Double Entry For Hire Purchase Of Motor Vehicle Malaysia

Credit hire purchase company.

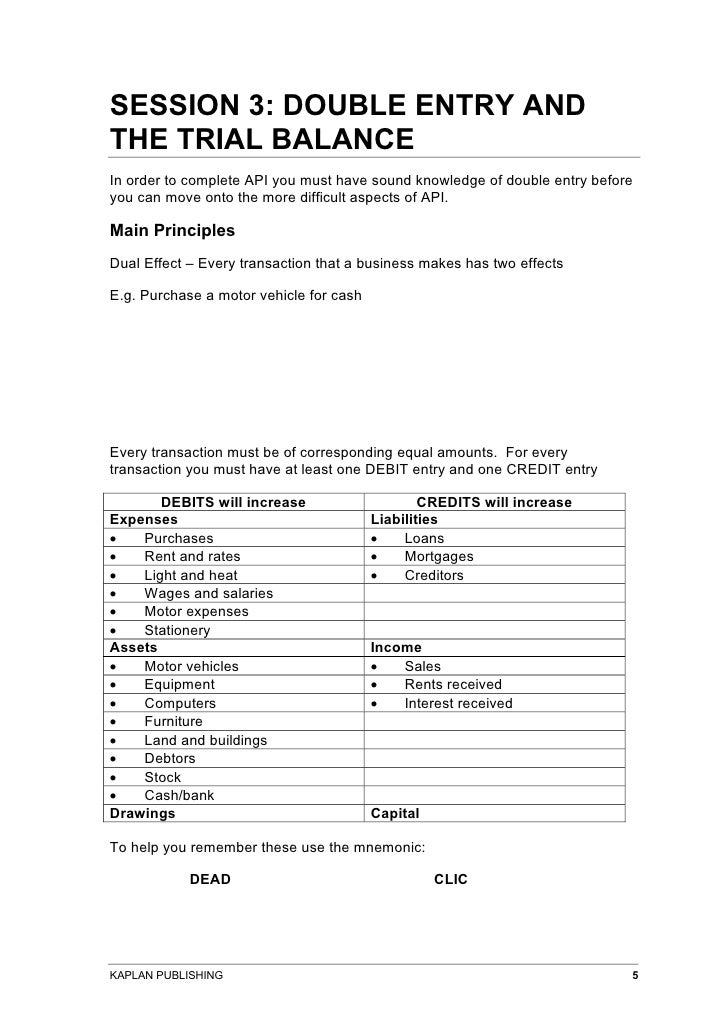

Double entry for hire purchase of motor vehicle malaysia. This matches the cost to purchase the van to the income associated with the expense. Transfer to hire purchase creditor account. If however there is a creditor set up for the hp agreement then you need to post invoices for the interest payable each month which will db hp interest and cr creditors. This in itself is straight forward.

Journal entries in the books of purchaser a for buying assets on hire purchase asset on hire purchase account dr. The new motor vehicle 30 000 is brought into the business and the business makes a loss 1 000 on disposal of the old vehicle. You should consult your accountant if you have doubt in the accounting entries or classification of accounts. Credit the old vehicle 17 000 11 000 and the cash 25 000 leave the business and are used to pay for the new motor vehicle.

The fixed assets were scrapped and written off as having no value. Disposal of fixed assets double entry example. However i would say you need to reconcile that creditor account very carefully. To accomplish this we need to make an entry to account for depreciation.

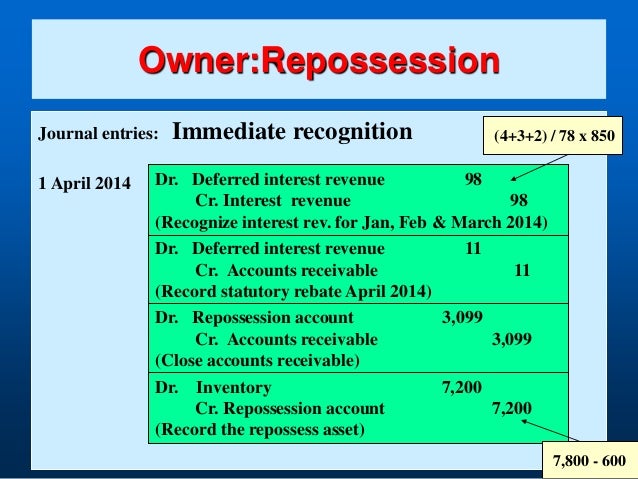

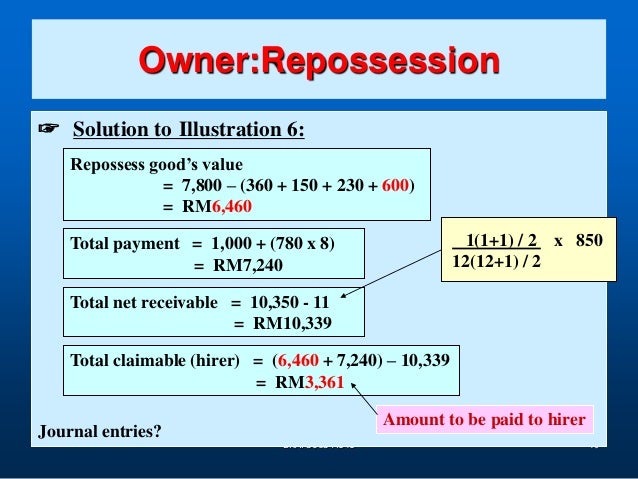

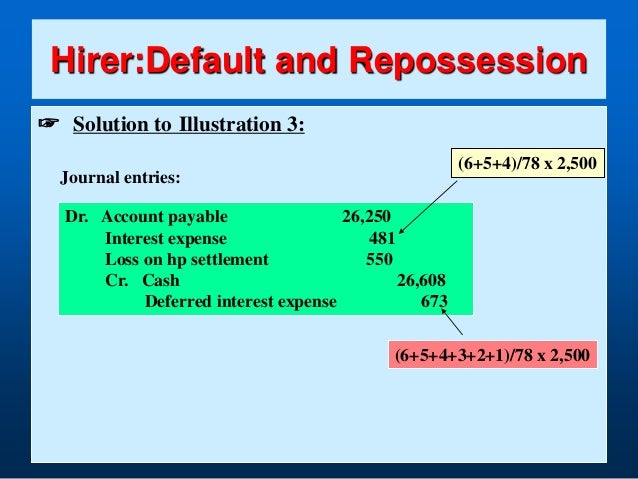

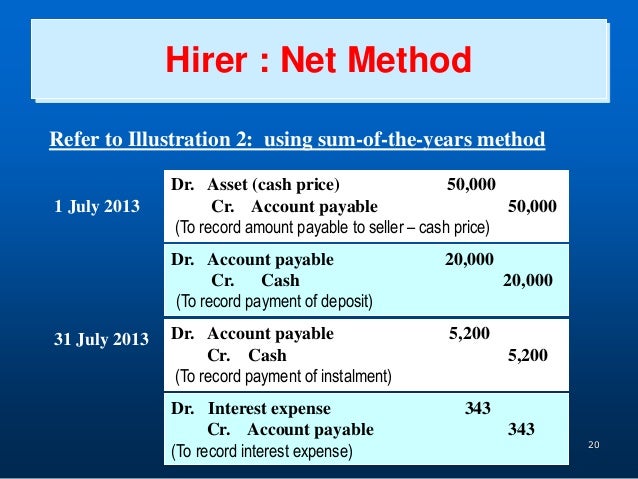

How do you record the disposal of fixed assets in the following situations. Recording of the liability to the hire purchase company. Double entry accounting examples. The double entry of this bill debits the hire purchase current account and credit accounts payable or bank account if write cheque is used instead of the enter bill transaction.

The entry is a debit to the inventory asset account and a credit to the cash asset account. Cash price method under cash price method we are deal hire purchase transactions just like normal transactions. Net of the interests and state the liability to the hire purchase company in full i e. The accounting rules require us to record the cost to purchase the van over its useful life.

You buy 1 000 of goods with the intention of later selling them to a third party. There are four methods of accounting for hire purchase. A business has fixed assets that originally cost 9 000 which have been depreciated by 6 000 to the date of disposal. When transactions or event happen we record them.

The fixed assets were sold for 2 000. Debit interest suspense balance sheet current liability type. Next pass a journal to transfer the amount from contra bank account to your hire purchase creditor account. But in book keeping we need to capitalise the asset at cost i e.

The double entry will be. Here are the double entry accounting entries associated with a variety of business transactions.