Difference Between Tax Avoidance And Tax Evasion

A planning made to reduce the tax burden without infringement of the legislature is known as tax avoidance.

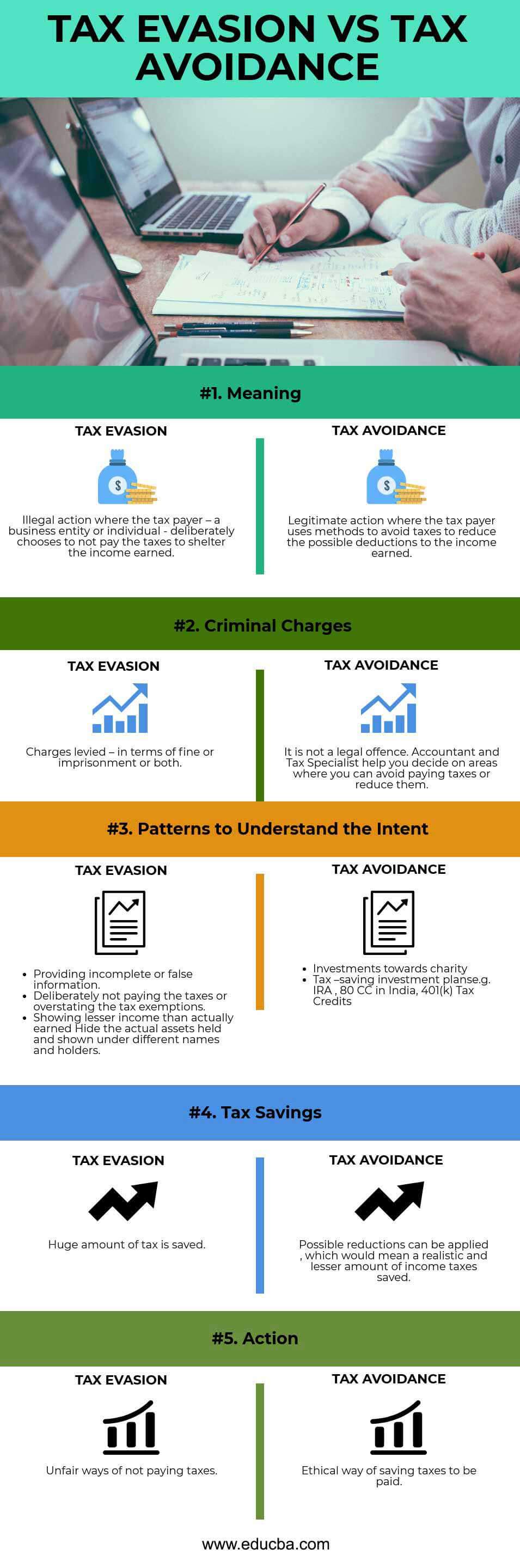

Difference between tax avoidance and tax evasion. Tax evasion vs tax avoidance as tax avoidance and tax evasion are both methods used by individuals and businesses to minimize or completely avoid the payment of taxes one should be able to recognize the difference between tax evasion and tax avoidance while these concepts may sound similar to one another there are a number of differences between tax evasion and tax avoidance. Tax avoidance is structuring your affairs so that you pay the least amount of tax due. In the wake of the panama papers revelations the distinction between tax planning tax avoidance aggressive tax avoidance and tax evasion seems to have been lost between the lines. Tax avoidance refers to hedging of tax but tax evasion implies the suppression of tax.

An unlawful act done to avoid tax payment is known as tax evasion. Usually tax avoidance takes place before the calculation of tax liability as it is meant to reduce the total amount beforehand or defer the payment date. Cornell legal information institute. Tax evasion accessed april 27 2020.

The difference between tax evasion and tax avoidance largely boils down to two elements. The major difference between tax avoidance and tax evasion is that tax avoidance is not punishable by law while tax evasion is punishable by law. The following are the major differences between tax avoidance and tax evasion. The line between tax avoidance and tax evasion can be slight.

Employment tax evasion criminal investigation ci accessed april 27 2020. Difference between tax evasion and tax avoidance. If a state or federal agency has already contacted you about an issue with your taxes it s important to have an skilled advocate on your side. The difference between tax avoidance and tax evasion accessed apr.

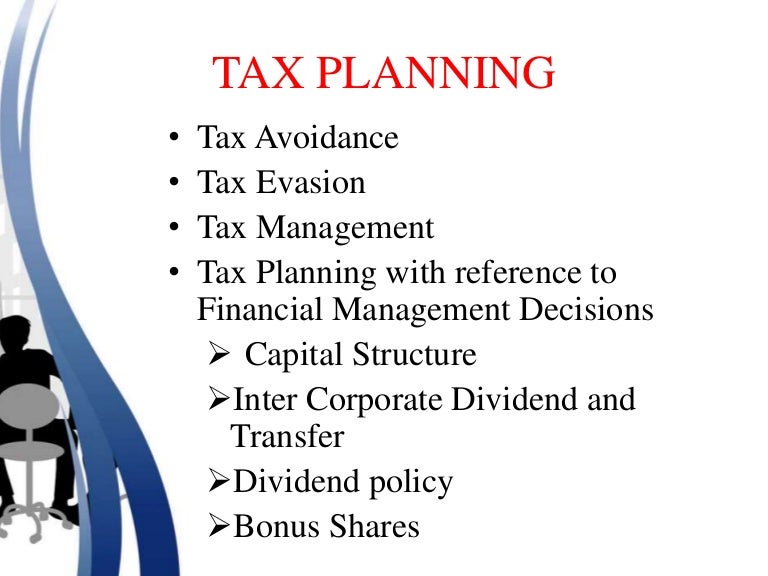

Tax avoidance use the loopholes weakness in tax statutes to reduce or avoid tax liability but tax evasion is the intentional use of fraudulently practices to pay less tax or not to pay tax at all. Each term has been clarified quite obviously in our above mentioned sections. The difference between tax avoidance and evasion is legality. Differences between tax evasion tax avoidance and tax planning.

Below are key differences between tax evasion tax avoidance and tax planning to help you get better understanding. Businesses in search of saving tax often come up with those couples of terms. Accessed april 27 2020. Tax evasion is the illegal practice of not paying taxes by not reporting income reporting expenses not legally allowed or by not.

/tax-avoidance-vs-evasion-397671-v3-5b71dfc846e0fb0025e54177.png)