Difference Between Pioneer Status And Investment Tax Allowance

A preferred area of investments may be declared pioneer if the activity.

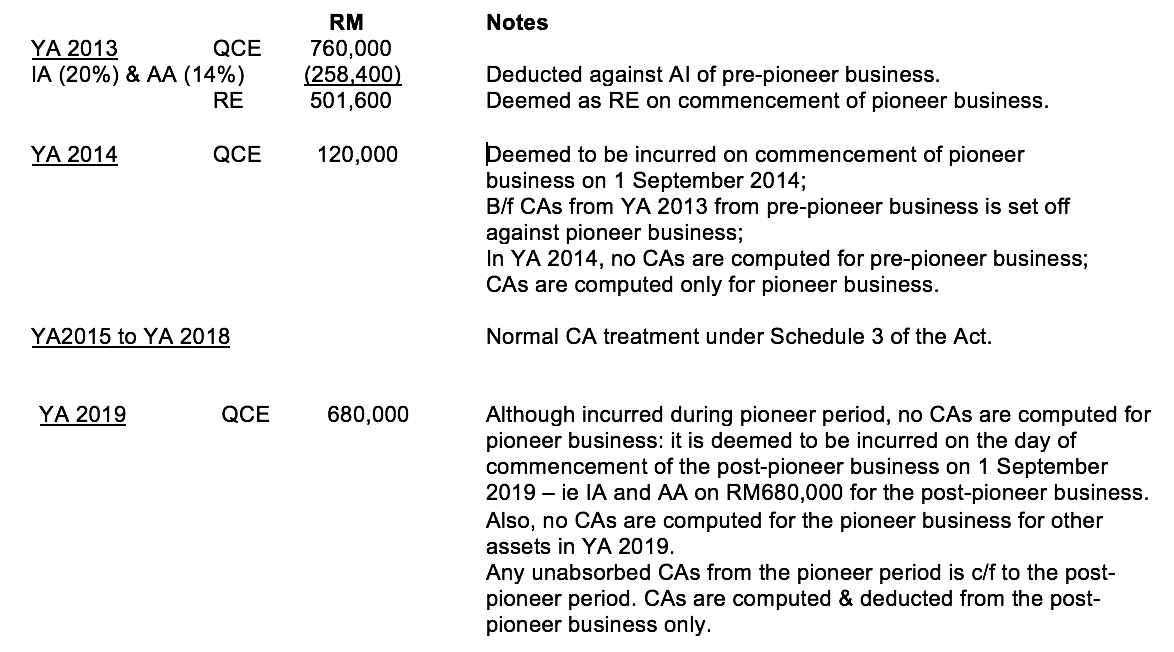

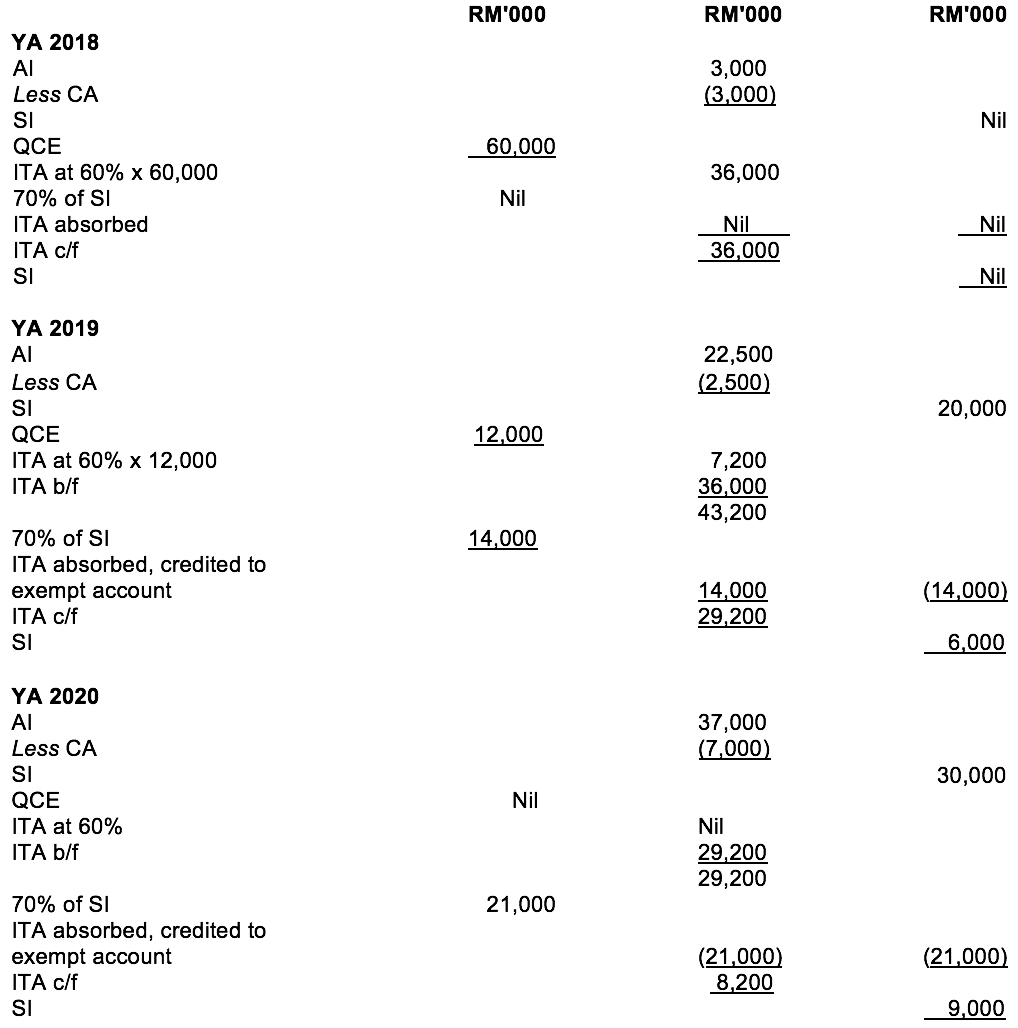

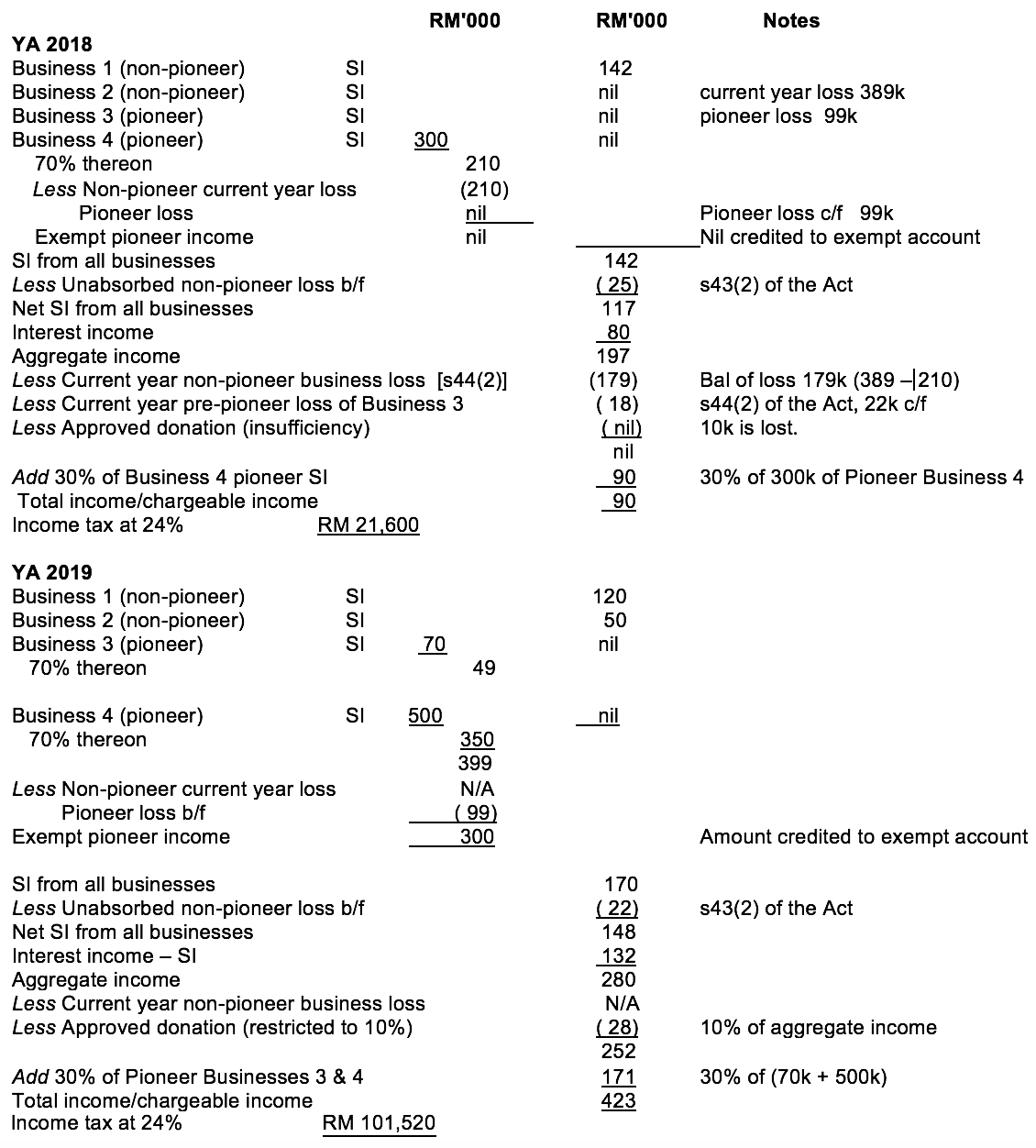

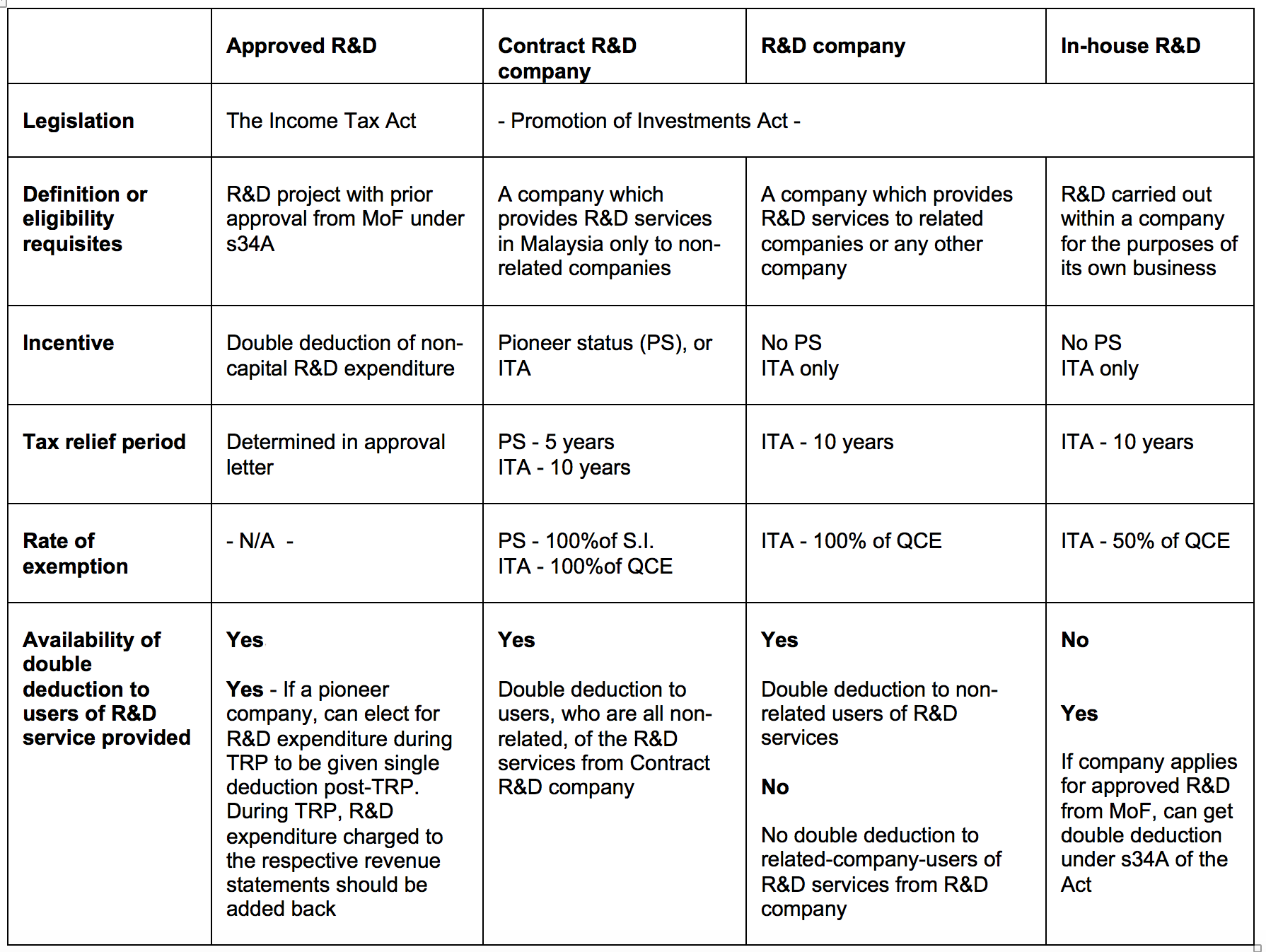

Difference between pioneer status and investment tax allowance. What is the difference between pioneer status and investment tax allowance a company approved with a pioneer. Candidates must first study closely the source authority for these incentives ie the relevant laws and the respective irb public rulings or guidelines where available to obtain a good general understanding. Investment tax allowance ita an allowance of 60 100 on qualifying capital expenditure factory plant machinery or other equipment used for the approved project incurred within 5 to 10 years from the date the first qualifying capital expenditure is incurred. Pioneer status ps and investment tax allowance ita companies in the manufacturing agricultural hotel and tourism sectors or any other industrial or commercial sector that participate in a promoted activity or produce a promoted product may be eligible for either ps or ita.

Involves the manufacturing or processing not merely assembly or packaging of goods or raw materials that have not been produced in the philippines on a commercial scale. Pioneer status and investment tax allowance are two of the main tax incentives available in malaysia. While pioneer status is an income based tax incentive investment tax allowance is a capital expenditure based one that generally provides for a. Income tax act 1967 or for any other reason but not so as to enjoy pioneer status.

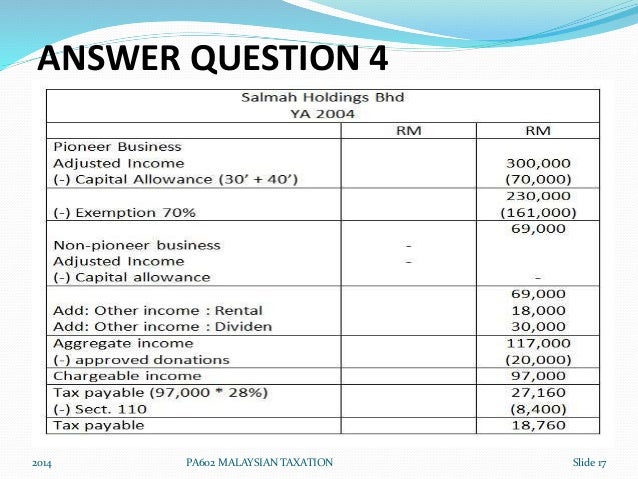

The unutilised capital allowances trade losses and donations can only be deducted against future income if companies satisfy the. We hear that these companies are given financial or fiscal incentives. Pioneer status often provides a 70 exemption of statutory income for a period of 5 years. Exempt and non exempt income ita is a capital expenditure based incentive which is given by way of an exemption of income.

Reinvestment allowance is not available to a company enjoying pioneer status or investment tax allowance. Iii pioneer status iv investment tax allowance and v reinvestment allowance. Understanding malaysia pioneer status and investment tax allowance for your business june 17 2009 by sabrie for those who are aware of the malaysian government s effort in promoting a selected industry ict for msc companies for example.