Distinguish Between Tax Avoidance And Tax Evasion

Accessed april 27 2020.

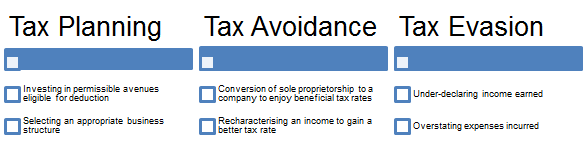

Distinguish between tax avoidance and tax evasion. Tax evasion accessed april 27 2020. The difference between tax avoidance and tax evasion accessed apr. Unsurprisingly hmrc do not like the idea of tax avoidance and they appear to view all actions taken to reduce a tax bill as suspect unless the action can clearly been seen as taking advantage of a tax relief in the manner intended. Tax avoidance is structuring your affairs so that you pay the least amount of tax due.

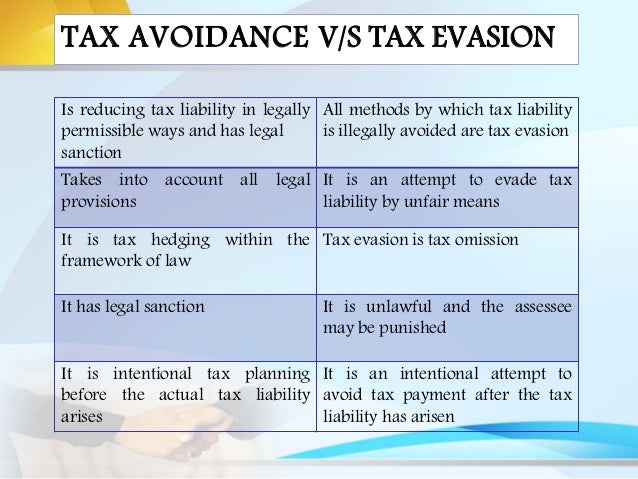

Cornell legal information institute. The difference between tax evasion and tax avoidance largely boils down to two elements. The result of tax avoidance is the postponement of the tax whereas the consequence of tax evasion if the assessee is found guilty of doing so is either imprisonment or penalty or both. Employment tax evasion criminal investigation ci accessed april 27 2020.

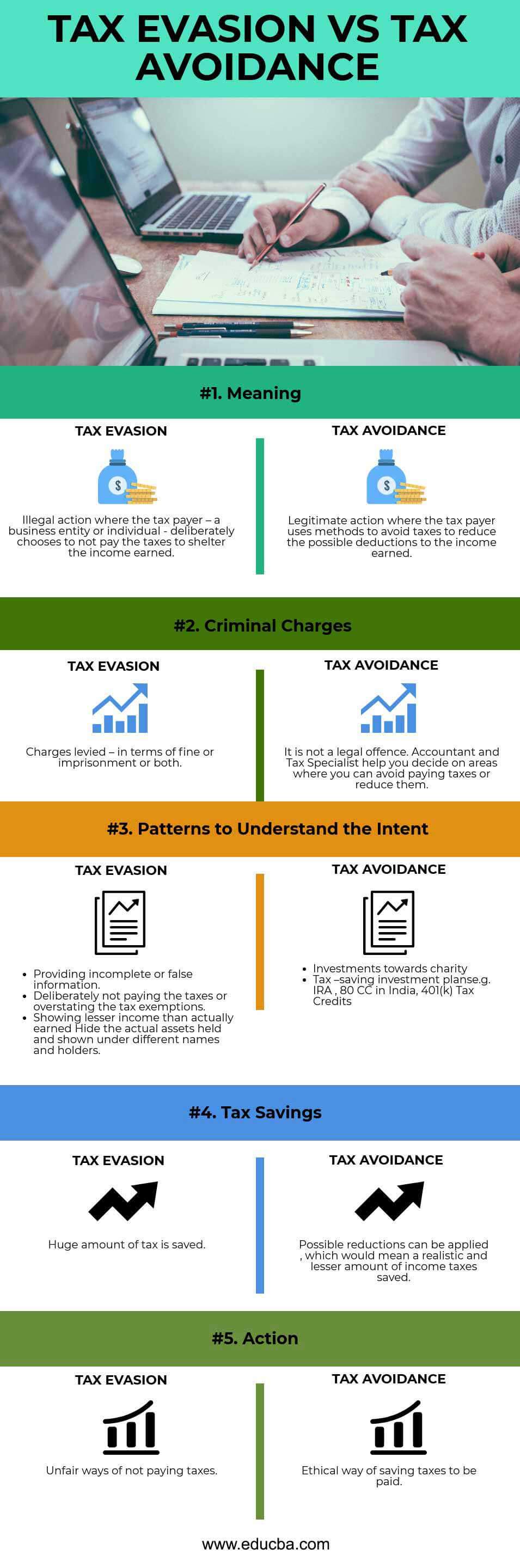

Tax evasion vs tax avoidance as tax avoidance and tax evasion are both methods used by individuals and businesses to minimize or completely avoid the payment of taxes one should be able to recognize the difference between tax evasion and tax avoidance while these concepts may sound similar to one another there are a number of differences between tax evasion and tax avoidance. Tax crimes handbook page 2. Conclusion tax avoidance and tax evasion both are meant to reduce the tax liability ultimately but what makes the difference is that the former is justified in the eyes of the law as it does not make any.

/tax-avoidance-vs-evasion-397671-v3-5b71dfc846e0fb0025e54177.png)