Difference Between Tax Avoidance And Tax Evasion And Tax Planning

Tax evasion is an unlawful way of paying tax and defaulter may punished.

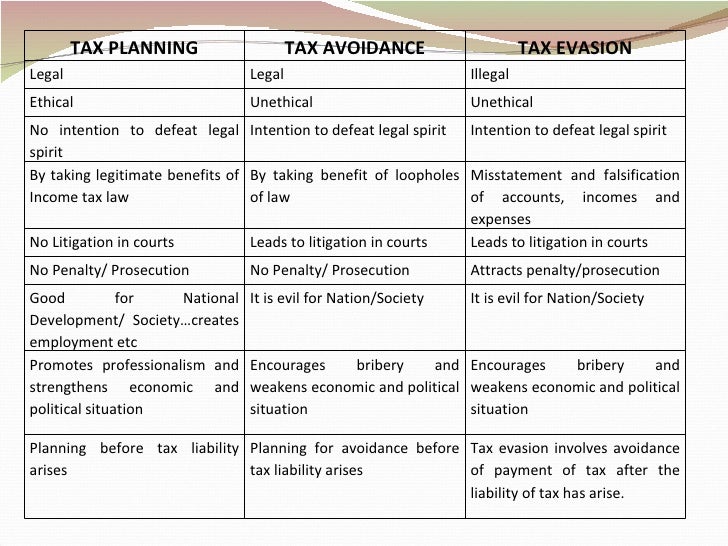

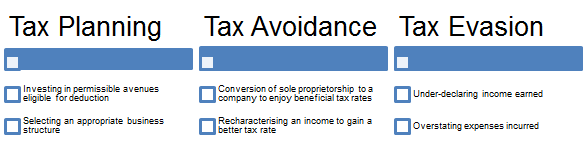

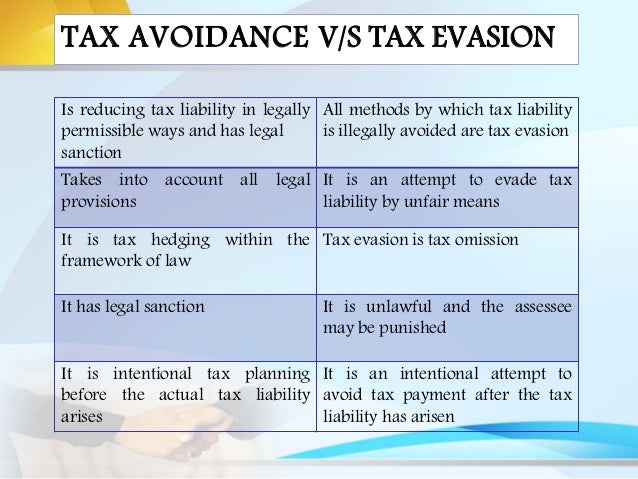

Difference between tax avoidance and tax evasion and tax planning. Difference between tax planning tax avoidance tax evasion. Tax avoidance refers to hedging of tax but tax evasion implies the suppression of tax. The difference between tax avoidance and tax evasion accessed apr. Criminal offence which involves the reduction of one s tax liability or obtainment of tax credits or refunds through illegal means such as the claim for fictitious or non existent expense or failure to declare taxable income.

A planning made to reduce the tax burden without infringement of the legislature is known as tax avoidance. Tax avoidance is lawful but in some cases it could come in the category of crime. Each term has been clarified quite obviously in our above mentioned sections. The difference between tax evasion and tax planning avoidance is relatively clear cut.

Tax avoidance can be done by adjusting the accounts in such a manner that there will be no violation of tax rules. Tax planning is an art to reduce your tax outgo by making sure that all the applicable provisions of our income tax act as designed to reduce your tax liability has been availed of. An unlawful act done to avoid tax payment is known as tax evasion. Businesses in search of saving tax often come up with those couples of terms.

Iv tax avoidance looks like a tax planning and is done before the tax liability arises. Tax evasion accessed april 27 2020. Tax evasion is blatant fraud and is done after the tax liability has arisen. The following are the major differences between tax avoidance and tax evasion.

Below are key differences between tax evasion tax avoidance and tax planning to help you get better understanding. Iii tax avoidance is done through not malafied intention but complying the provision of law. Tax crimes handbook page 2. Employment tax evasion criminal investigation ci accessed april 27 2020.

Accessed april 27 2020.

/tax-avoidance-vs-evasion-397671-v3-5b71dfc846e0fb0025e54177.png)