Difference Between Tax Evasion And Tax Avoidance And Tax Planning Pdf

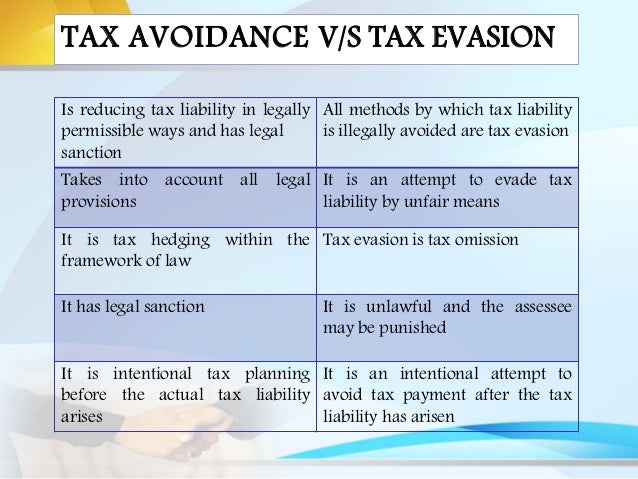

Tax avoidance refers to hedging of tax but tax evasion implies the suppression of tax.

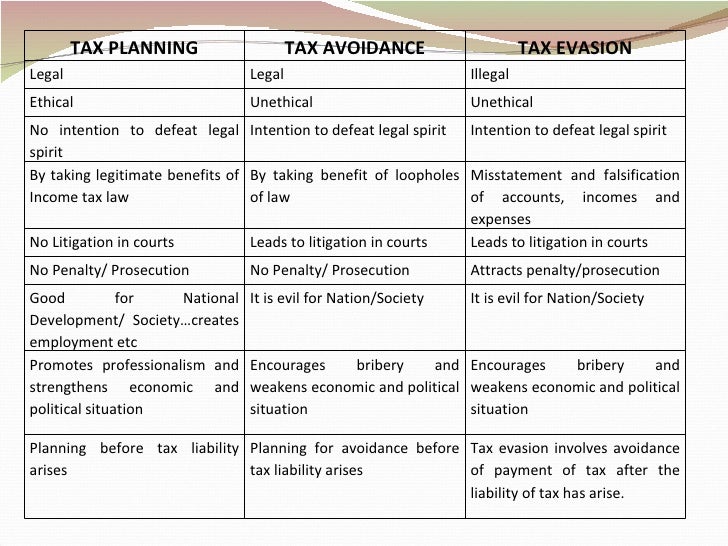

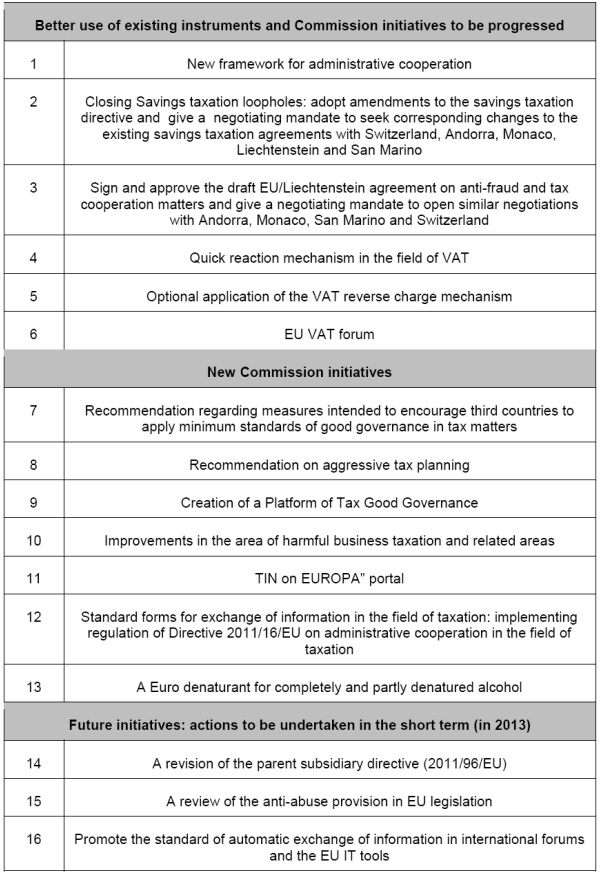

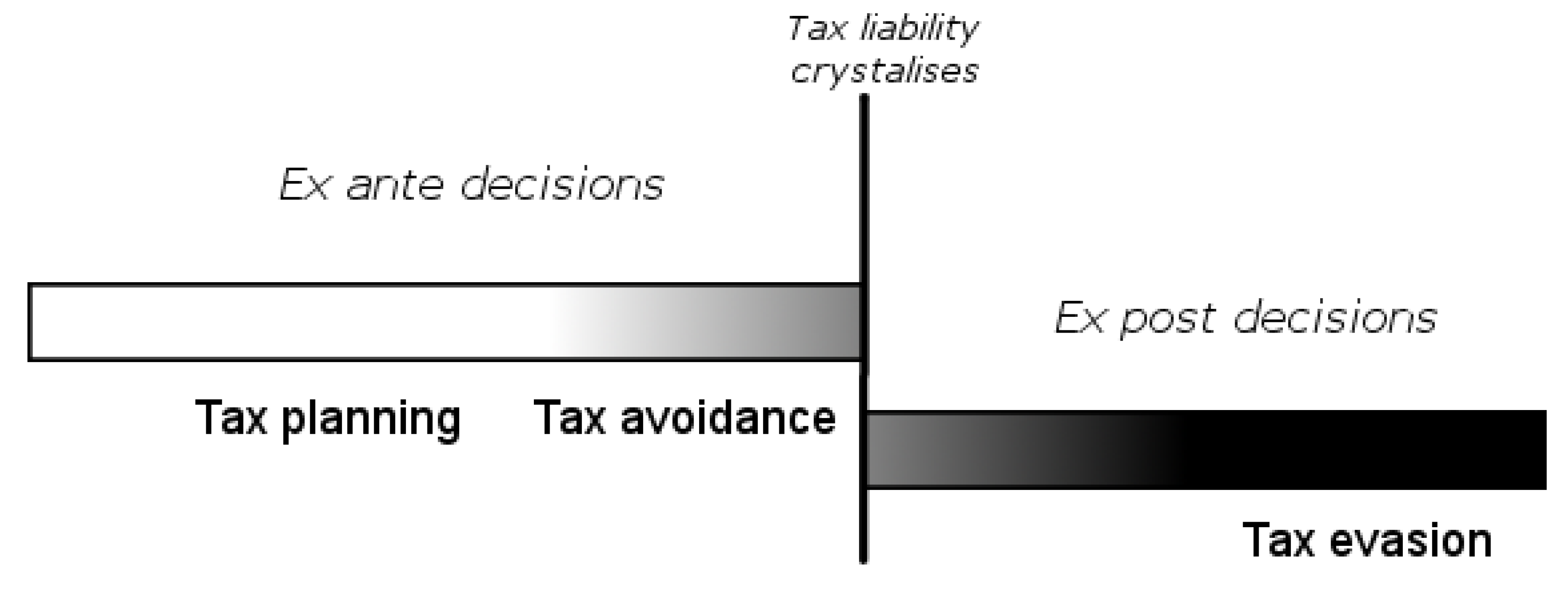

Difference between tax evasion and tax avoidance and tax planning pdf. The terms tax avoidance and tax evasion are often used interchangeably but they are very different concepts. The purpose of this thesis is to review the causes of and solutions to tax avoidance. Evade tax liability with the help of unfair means. Difference between tax planning tax avoidance and tax evasion.

Formerly tax avoidance is considered legitimate but with the passage of time tax avoidance is as evil as tax evasion and even attracts penality when discovered. Although from an economic point of view legal considerations apart tax avoidance tax evasion and tax flight have similar effects namely a reduction of revenue yields and are based on the same. The thesis assesses various definitions. Businesses get into trouble with the irs when they intentionally evade taxes.

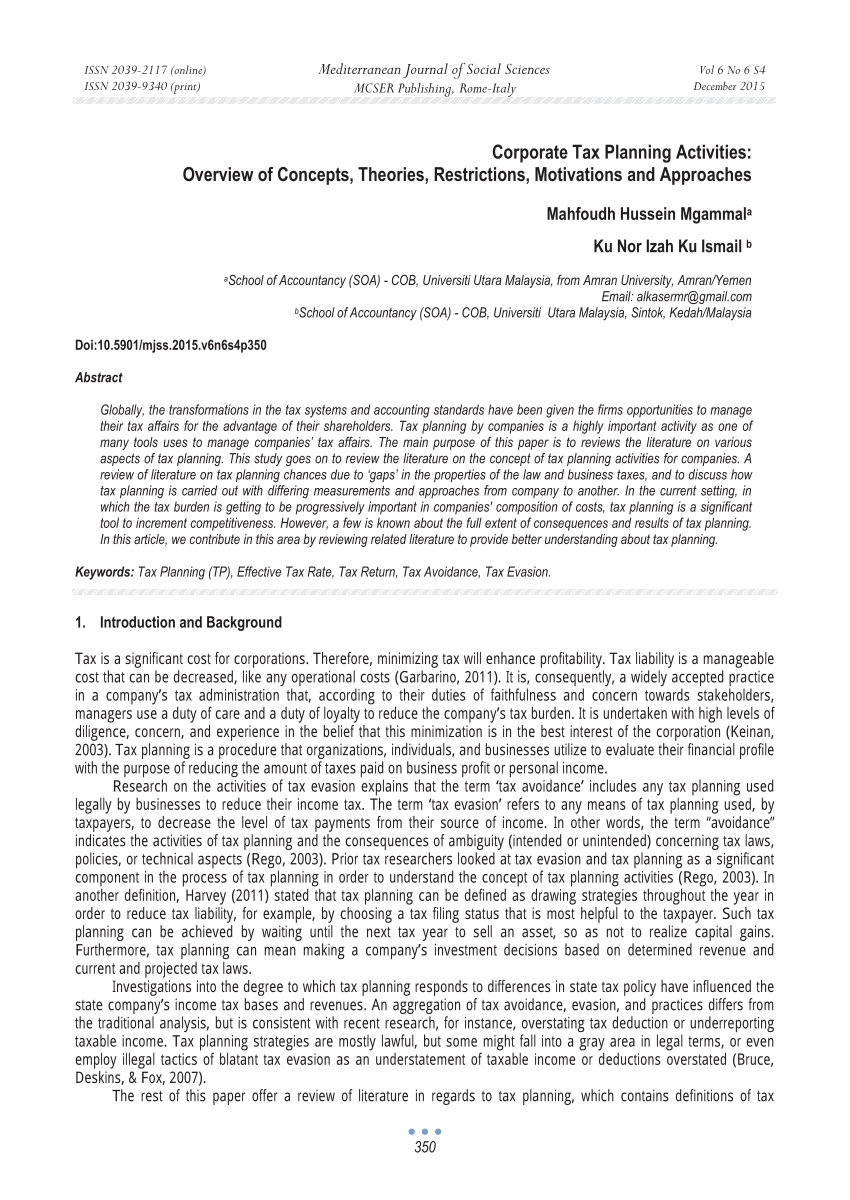

Tax avoidance is immoral that tends to bend the law without causing any damage to it. Illustration of difference between tax planning tax avoidance and tax evasion. All serve for tax saving but tax avoidance aims at minimizing tax while tax evasion is deemed a form of not paying tax. Different people have different understanding and definitions of tax avoidance.

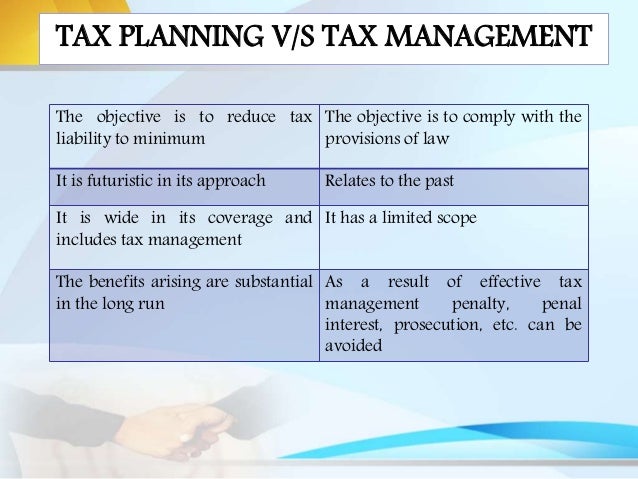

The objective of tax avoidance is to reduce tax liability by applying the script of law whereas tax evasion is done to reduce tax liability by exercising unfair means. A planning made to reduce the tax burden without infringement of the legislature is known as tax avoidance. Tax planning can neither be equated to tax evasion nor to tax avoidance with reference to a company it is the scientific planning of the company s operations in such a way so as to attract minimum liability to tax or postponement or for the matter of deferment of the tax liability for the subsequent period by availing various incentives concessions allowances rebates and relief s. Tax planning is done to reduce the liability of tax by applying the provision and moral of law.

Tax planning on the other hand helps businesses to ensure tax efficiency. The government has issued notifications no. Tax avoidance is attracting more and more attention from the public. An unlawful act done to avoid tax payment is known as tax evasion.

It is a way to reduce tax liability by taking full advantages provided by the act through various exemptions deductions rebates and relief. On the other hand tax planning is completely legal because it does not involve taking any advantage of the loopholes in the law and so it is permissible.

/tax-avoidance-vs-evasion-397671-v3-5b71dfc846e0fb0025e54177.png)