Difference Between Tax Planning Tax Avoidance And Tax Evasion Ppt

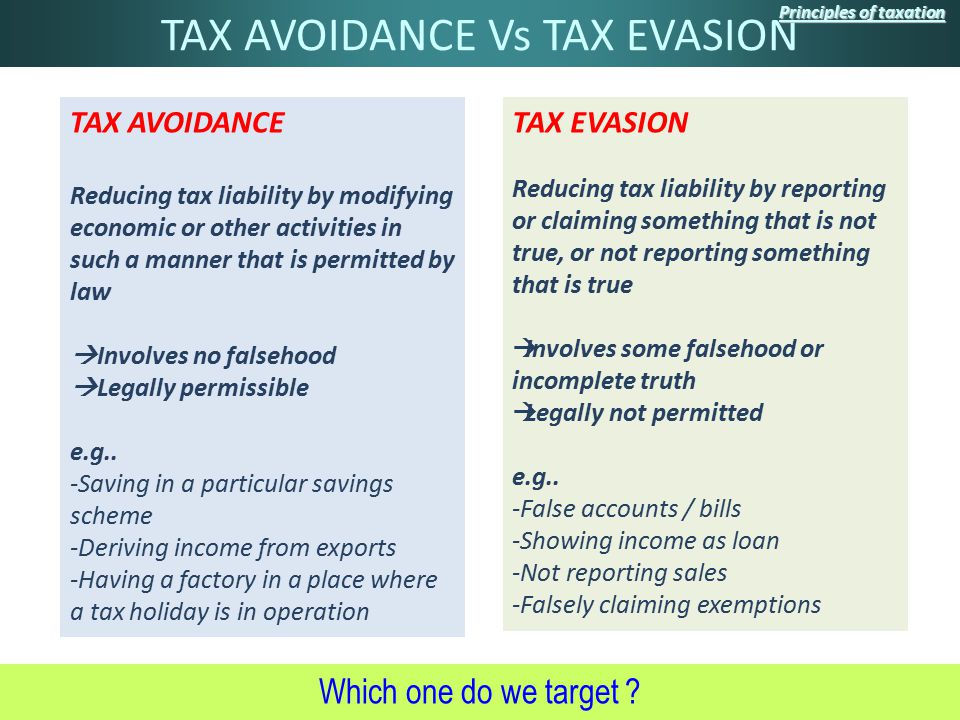

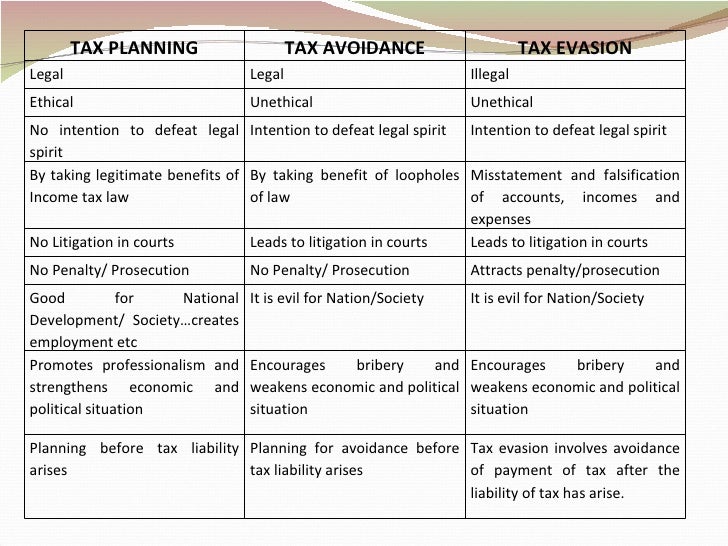

Iv tax avoidance looks like a tax planning and is done before the tax liability arises.

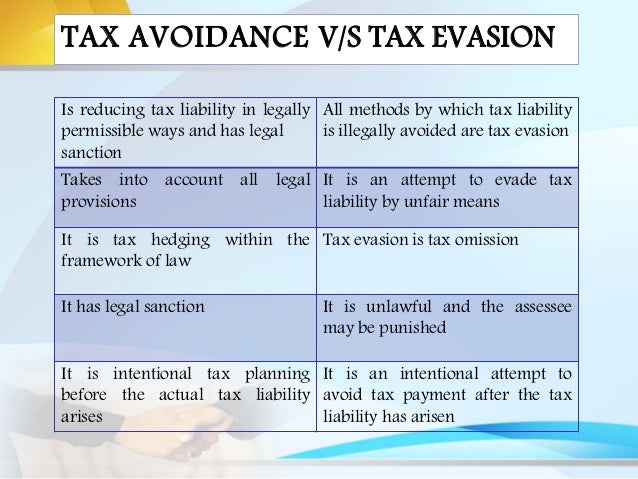

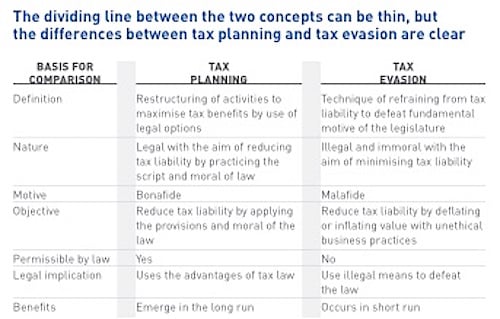

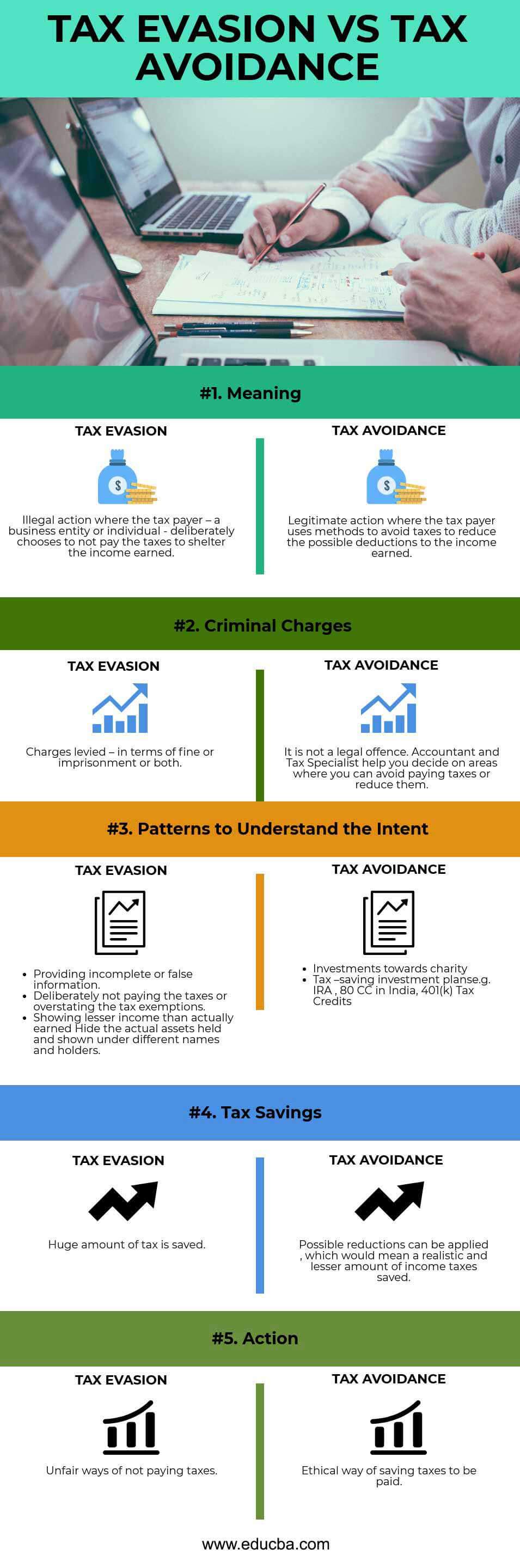

Difference between tax planning tax avoidance and tax evasion ppt. Tax evasion is an unlawful way of paying tax and defaulter may punished. An unlawful act done to avoid tax payment is known as tax evasion. The difference between tax avoidance and tax evasion accessed apr. Below are key differences between tax evasion tax avoidance and tax planning to help you get better understanding.

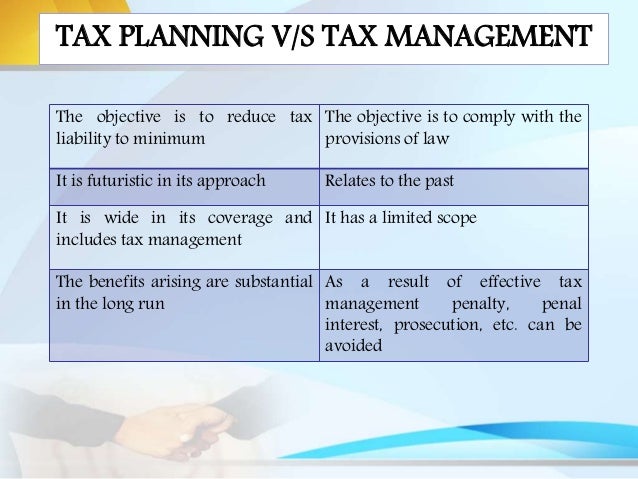

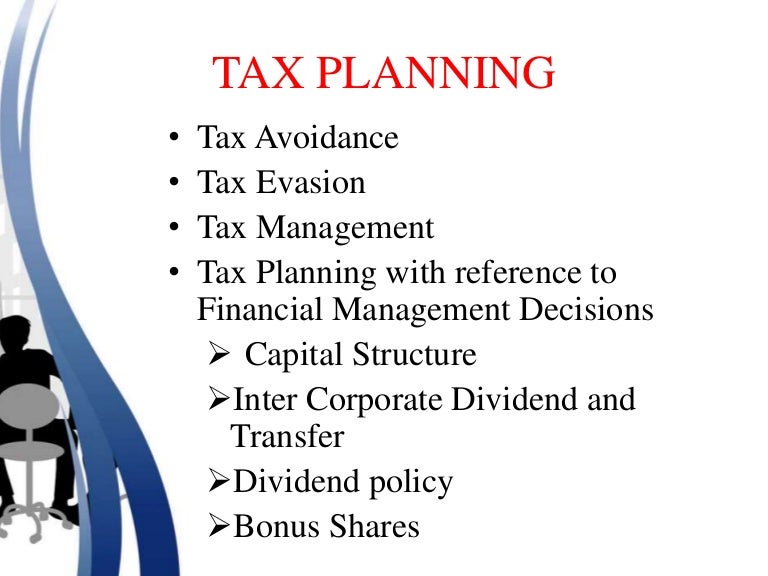

Key differences between tax avoidance and tax evasion the following are the major differences between tax avoidance and tax evasion. Introduction the avid goal of every taxpayer is to minimize his tax liability. Accessed april 27 2020. Tax planning tax avoidance tax evasion tax management tax planning with reference to financial management decisions capital structure inter corporate dividend and transfer dividend policy bonus shares 2.

Each term has been clarified quite obviously in our above mentioned sections. Tax evasion is blatant fraud and is done after the tax liability has arisen. Businesses in search of saving tax often come up with those couples of terms. A planning made to reduce the tax burden without infringement of the legislature is known as tax avoidance.

Employment tax evasion criminal investigation ci accessed april 27 2020. Tax evasion accessed april 27 2020. Cornell legal information institute.

/tax-avoidance-vs-evasion-397671-v3-5b71dfc846e0fb0025e54177.png)