Difference Between Tax Avoidance And Tax Evasion With Comparison Chart

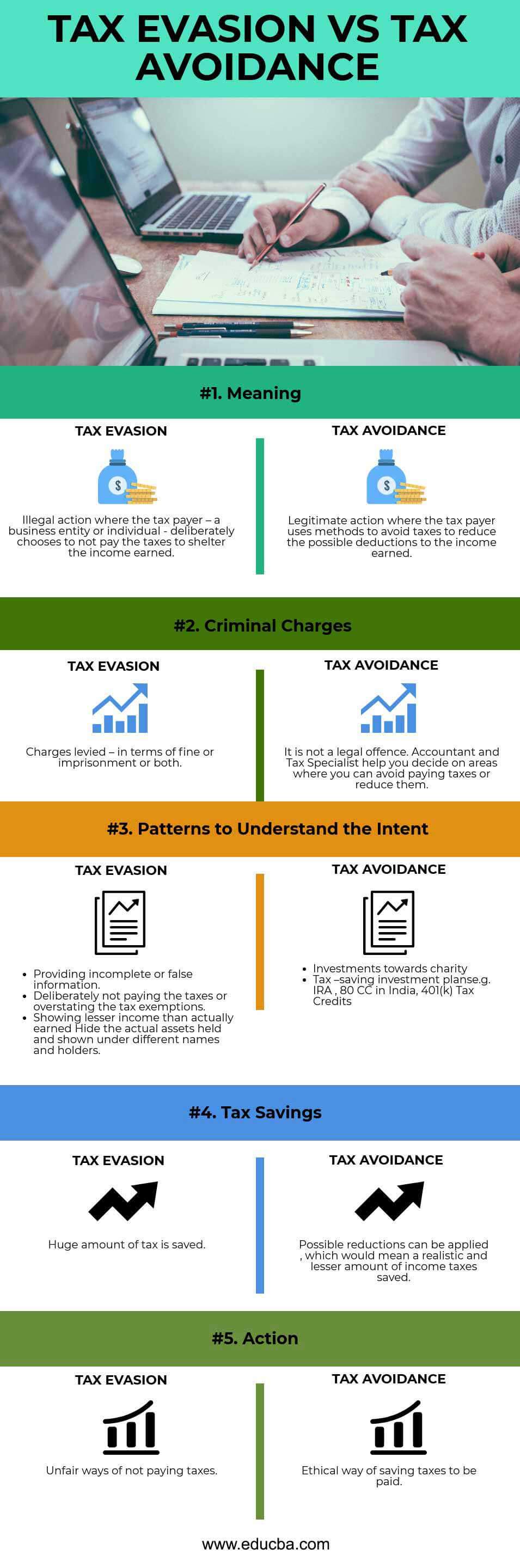

Key differences between tax evasion vs tax avoidance.

Difference between tax avoidance and tax evasion with comparison chart. Let us discuss some of the major differences between tax evasion vs tax avoidance. Tax avoidance refers to hedging of tax but tax evasion implies the suppression of tax. Tax evasion accessed april 27 2020. An unlawful act done to avoid tax payment is known as tax evasion.

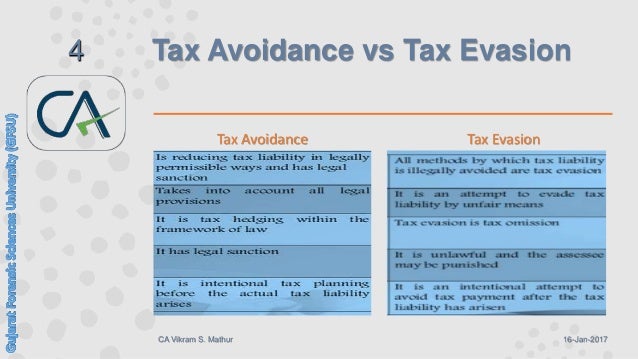

The difference between tax evasion and tax avoidance largely boils down to two elements. It is concluded from the above discussion that tax avoidance and tax evasion are those concepts which enables a person to avoid liability on his income tax charged. Employment tax evasion criminal investigation ci accessed april 27 2020. Tax avoidance is structuring your affairs so that you pay the least amount of tax due.

The difference between tax avoidance and tax evasion accessed apr. One concept is completely legal as provided under income tax act 1961 and another is a complete illegal. Cornell legal information institute. Tax evasion is a known fraud of not paying the liable taxes while tax avoidance is a well structured plan to identify methods to reduce the outflow towards tax payments.

Tax evasion refers to the adoption of illegal methods for reducing liability of payment of taxes such as manipulation of business accounts understating of incomes or overstating of expenses etc whereas tax avoidance is the legal way to reduce the tax liability by following the methods that are allowed in the income tax laws of the country. The following are the major differences between tax avoidance and tax evasion. Accessed april 27 2020. Tax evasion vs tax avoidance as tax avoidance and tax evasion are both methods used by individuals and businesses to minimize or completely avoid the payment of taxes one should be able to recognize the difference between tax evasion and tax avoidance while these concepts may sound similar to one another there are a number of differences between tax evasion and tax avoidance.

Tax crimes handbook page 2. The distinction between tax planning avoidance and evasion has been a long discussed topic in the field of taxation law and one of the foremost indian case in which the discussion was taken up was in the landmark case of mcdowell co. A planning made to reduce the tax burden without infringement of the legislature is known as tax avoidance. Commercial tax officer wherein justice reddy stated much legal sophistry and judicial exposition both in england and india have gone into the.

The difference between tax avoidance and evasion is legality.

/tax-avoidance-vs-evasion-397671-v3-5b71dfc846e0fb0025e54177.png)