Challenges Faced By Islamic Banking In Malaysia

On the m ajor issues and challenges faced by islamic banks in the 21 st century.

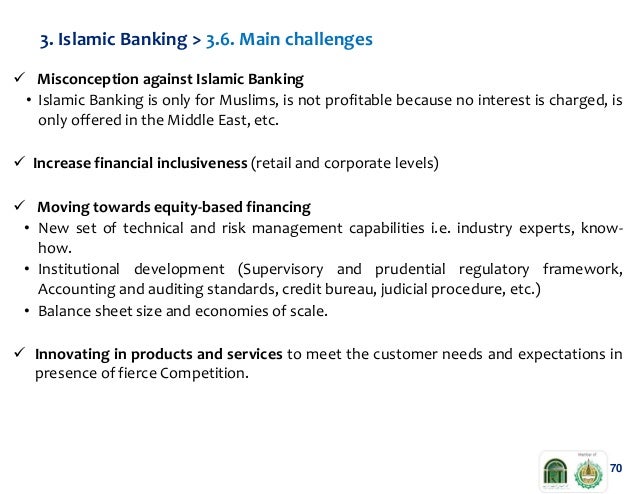

Challenges faced by islamic banking in malaysia. In spite of the growth potential in islamic banking there are several challenges facing islamic financial institutions. According to ram ratings malaysia was the top sukuk issuer with us 13 9 bil ringgit equivalent or 35 1 of the us 39 5 bil ringgit equivalent sukuk issued in the first quarter ended march 31 2019. Shortage of experts in islamic banking. The supply of trained or.

Malaysia has recorded 17 3 growth of islamic finances market between 2009 2014 mifc 2015a. Islamic banking and finance in malaysia system issues and challenges sep 04 2020 posted by georges simenon ltd text id 26897dc3 online pdf ebook epub library islamic banking and finance ii highlights various studies on fast growing islamic finance industry it focuses specifically on islamic banking and islamic capital market. 965 977 2013 967 turnover is estimated to be usd 70 billion compared to a mere usd 5 billion in 1985 and this is projected to grow further zamir iqbal 1997. Many regulators treat these as deposits which undermines their loss and liquidity absorbency feature.

Indeed islamic banking with the development of sukuk and the islamic capital market wealth management and takaful in malaysia and elsewhere is trying to offer alternative financing needs of society as opposed to the prevalent ribawi interest based system that is full of zulm oppression and exploitation. An important regulatory challenge is to ensure that profit sharing investment accounts psia at islamic banks are treated in a manner that is consistent with financial stability. When bank negara malaysia s banking and financial institutions act 1989 was amended in 1993 most conventional banks in malaysia started to set up full fledged islamic subsidiary. The islamic finance industry in malaysia is characterised by having comprehensive market components ranging from islamic banking takaful islamic money market and islamic capital market.

Islamic banks face a serious problem with late payments not to speak of outright defaults since some people take advantage of every dilatory legal and religious device. In most islamic countries various forms of penalties and late fees have been established only to be outlawed or considered unenforceable. It has tremendous potential to grow further in future.