysia company audit exemption has been the focus of wide debate and contemplation over the years. Ssm has issued practice directive no.

This practice directive is issued pursuant to section 20c of the companies commission of malaysia act 2001 and subsection 267 2 of the companies act 2016 ca 2016. On 4 august 2017 the companies commission of malaysia or ssm its malay acronym has brought into force audit exemption for certain categories of private companies. The companies commission of malaysia ssm has brought into force audit exemption for certain categories of private companies and had on 4 august 2017 issued a practice directive no. Feedbacks from stakeholders comprising 61 audit accounting related professional firms and 39 from the public showed that more than 65 of the respondents agreed with the audit exemptions proposal.

Additionally the criteria adopted by the registrar is also coupled with safeguards of allowing shareholders holding not less than 5 of the total voting shares to require the company to have its. 3 2017 to set out the qualifying criteria for private companies to be exempted from appointing an auditor for a financial year. 1 banks may reject your financing application this is because banks will usually depend on audited financial statement to do risk assessment before granting any loan facility.