Goods And Service Tax Network Meaning

Overall the goods and services tax network was developed to ensure a safe and secure system for financial transactions with respect to the gst.

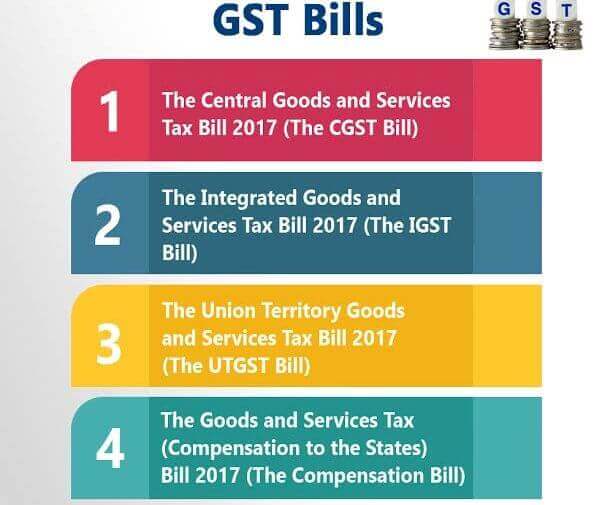

Goods and service tax network meaning. It is registered as a non profit company under the new companies act in march 2013. Act 20 of 2010 wef 01 01 2011 output tax has the meaning given to it by section 19. The goods and services tax gst is a value added tax levied on most goods and services sold for domestic consumption. In other countries gst is known as the value added tax or vat.

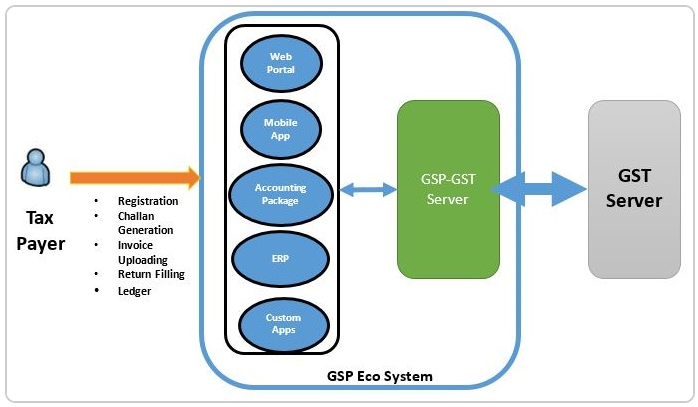

It is a comprehensive multistage destination based tax. The gst is paid by consumers but it is remitted to the government by the. The goods and services tax network gstn is a not for profit non government company promoted jointly by the central and state governments which will provide shared it infrastructure and services to both central and state governments including tax payers and other stakeholders. Open market value in relation to a supply of goods or services has the meaning given to it by section 17 5.

Goods and services tax gst is an indirect tax or consumption tax used in india on the supply of goods and services. Goods and services tax meaning. The goods and service tax network or gstn is a non profit non government organization. Gst exemptions apply to the provision of most financial services the supply of digital payment tokens the sale and lease of residential.

Goods and services tax or gst is a broad based consumption tax levied on the import of goods collected by singapore customs as well as nearly all supplies of goods and services in singapore. Comprehensive because it has subsumed almost all the indirect taxes except a few state taxes. It helps connect the taxpayer as well as the taxing authority in a transparent manner. Gst or goods and services tax is a tax that customers have to bear when they buy any goods or services such as food clothes items of daily needs.