Business Income Tax Malaysia Format

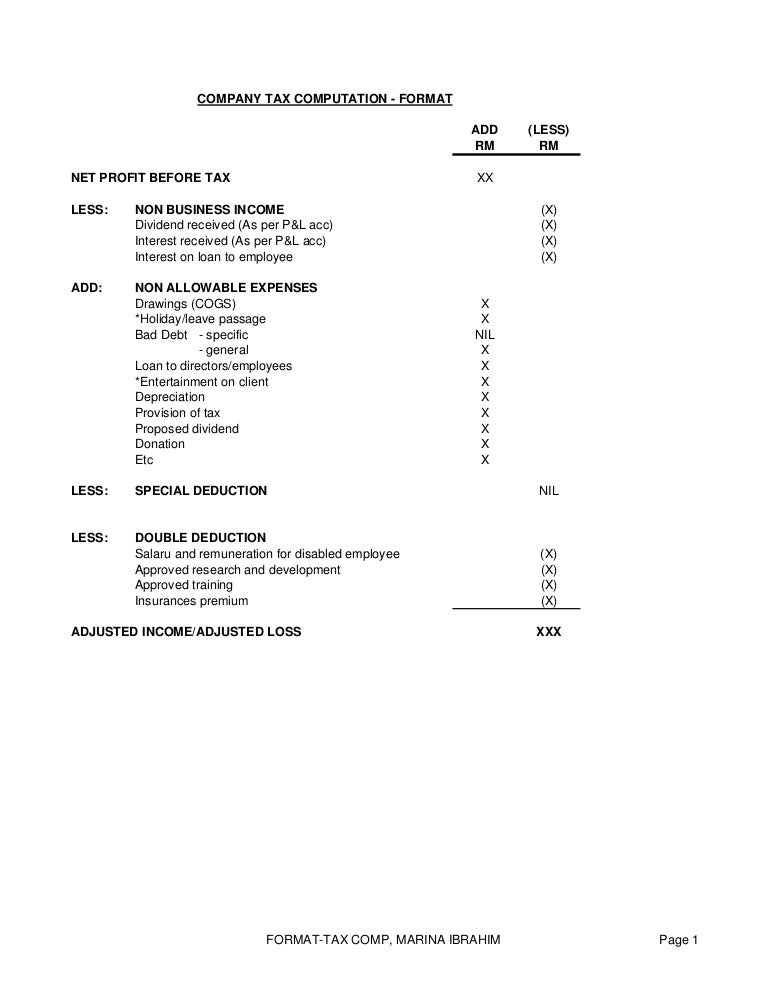

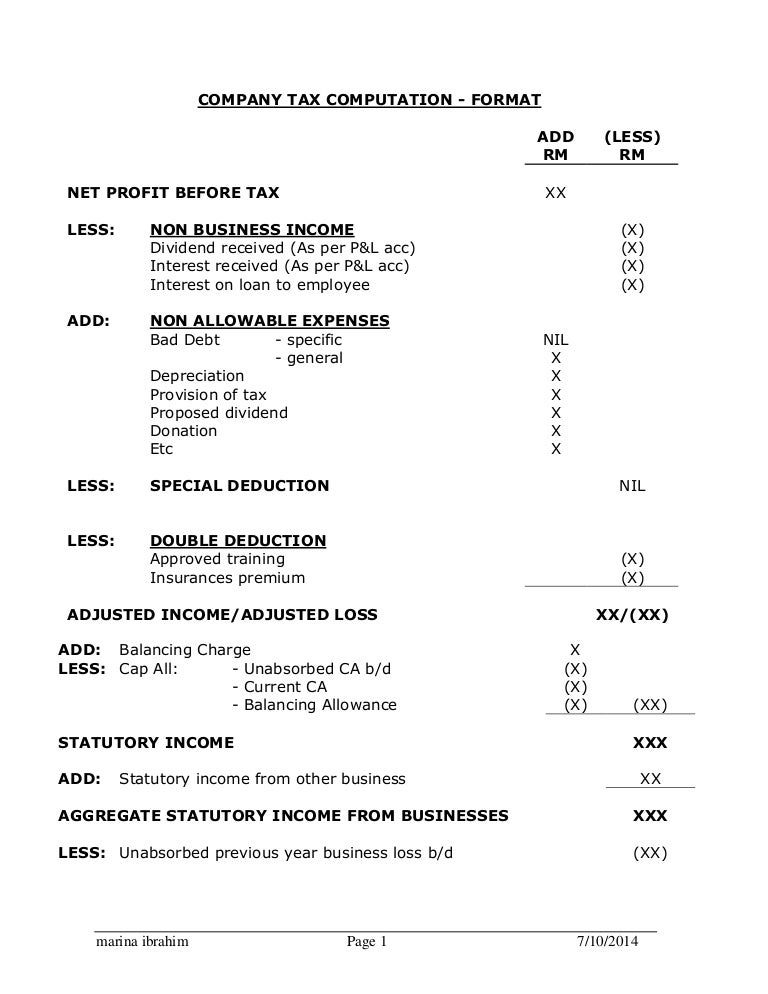

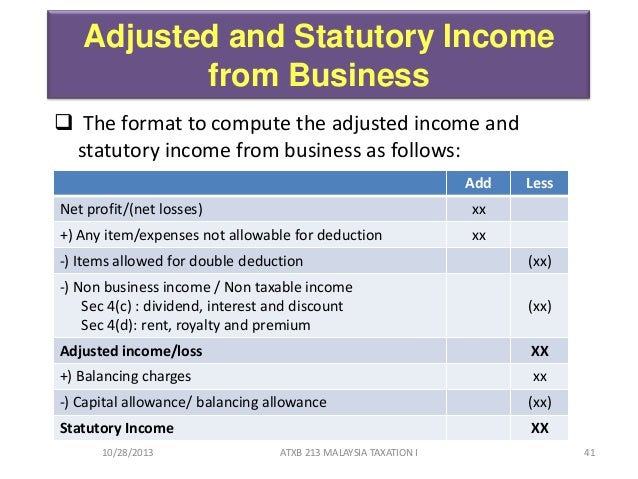

Non business income x dividend received as per p l acc x interest received as per p l acc x interest on loan to employee x add.

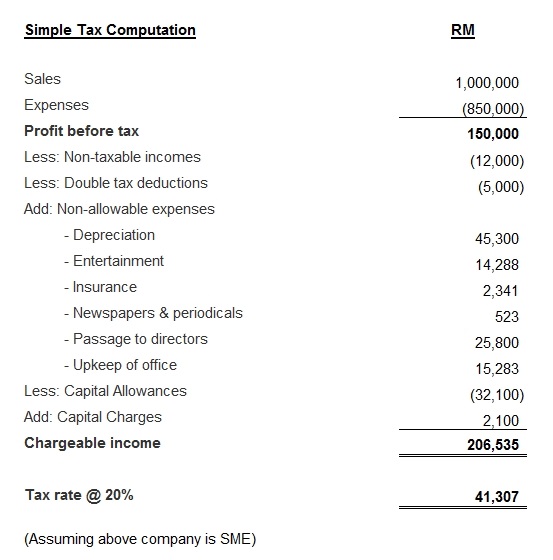

Business income tax malaysia format. You make payment on income generated the previous year i e. No other taxes are imposed on income from petroleum operations. Tax submitted in 2017 is for 2016 income. Accelerated capital allowance is available for certain types of industrial building plant and machinery some of which include buildings used as a warehouse buildings used as a school or an educational institution computers information technology equipment environmental protection equipment waste recycling equipment and.

There are no other local state or provincial. Petroleum income tax is imposed at the rate of 38 on income from petroleum operations in malaysia. The cheapest way is to make an excel document and log in income and expenses. Is all income accruing in or derived from malaysia or received in malaysia from sources outside malaysia whether that income is the subject of charge to tax or not to enable a proper assessment to be made and to give those deductions reliefs reductions refunds and exemptions applicable.

4 keep tally of business income expenses and receipts. Sort it by month and year. If you re still unsure which type of business you should register as we recommend checking out our article on the different types of business entities in malaysia. An effective petroleum income tax rate of 25 applies on income from petroleum operations in marginal fields.

Thereby no separate tax return file is needed sole proprietorships in malaysia are charged the income tax on a gradual scale applied to individual income from 2 to 26. In budget 2020 it is proposed that the first chargeable income which is subject to the concessionary income tax rate of 17 be increased from rm500 000 to rm600 000. Once you ve registered your side business it will be recorded on form b. Restrictions apply on maximum qualifying capital expenditure.

Otherwise you can also pay an accounting service and log all the info in there google accounting small business malaysia. Non allowable expenses drawings cogs x holiday leave passage x bad debt specific nil general x loan to directors employees x entertainment on client x depreciation x. A sole proprietorship in malaysia makes no difference between the natural person who owns it and the business sole proprietorships are pass through entities. All profits and losses go directly to the business owner.

Company tax computation format add less rm rm net profit before tax xx less.