Goods And Service Tax Gstr 2a

And gstr 8 tcs when all these auto.

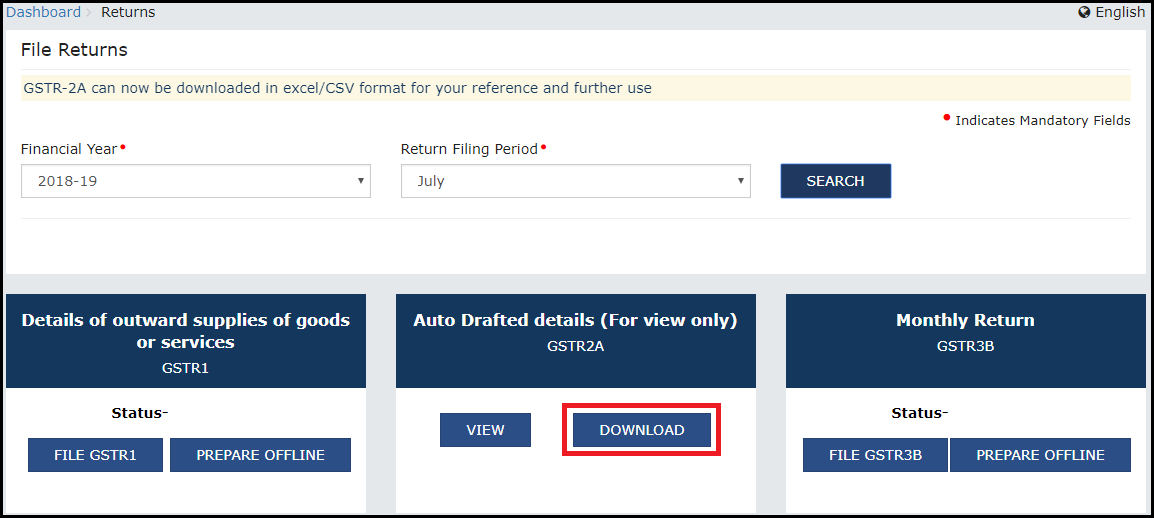

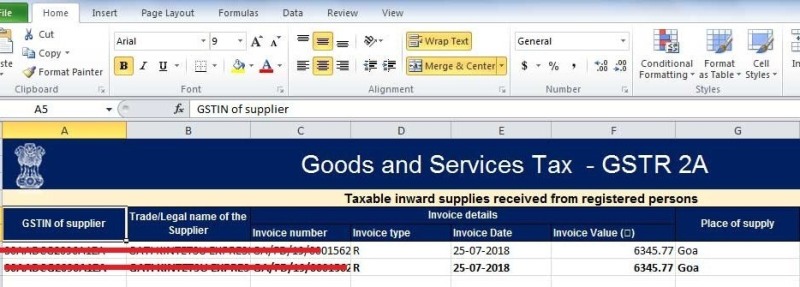

Goods and service tax gstr 2a. Gstr 2a is a auto populated summary of the details of inward supplies of goods and services during any period or month. When a seller files his gstr 1 the information is captured in gstr 2a. Also the details are fetched from gstr 1 of the seller and filled automatically with the most essential information. Now i have to file gstr 9 within sep 2020.

My client purchased in march 2019 and availed itc via gstr 3b in the month of march 2019. Lodge your grievance using self service help desk portal. But on verification of gstr 2a on gst portal the supplier s invoice has not been updated in gstr 2a. Goods and services tax.

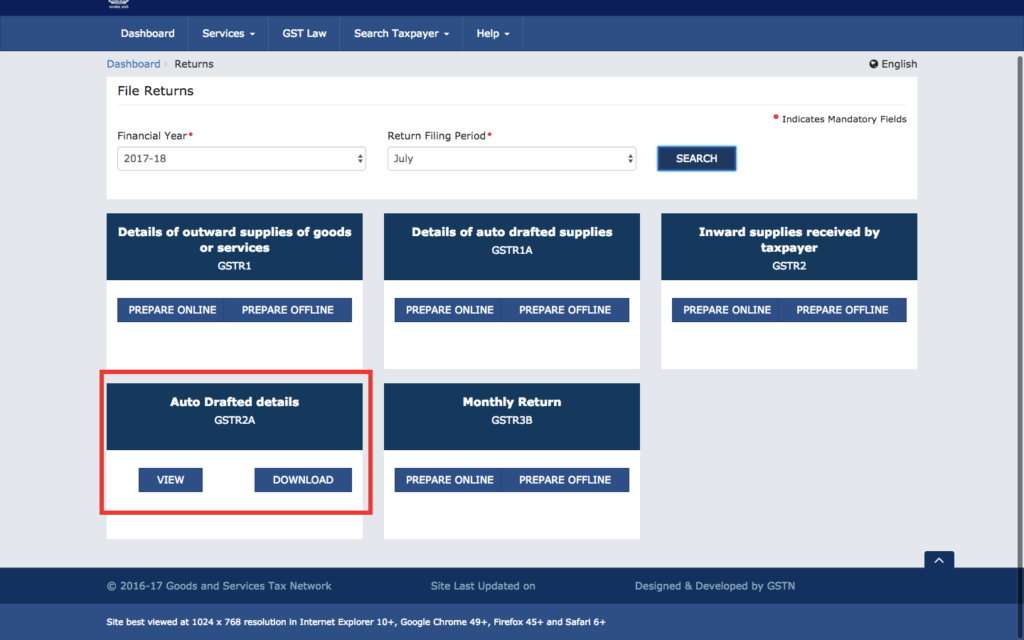

Gstr 1 gstr 5 and gstr 6 isd. It is created for a recipient when the form gstr 1 5 6 7 tax deductor 8 tax collector is filed submitted uploaded by the supplier taxpayer. In simple words gstr 2a is basically a gst return which contains details of the purchased goods and or services that are supplied by the supplier. The input tax credit taken by the buyer is on self assessment basis.

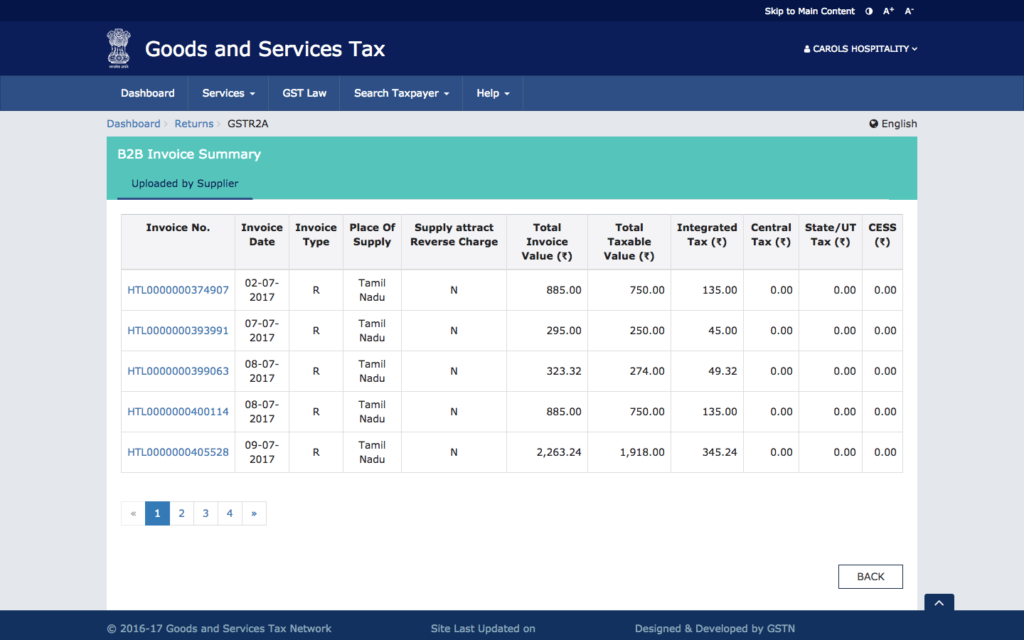

Form gstr 2a is return filing form which is generated by the system for a receiver taxpayer as the draft statement of inward supplies form gstr 2a is auto populated by the data which was entered in the following forms of all suppliers or counter party taxpayers of goods services in a given tax period. There is no compulsion as of now to match the invoice appearing in gstr 2a with the details uploaded by the supplier in his gstr 1 however as rightly said by sri kasturi sir the onus of claiming the credit is upon the buyer. As we discussed gstr 2a is an auto populated form which gets created when the goods or service provider files for gstr 1. In the form gstr 2a invoice records up to 500 for a table section can be seen online if the invoice is more than 500 the common portal will create a gstr 2a file and the registered taxable person shall view these details of the invoice in the offline utility tool available on the goods and services tax portal.

Gstr 2a is a system generated draft statement of purchase related tax return for a receiver taxpayer. As we know that through gstr 1 the dealer or business provides the details of invoices raised by him towards the buyer the buyer gets an intimation of the same in the form of gstr 2a.