Income Tax E Filing Pan Card

The income tax department never asks for your pin passwords or similar access information for credit cards banks or other financial accounts through e mail.

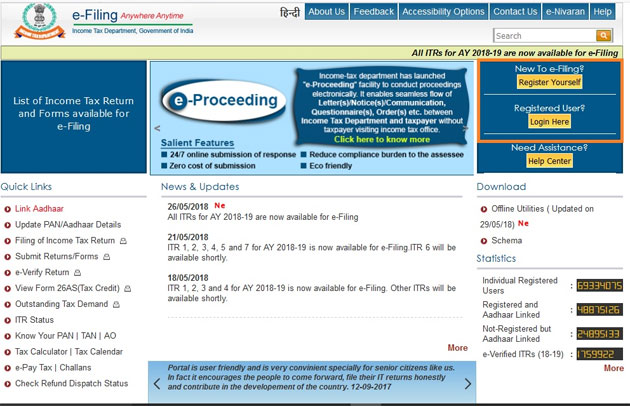

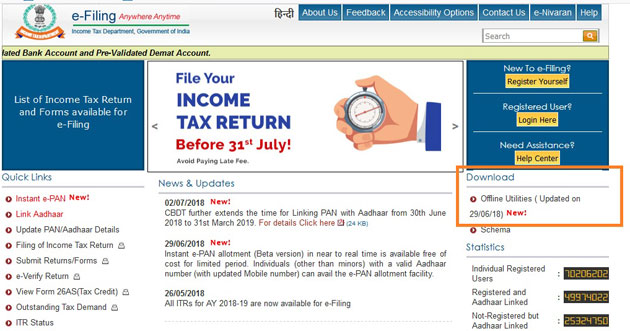

Income tax e filing pan card. The permanent account number pan card issued by the income tax department is one of the most important documents nowadays. Log on to e filing portal at https incometaxindiaefiling gov in. You may be one of them. The card was issued in order to prevent tax evasion by individuals and entities as it links all financial transactions made by a particular individual or entity.

Now you will see an option there which is saying e filing gs you have to click on that option. The income tax department appeals to taxpayers not to respond to such e mails and not to share information relating to their credit card bank and other financial accounts. If you are not registered with the e filing portal use the register. So the very first thing you have to do is to reach the income tax e filing official website.

The income tax department never asks for your pin numbers passwords or similar access information for credit cards banks or other financial accounts through e mail. So those people have to go through provided details carefully. The last date or deadline for linking of the pan card with the aadhaar card is. In 2014 income tax department has identified additional 22 09 464 non filers who have done high value transactions.

In 2013 income tax department issued letters to 12 19 832 non filers who had done high value transactions. A pan card is a 10 digit alpha numeric unique code issued by the income tax department of india to file the income tax returns or to make banking transactions exceeding rs. December 10th 2017 rehmat leave a comment. This is to inform that by clicking on the hyper link you will be leaving e filing portal and entering website operated by other parties.

Moreover a pan card is also considered as one of the important identification documents for opening a bank account purchasing a property investing in mutual funds applying for a debit credit card and more. Pan card is the most important document needed while filing income tax related work like income tax filling. Most of the people do not know how to check their pan number without pan card. Know your pan card details from the income tax e filing website without entering pan number.

Income tax know your pan. An option is their saying services click on it now. The income tax department appeals to taxpayers not to click on hyperlinks contained in such phishing mails not to respond and not to share information relating to their credit card bank and other financial details accounts. Pan card is a very important document that is needed for various things like filing income tax returns investing in mutual funds etc.

Such links are provided only for the convenience of the client and e filing portal does not control or endorse such websites and is not responsible for their contents.