Good And Service Tax Pdf

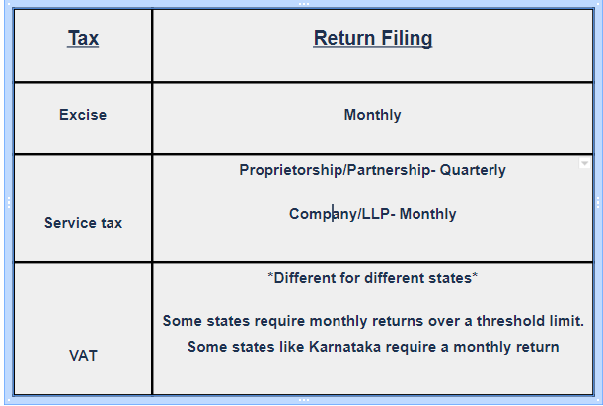

The goods and services tax council has passed the rate slabs at nil 5 12 18 28.

Good and service tax pdf. I can also hire someone to clean my house. Goods and services tax or gst is a broad based consumption tax levied on the import of goods collected by singapore customs as well as nearly all supplies of goods and services in singapore. Good service read the situations below and tell if it is a good or a service that is being paid for. First year lecture notes and ebook of goods services tax gst are.

First year subject goods services tax gst. Goods and services tax. Legislation is reproduced on this website with the permission of the government of singapore. However government has exempted healthcare and educational services from the purview of the gst.

In other countries gst is known as the value added tax or vat. Goods and services tax. A service is something you hire somebody to do for you for a fee. Goods and services tax act goods and services tax subsidiary legislation.

12 of 2017 12th april 2017 an act to make a provision for levy and collection of tax on intra state supply of goods or services or both by the central government and for matters connected therewith or incidental thereto. Complete this line only if you are a gst hst registrant who has to self assess gst hst on an imported taxable supply or who has to self assess the provincial part of hst. The major topics covered in these b com. Assessment of principles and practices of good governance in tax administration the assessment and collection of taxes from category c taxpayers in addis ababa.

Goods services tax gst is mostly taught as part of the b com. Lodge your grievance using self service help desk portal. The 2016 act requires parliament to compensate states for any revenue loss owing to the implementation of gst. Acts of parliament are available without charge and updated monthly at the singapore statutes online website.

You buy a sofa from a furniture. Input tax credit on the purchase include this amount on line 108. Gst rates on services comprising of 5 12 18 and 28 comes with various pros and cons for the consumers. 1st year course and these pdf lecture notes will help prepare well for your bcom semester exams.

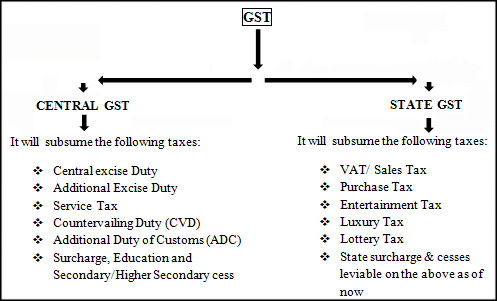

The centre will levy the integrated gst igst on the interstate supply of goods and services and apportion the state s share of tax to the state where the good or service is consumed. The central goods and services tax act 2017 no. For example i can hire a mechanic to repair my car. Gst exemptions apply to the provision of most financial services the supply of digital payment tokens the sale and lease of residential.

All of these are services.