Business Income Tax Malaysia

It should be highlighted that based on the lhdn s website for the assessment year 2020 the max tax rate stands at 30.

Business income tax malaysia. The proportion of interest expense will be allowed against the non business income. Deduction of tax from gains or profits in certain cases derived from malaysia 109 g. 4 keep tally of business income expenses and receipts. Sort it by month and year.

Both your employment and business income can be captured on this form. An effective petroleum income tax rate of 25 applies on income from petroleum operations in marginal fields. Once you ve registered your side business it will be recorded on form b. The corporate income tax rate is 24 per cent reduced in 2016 from an earlier 25 per cent tax rate.

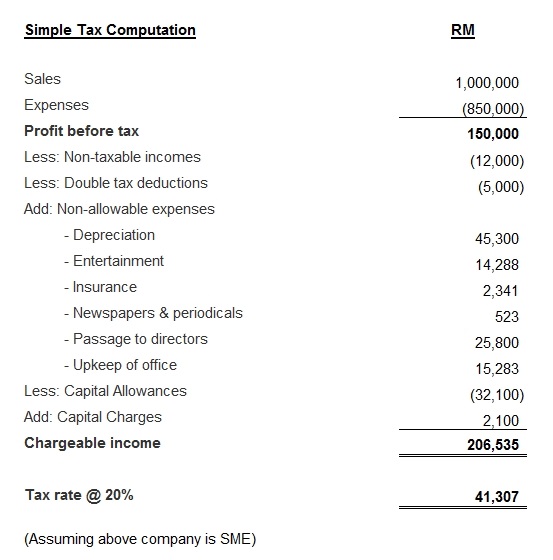

Listed below are the progressive income tax rates for the year of assessment 2020. Smes resident small and medium enterprises companies incorporated in malaysia with paid up capital of rm2 5 million s 822 000 or less get a concessionary tax rate of 18 per cent on the first rm500 000 of their chargeable income. This page provides malaysia corporate tax rate actual values historical data forecast chart statistics economic calendar and news. No other taxes are imposed on income from petroleum operations.

The corporate tax rate in malaysia stands at 24 percent. There are no other local state or provincial. Capital allowance tax depreciation on industrial buildings plant. For non residents in malaysia the income tax rate ranges from 10 28 for ya 2019.

Otherwise you can also pay an accounting service and log all the info in there google accounting small business malaysia. Is all income accruing in or derived from malaysia or received in malaysia from sources outside malaysia whether that income is the subject of charge to tax or not to enable a proper assessment to be made and to give those deductions reliefs reductions refunds and exemptions applicable. Therefore income received from employment exercised in singapore is not liable to tax in malaysia. The cheapest way is to make an excel document and log in income and expenses.

Corporate tax rate in malaysia averaged 26 21 percent from 1997 until 2020 reaching an all time high of 30 percent in 1997 and a record low of 24 percent in 2015. For deductibility of interest expense in a cross border controlled transaction. Generally income taxable under the income tax act 1967 ita 1967 is income derived from malaysia such as business or employment income. If you re still unsure which type of business you should register as we recommend checking out our article on the different types of business entities in malaysia.

Deduction of tax on the distribution of income of a unit trust 109 e. Deduction of tax from income derived from withdrawal of a deferred annuity or a private retirement scheme 109 h.