Difference Between Tax Planning Tax Evasion Tax Avoidance And Tax Management

/tax-avoidance-vs-evasion-397671-v3-5b71dfc846e0fb0025e54177.png)

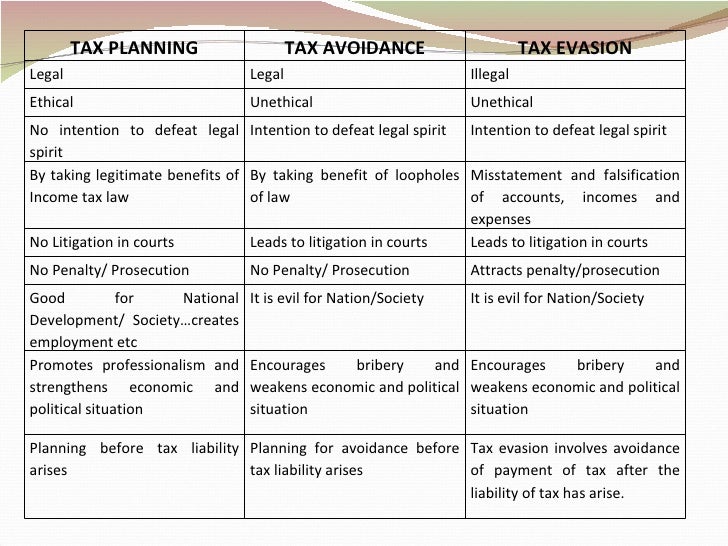

As against this tax avoidance aims at minimising tax liability by practising the script of law only.

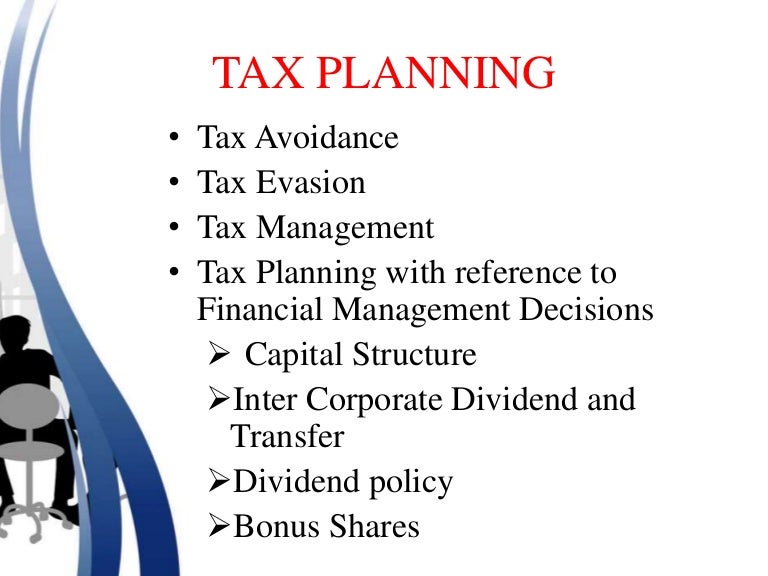

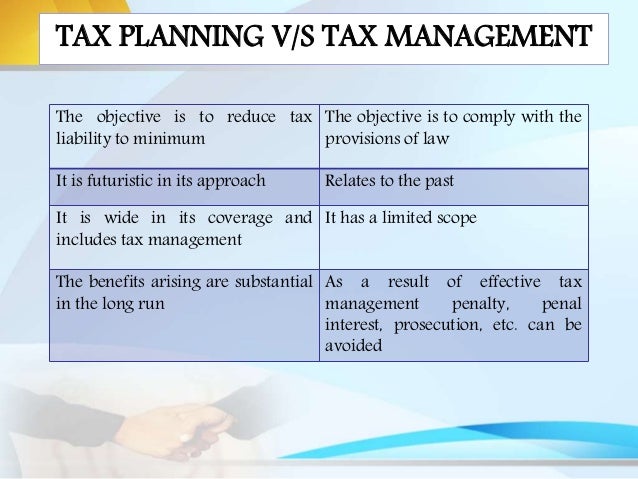

Difference between tax planning tax evasion tax avoidance and tax management. Tax evasion is blatant fraud and is done after the tax liability has arisen. The following are the major differences between tax avoidance and tax evasion. Tax planning is an art to reduce your tax outgo by making sure that all the applicable provisions of our income tax act as designed to reduce your tax liability has been availed of. Tax planning is done to reduce the liability of tax by applying the provision and moral of law.

Tax evasion is an unlawful way of paying tax and defaulter may punished. A tax avoidance arrangement normally fulfils the legal requirements of the law but not necessarily the intent of the law. On the flip side tax planning has the element of bonafide motive. Tax planning on the other hand helps businesses to ensure tax efficiency.

Difference between tax planning tax avoidance tax evasion. Tax planning tax evasion tax avoidance 1. But your business can avoid paying taxes and your tax preparer can help you do that. Tax avoidance refers to hedging of tax but tax evasion implies the suppression of tax.

Basically tax avoidance is legal while tax evasion is not. Tax planning is a process of structuring transactions to minimise one s liability to tax and usually fulfills both the legal requirements and intent of the income tax law. It is closely supported by sound commercial decision. The term aggressive tax planning in a way moves away from this legal distinction between tax evasion and tax avoidance.

Businesses get into trouble with the irs when they intentionally evade taxes. Tax avoidance is accomplished with a malafide motive. The objective of tax avoidance is to reduce tax liability by applying the script of law whereas tax evasion is done to reduce tax liability by exercising unfair means. Aggressive tax planning or tax aggressiveness according to lanis and richardson 2 can be broadly defined as the downward management of taxable income through tax planning activities.

An unlawful act done to avoid tax payment is known as tax evasion. Tax planning aims at reducing tax liability by practising the script and moral of law. A planning made to reduce the tax burden without infringement of the legislature is known as tax avoidance.