E Filing Income Tax

It does not matter how much you earned in the previous year or whether your employer is participating in the auto inclusion scheme ais for employment income.

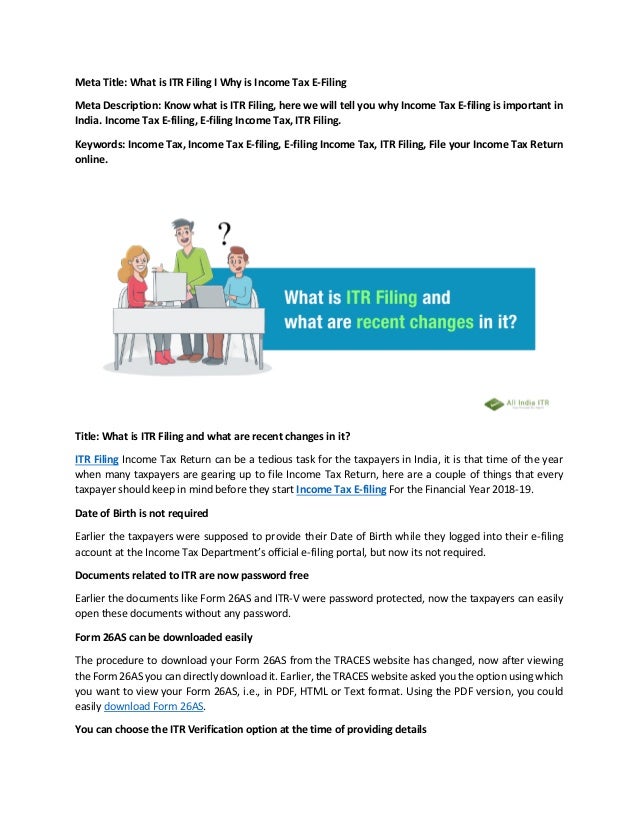

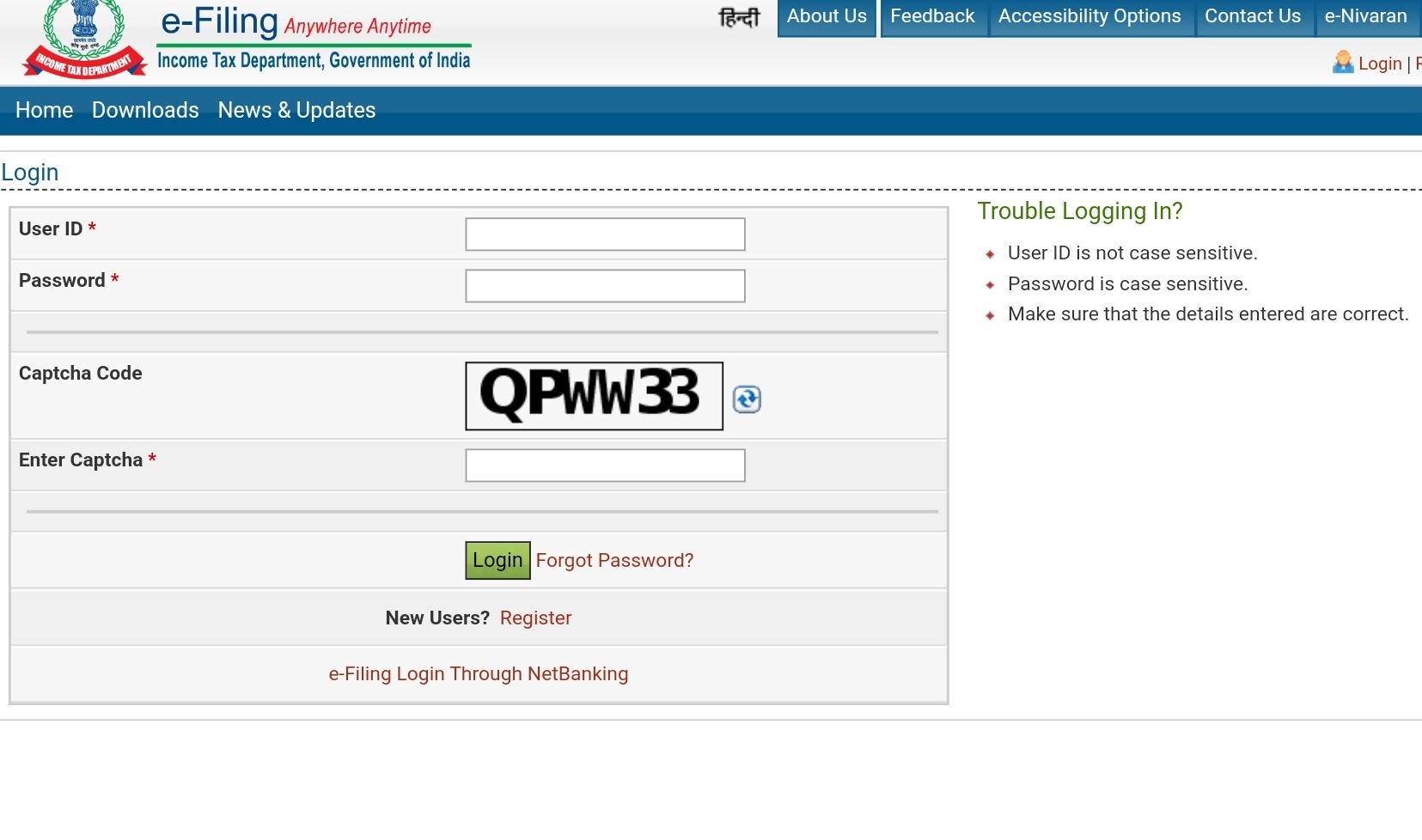

E filing income tax. You may choose master giro application form if you wish to pay more than one of your taxes individual income tax property tax gst or withholding tax. Notification to file income tax return. Click the login to e filing account button to pay any due tax intimated by the ao or cpc. Lembaga hasil dalam negeri malaysia inland revenue board of malaysia.

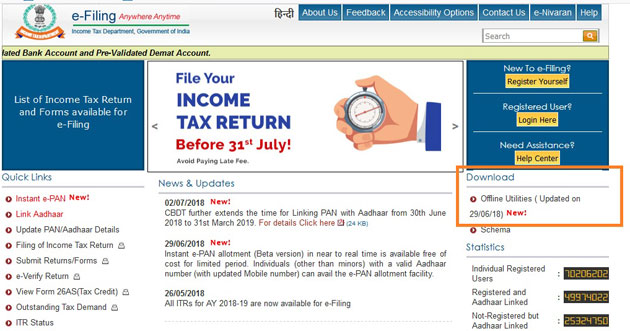

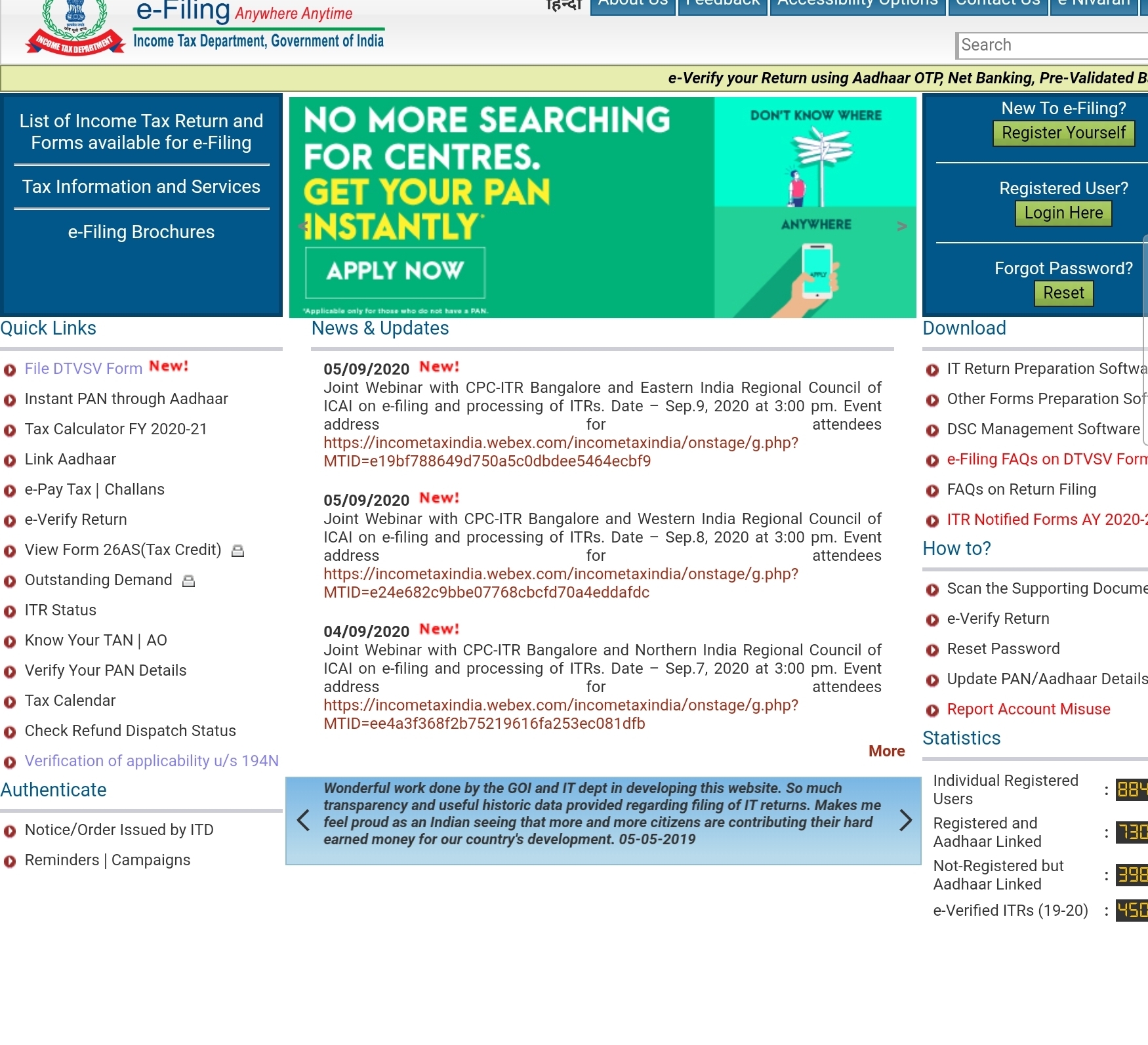

Tac akan dihantar kepada no. For more information and prerequisites refer the read me document. Seamless e filing facility for uploading of income tax returns anywhere and anytime around the clock about 2 00 00 000 returns filed till 31st aug 15 in current financial year automated ecosystem for processing of returns capacity peak 5 lakh returns per day average processing time reduced from 12 to 14 months to 55 days. Go to the income tax e filing portal www incometaxindiaefiling gov in.

Dimaklumkan bahawa pembayar cukai yang pertama kali melaporkan pendapatan menyamai atau melebihi rm 450 000 melalui hantaran borang secara e filing perlu memohon tac. Download the appropriate itr utility under downloads it return preparation software. Extract the downloaded utility zip file and open the utility from the extracted folder. You must file an income tax return if you receive a letter form or an sms from iras informing you to do so.

Telefon bimbit yang berdaftar dengan lhdnm.