Exempt Private Company Malaysia

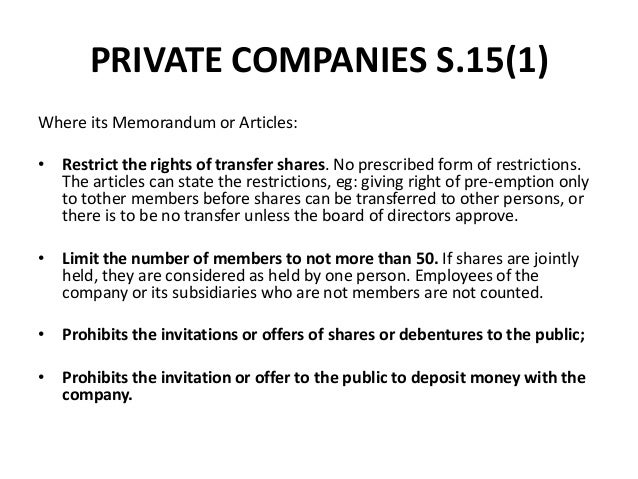

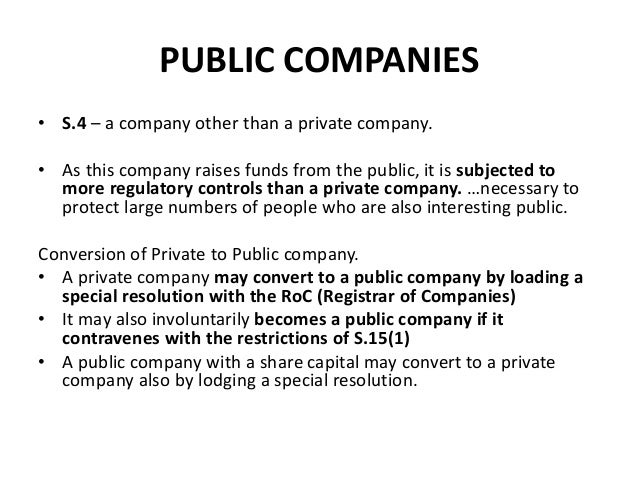

C any company converted into a private company pursuant to section 26 1 being a company which has not ceased to be a private company under section 26 or 27.

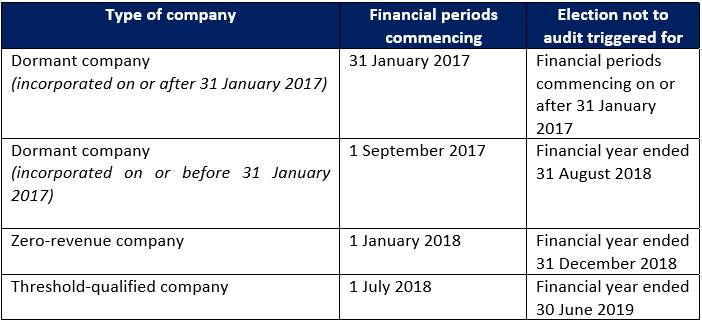

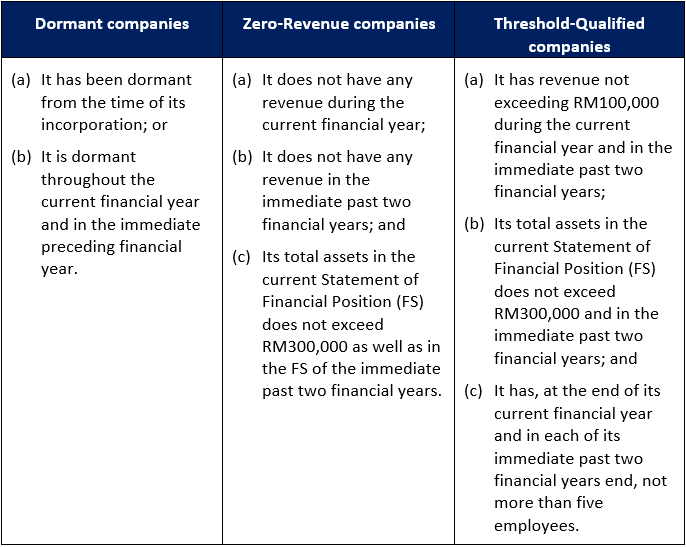

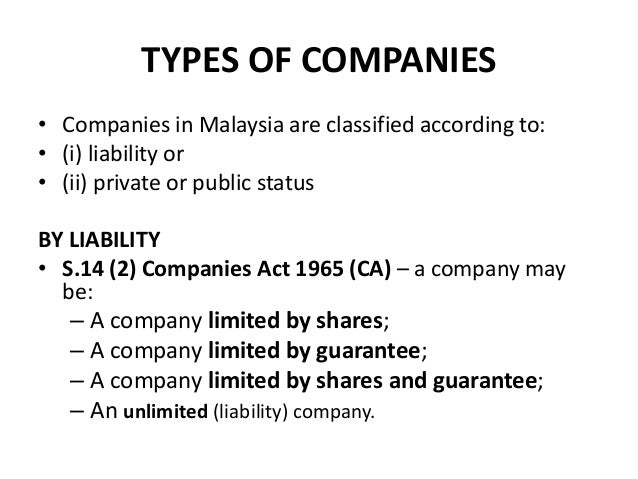

Exempt private company malaysia. This practice directive sets out the qualifying criteria for. A company is dormant in a financial year if the company does not carry on business and there is no accounting transaction occurred. A dormant company is a private entity as defined by the malaysian accounting standards board masb and the company is qualified for audit exemption if it has been dormant from the time of its incorporation. Exempt private company in malaysia.

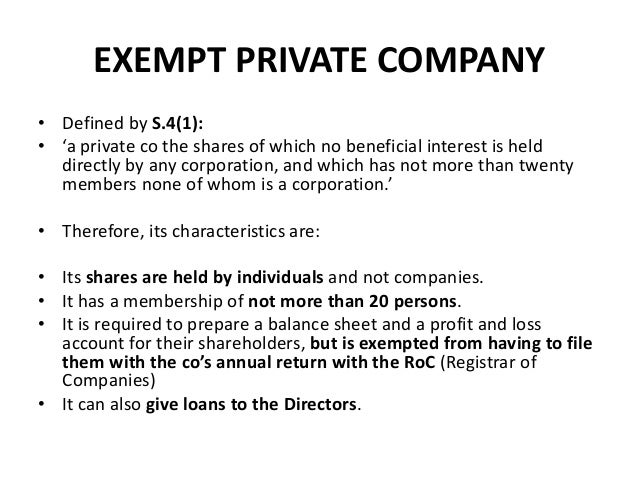

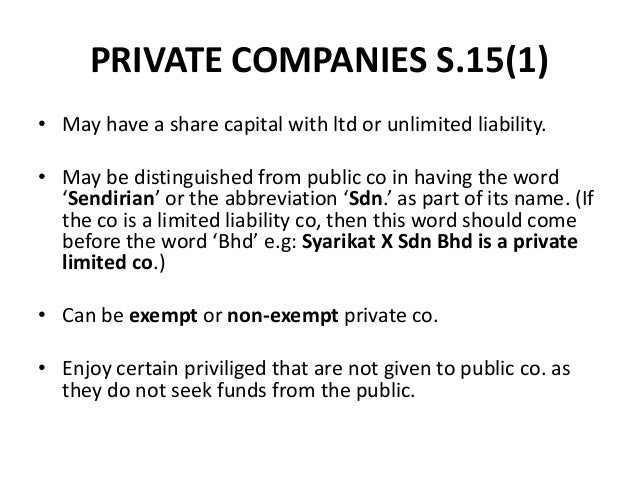

Otherwise the minister can also gazette the company as an exempt private company epc. There is no special treatment for exempt private companies epcs said companies commission of malaysia ssm director for corporate development and policy division nor azimah abdul. Exempt private company limited by shares an exempt private company limited by shares is a private company which has at most 20 shareholders. The shares of an exempt private company should not be held and are not held directly or indirectly by any corporation.

Also none of the shareholders is a corporation. Profit and loss account includes income and expenditure account revenue account or any other account showing the results of the business of a corporation for a period. Have no more than 20 shareholders and. A threshold qualified company is a private entity as defined by the malaysian accounting standards board masb and the company is qualified for an audit exemption if it has revenue includes revenue receivable during the year not exceeding rm100 000 during the current financial year and in the immediate past two 2 financial years.

An exempt private company need not file its annual accounts with the companies commission of malaysia ccm for the information of the public as long as the company files a certificate signed by a director of the company the secretary and the auditor of the company that the company is able to meet its liabilities as and when they fall due. An exempt private company cannot have more than 20 members. An exempt private company need not file its annual accounts with the companies commission of malaysia ccm for the information of the public. It can also be a company which the minister has gazetted as an exempt private company.

Acra defines an exempt private company epc as a singapore company that meets the following 3 main characteristics. An exempt private company is a private limited company. Where beneficial interest of shares in the company are not held directly or indirectly by any corporation ie. This practice directive is issued pursuant to section 20c of the companies commission of malaysia act 2001 and subsection 267 2 of the companies act 2016 ca 2016.

Qualifying criteria for audit exemption for certain categories of private companies 1. It is dormant throughout the current financial year and in the immediate preceding financial year. Based on the ca 2016 exempt private company means a private company.