Difference Between Tax Evasion And Tax Avoidance And Tax Planning And Tax Management

Commercial tax officer wherein justice reddy stated much legal sophistry and judicial exposition both in england and india have gone into the.

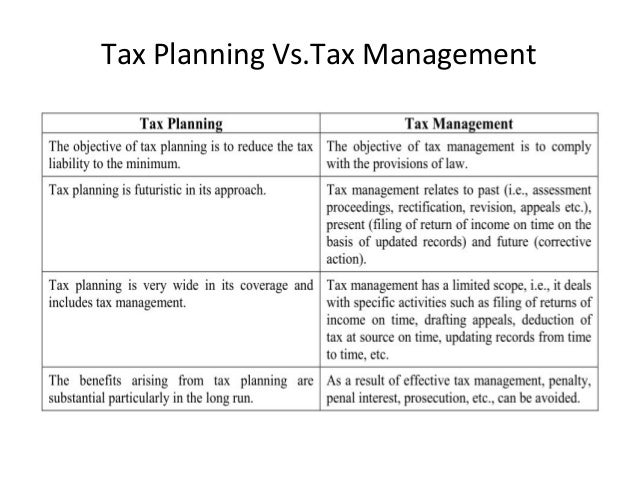

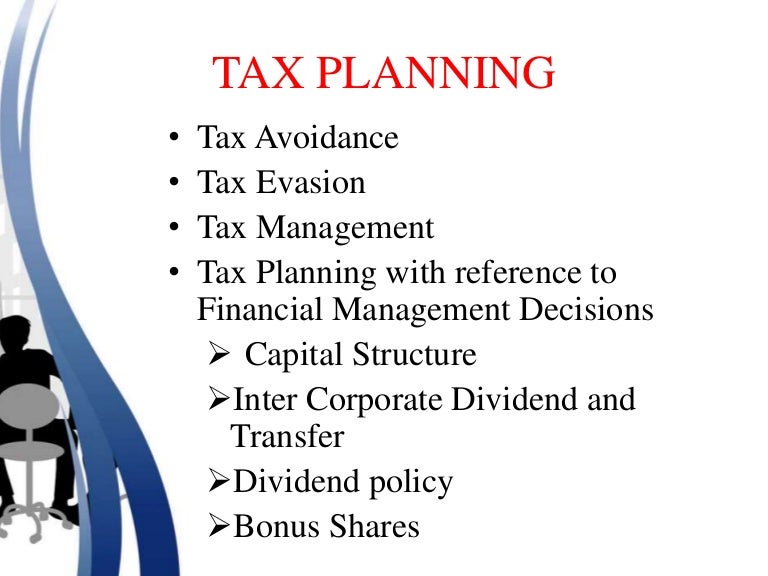

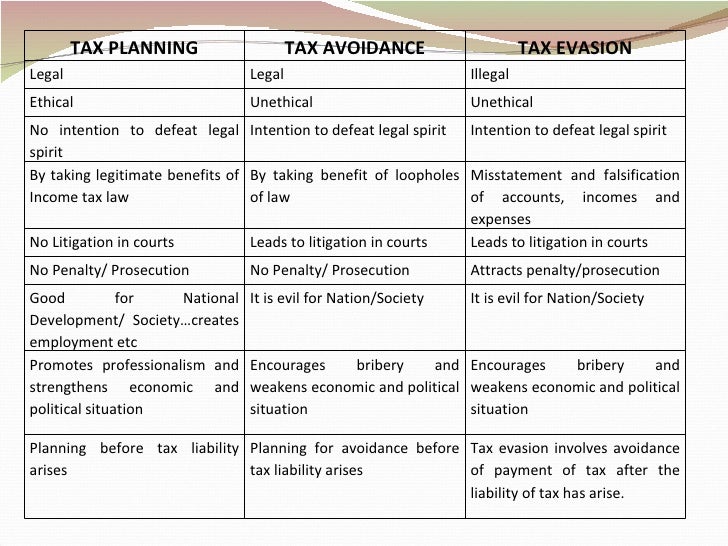

Difference between tax evasion and tax avoidance and tax planning and tax management. Tax planning can neither be equated to tax evasion nor to tax avoidance with reference to a company it is the scientific planning of the company s operations in such a way so as to attract minimum liability to tax or postponement or for the matter of deferment of the tax liability for the subsequent period by availing various incentives concessions allowances rebates and relief s. Tax avoidance is immoral that tends to bend the law without causing any damage to it. Tax evasion is undertaken by employing unfair means. Tax planning is an art to reduce your tax outgo by making sure that all the applicable provisions of our income tax act as designed to reduce your tax liability has been availed of.

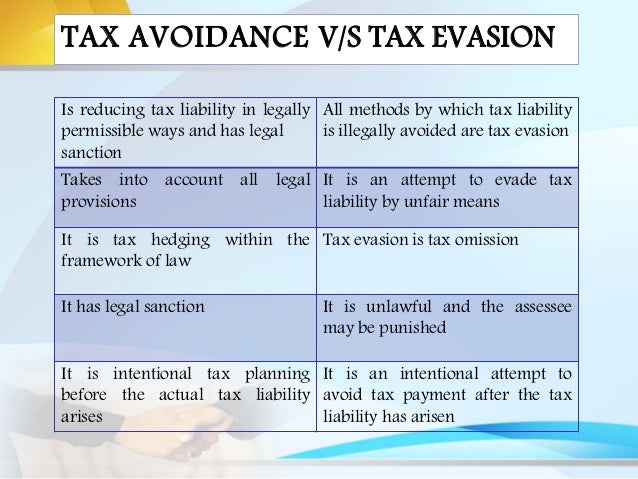

Iv tax avoidance looks like a tax planning and is done before the tax liability arises. Tax avoidance can be thought of as the grey area between tax evasion and strategic tax planning. Tax evasion is a criminal act that has serious implications. Tax planning on the other hand helps businesses to ensure tax efficiency.

A planning made to reduce the tax burden without infringement of the legislature is known as tax avoidance. Difference between tax planning tax avoidance tax evasion. An unlawful act done to avoid tax payment is known as tax evasion. On the other hand tax planning is completely legal because it does not involve taking any advantage of the loopholes in the law and so it is permissible.

Tax evasion is a severe crime. Tax avoidance refers to hedging of tax but tax evasion implies the suppression of tax. The distinction between tax planning avoidance and evasion has been a long discussed topic in the field of taxation law and one of the foremost indian case in which the discussion was taken up was in the landmark case of mcdowell co. If you get caught you would be penalized either through hefty fines or a lengthy jail term.

The main difference between tax evasion and tax avoidance lies in that tax evasion is illegal whereas tax avoidance is a legal method used to reduce tax payments that at times can be unethical in nature. Tax avoidance and tax evasion are both mechanisms used in order to avoid or reduce the amount paid as taxes. All serve for tax saving but tax avoidance aims at minimizing tax while tax evasion is deemed a form of not paying tax. Iii tax avoidance is done through not malafied intention but complying the provision of law.

The objective of tax avoidance is to reduce tax liability by applying the script of law whereas tax evasion is done to reduce tax liability by exercising unfair means.

/tax-avoidance-vs-evasion-397671-v3-5b71dfc846e0fb0025e54177.png)