Income Tax Act Malaysia 2018

.jpg)

Restriction on deductibility of interest section 140c income tax act 1967 study group on asian tax administration and.

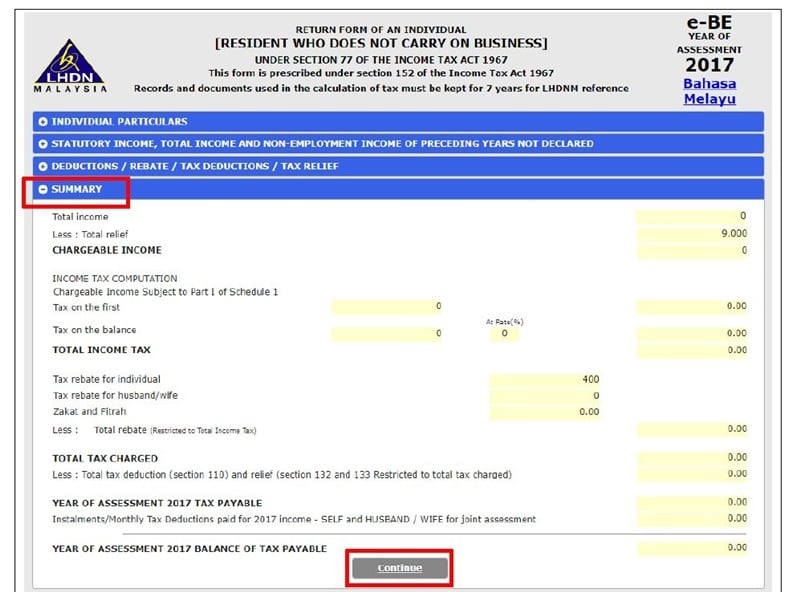

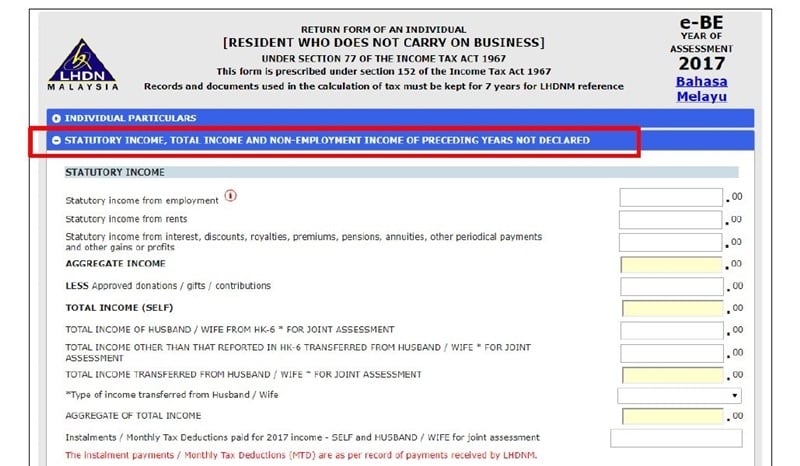

Income tax act malaysia 2018. Inland revenue board of malaysia shall not be liable for any loss or damage caused by the usage of any information. Interpretation part ii imposition and general characteristics of the tax 3. Hopefully this guide has helped answer your main questions about filing personal income taxes in malaysia for ya 2018. These new rates will apply for those who have accumulated their income from january 2018 to december 2018 and are filing their taxes from march april 2019.

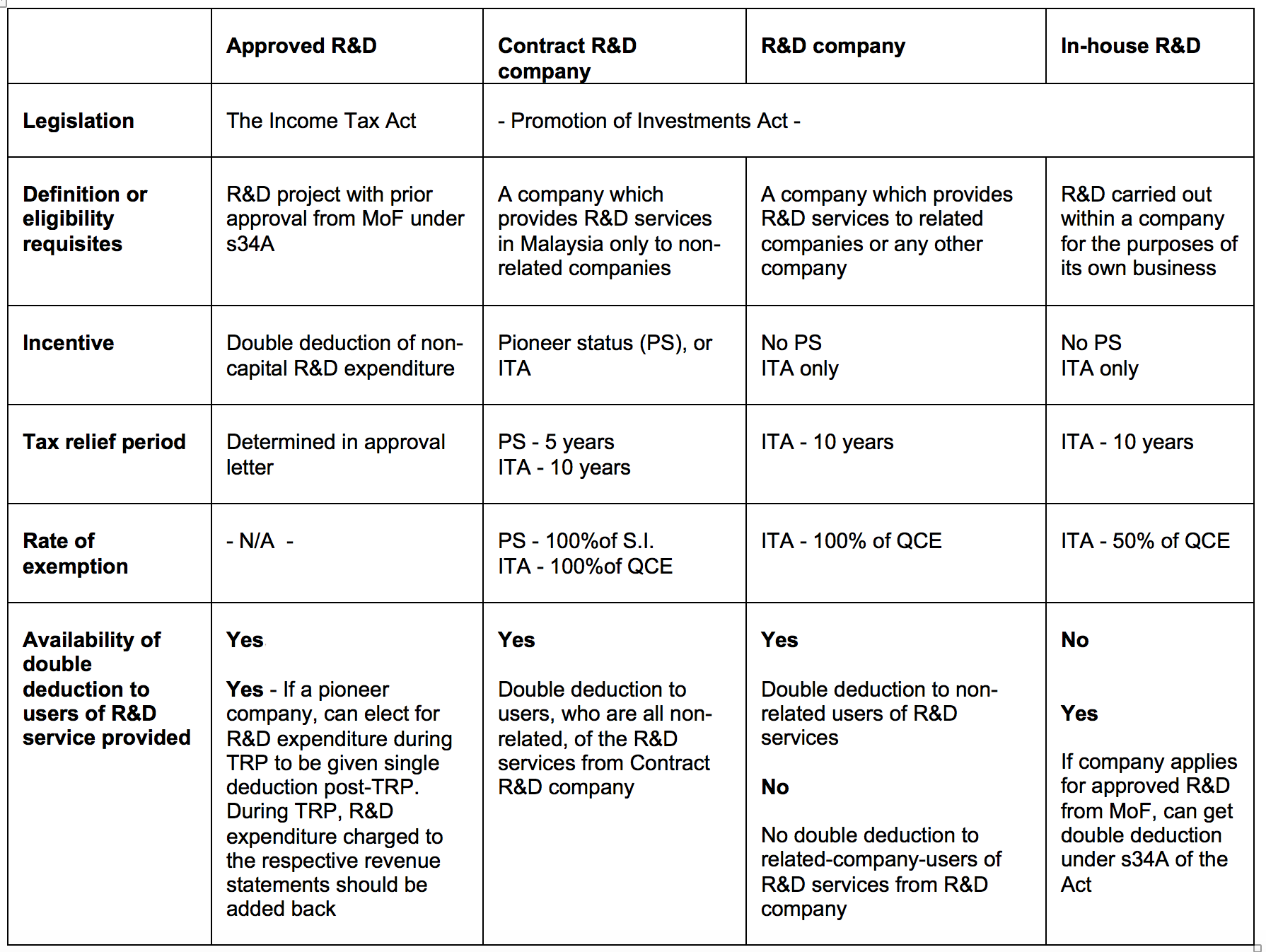

Reduction of the income tax rate from 18 to 17 on the first myr 500 000 of chargeable income of small and medium sized enterprises i e. Amendment of acts 2. The income tax act 1967 act 53 the promotion of investments act 1986 act 327 the stamp act 1949 act 378 the real property gains tax act 1976 act 169 the labuan business. The income tax amendment act seeks to amend the income tax act 1967 ita to introduce the following key amendments.

Companies incorporated in malaysia with paid up capital or limited liability partnerships resident in malaysia with a total capital contribution of myr 2 5 million or less and that are not part of a group containing an entity exceeding this capitalization threshold. Capital allowances consist of an initial allowance and annual allowance. However schedule 3 of the income tax act 1967 has laid down several allowable deductions in the form of allowances for the capital expenditures that have been incurred. Sme it is proposed that the income tax rate on first rm500 000 of chargeable income of sme be reduced from 18 to 17.

Enacted by the parliament of malaysia as follows. If you have any questions about the whole process don t hesitate to ask us in the comments and we ll do our best to help you out. On 27 december 2018 the income tax amendment act 2018 income tax amendment act was published in the federal gazette. Chapter i preliminary short title 1.

Laws of malaysia act 53 income tax act 1967 arrangement of sections part i preliminary section 1. Non chargeability to tax in respect of offshore business activity 3 c. More on malaysia income tax 2019. Act 2018 and sales tax act 2018.

For year of assessment 2018 the rates for lower brackets earners have been decreased from 5 to 3 10 to 8 and 16 to 14 for the year of assessment 2018. This act may be cited as the finance act 2018. Short title and commencement 2. A resident company incorporated in malaysia with an ordinary paid up share capital of rm2 5 million and below or 2.

.jpg)