Difference Between Tax Avoidance And Tax Evasion With Examples

What is tax evasion.

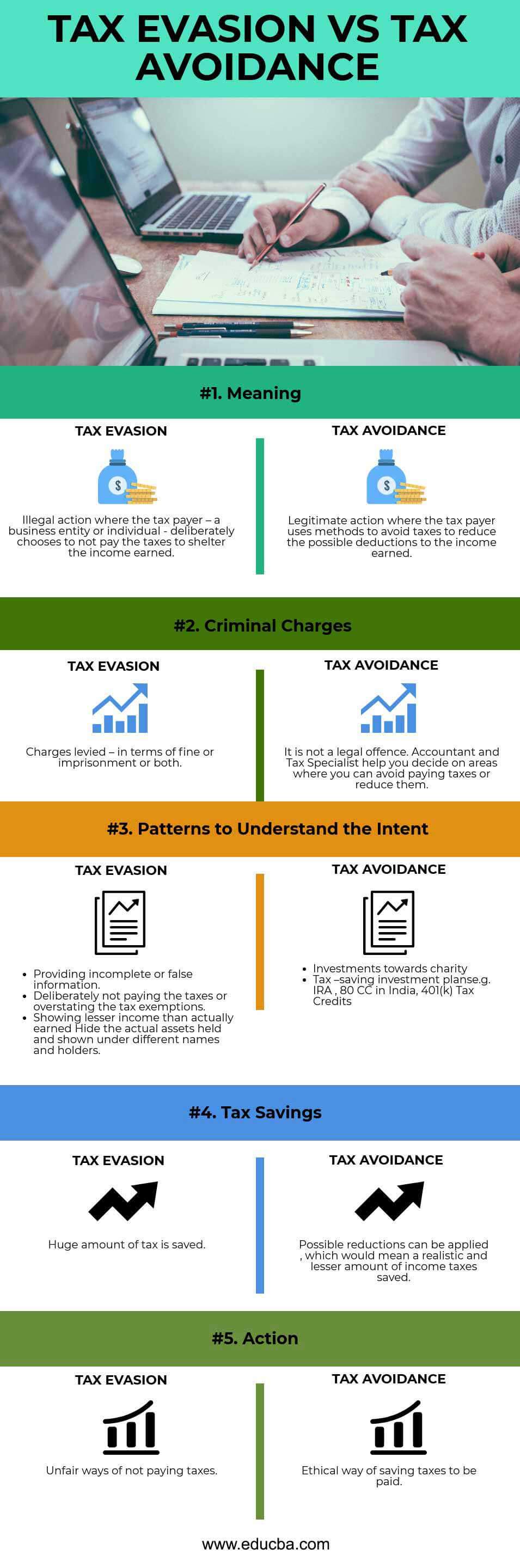

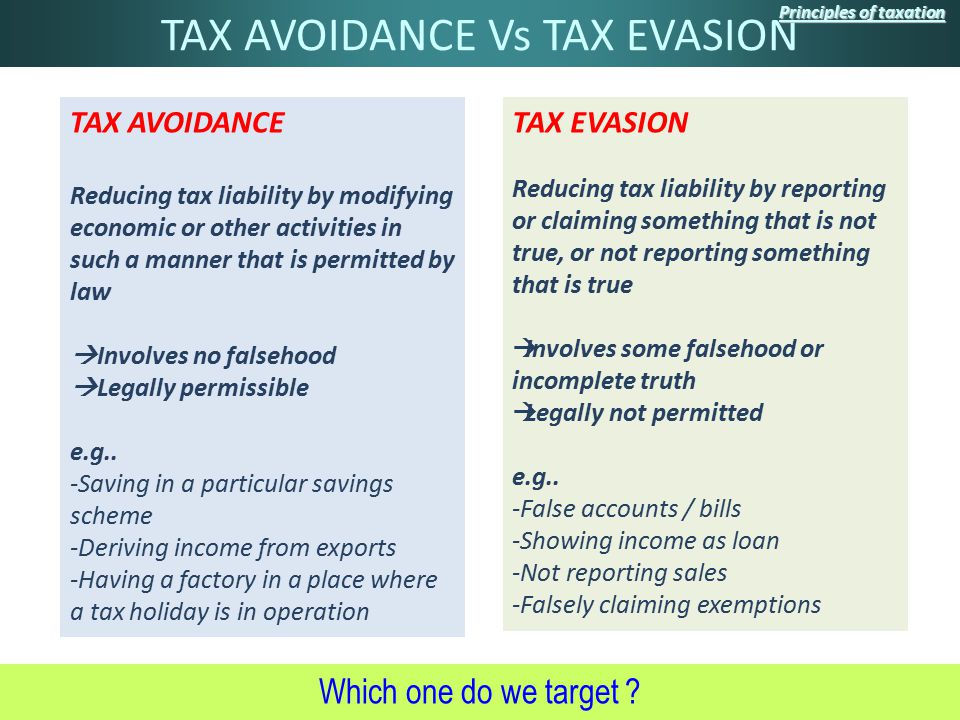

Difference between tax avoidance and tax evasion with examples. Difference between tax evasion vs tax avoidance. Basically tax avoidance is legal while tax evasion is not. In other words taxpayers can use legitimate methods to reduce the amount of tax payable in association with their financial activities. Businesses get into trouble with the irs when they intentionally evade taxes.

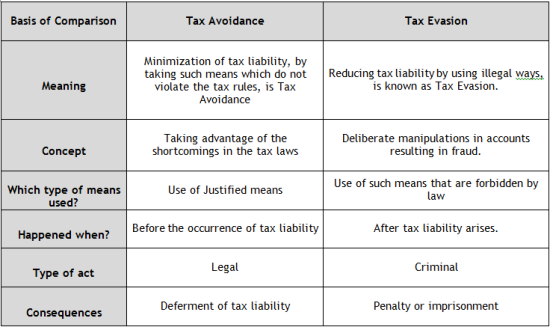

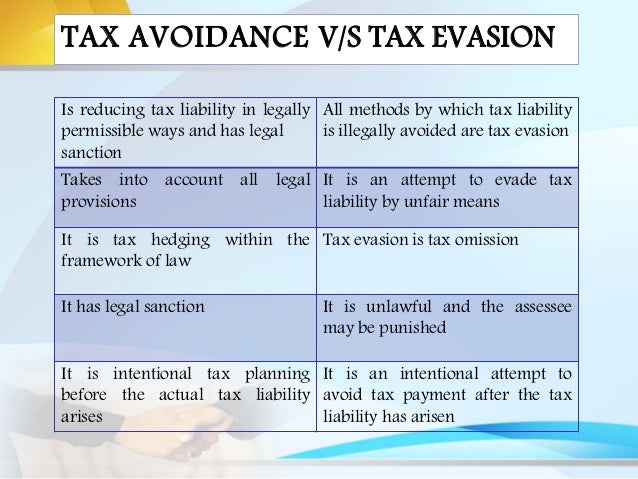

The main difference between tax evasion and tax avoidance lies in that tax evasion is illegal whereas tax avoidance is a legal method used to reduce tax payments that at times can be unethical in nature. A highlight to note down is that tax avoidance is totally legal whilst tax evasion is not. Tax avoidance refers to hedging of tax but tax evasion implies the suppression of tax. The difference between tax evasion and tax avoidance largely boils down to two elements.

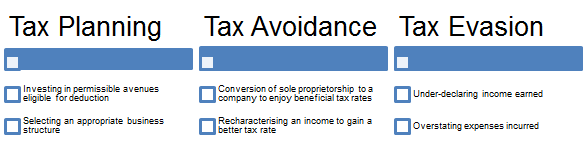

Paying the taxes by an individual or an entity is mandatory by law however it is still a voluntary compliance. Tax avoidance use the loopholes weakness in tax statutes to reduce or avoid tax liability but tax evasion is the intentional use of fraudulently practices to pay less tax or not to pay tax at all. An unlawful act done to avoid tax payment is known as tax evasion. Tax avoidance and tax evasion are both mechanisms used in order to avoid or reduce the amount paid as taxes.

Tax free investments for example donations to charity or paying into a pension scheme. The major difference between tax avoidance and tax evasion is that tax avoidance is not punishable by law while tax evasion is punishable by law. But your business can avoid paying taxes and your tax preparer can help you do that. Tax avoidance is structuring your affairs so that you pay the least amount of tax due.

Tax evasion is basically using an illegal means or ways for people to avoid paying the taxes. But it s not quite as simple as that. There are many legitimate ways in which tax can be saved and that are actively promoted by governments. A planning made to reduce the tax burden without infringement of the legislature is known as tax avoidance.

The following are the major differences between tax avoidance and tax evasion. Taxes are the result of your earnings or by generating wealth by running a business. Tax evasion is considered to be a felony and it is criminal in nature.

/tax-avoidance-vs-evasion-397671-v3-5b71dfc846e0fb0025e54177.png)