Difference Between Tax Avoidance And Tax Evasion Uk

But it should not be forgotten that tax avoidance is perfectly legal and used to a certain extent by most taxpayers.

Difference between tax avoidance and tax evasion uk. The terms tax avoidance and tax evasion are often used interchangeably but they are very different concepts. Businesses get into trouble with the irs when they intentionally evade taxes. The difference between tax avoidance and evasion is legality. A planning made to reduce the tax burden without infringement of the legislature is known as tax avoidance.

An unlawful act done to avoid tax payment is known as tax evasion. Tax avoidance is immoral that tends to bend the law without causing any damage to it. The quotation in the title comes from the ex chancellor of the exchequer dennis healey when he was asked the difference between tax avoidance and tax evasion. It s because there s a difference between tax avoidance and tax evasion.

Tax avoidance and tax evasion tax avoidance means exploiting legal loopholes to avoid tax. A highlight to note down is that tax avoidance is totally legal whilst tax evasion is not. Deliberate tax evasion on the other hand is illegal and a criminal offence. This article is an extract from james new book tax secrets for property developers renovators available from the property tax portal.

But taxes are the law. Tax avoidance refers to hedging of tax but tax evasion implies the suppression of tax. In other words taxpayers can use legitimate methods to reduce the amount of tax payable in association with their financial activities. One is illegal the other is legal though arguably immoral when done on a larger scale.

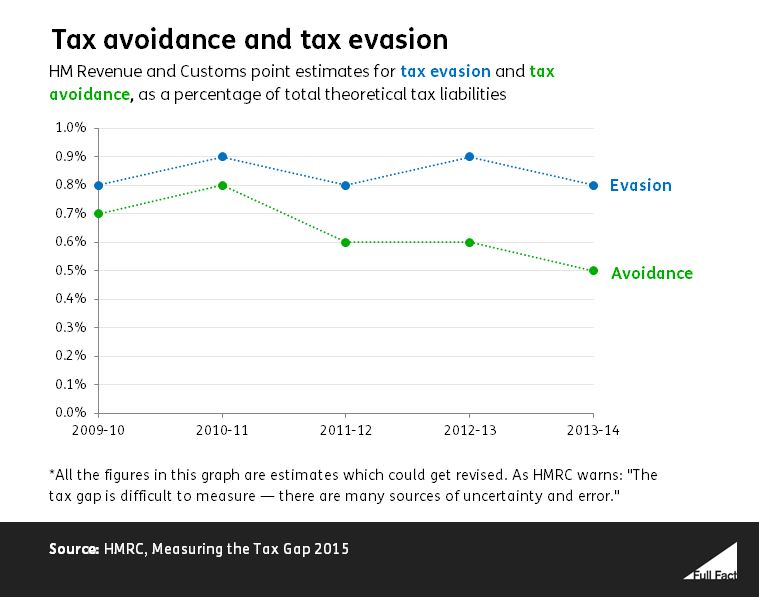

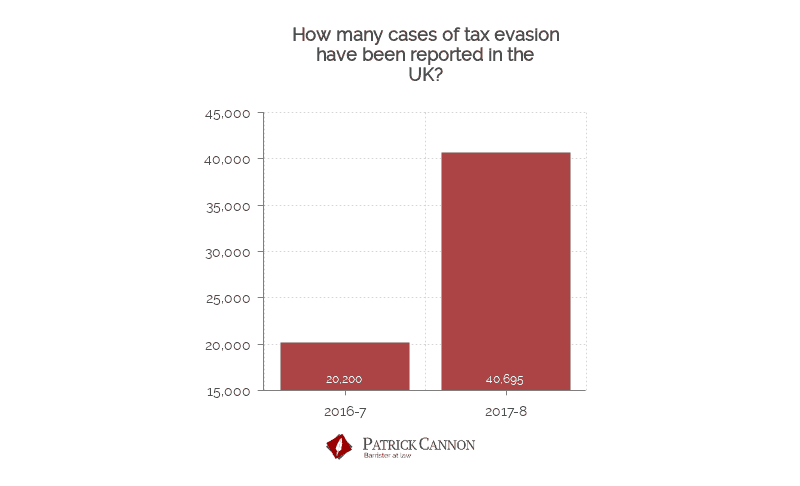

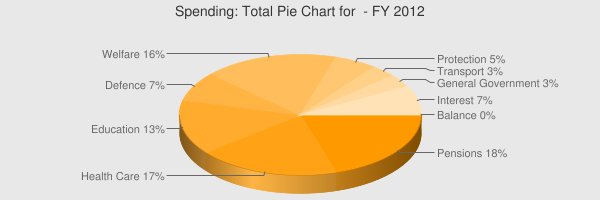

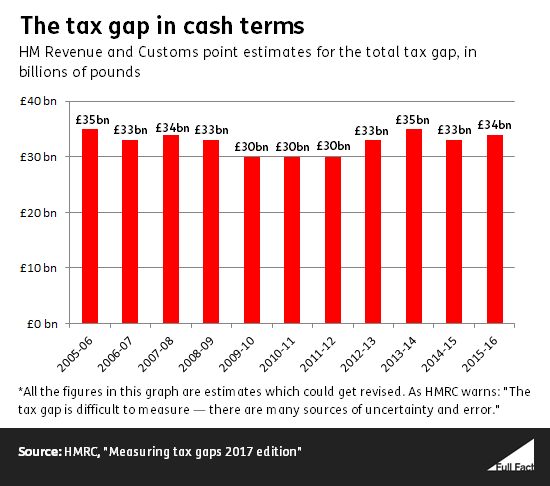

Tax avoidance is the act of minimizing tax liability within the limits of the law or without breaking the law. Tax evasion is the illegal practice of not paying taxes by not reporting income reporting expenses not legally allowed or by not. Over the last five years hmrc estimate that proportion of tax lost through tax evasion has stayed roughly the same whilst the proportion lost through tax avoidance appears to be falling. The main difference between tax evasion and tax avoidance lies in that tax evasion is illegal whereas tax avoidance is a legal method used to reduce tax payments that at times can be unethical in nature.

It is sometimes difficult to appreciate the difference between the two but in basic terms tax evasion is deliberately escaping from paying tax that should be paid whereas tax avoidance is the exploitation of rules in order to reduce the tax that would otherwise be paid.

/tax-avoidance-vs-evasion-397671-v3-5b71dfc846e0fb0025e54177.png)