Income Tax E Filing Processing Status

In 2013 income tax department issued letters to 12 19 832 non filers who had done high value transactions.

Income tax e filing processing status. Tax refund if due is paid when the itr is processed and the claim of the taxpayer is accepted. The income tax return or itr status can be checked online through the income tax department s website. Checking income tax refund status on the e filing website. You may be one of them.

Log into mytax portal. Normally after verification the status of your tax return would be successfully verified or successfully e verified. Itr v is a duly filled form which also contains the acknowledgement number of e filling you need to get the printout of the duly filled form and verify the same with your signature and post the verified copy to the it department for further process. After processing is complete the status would be itr processed.

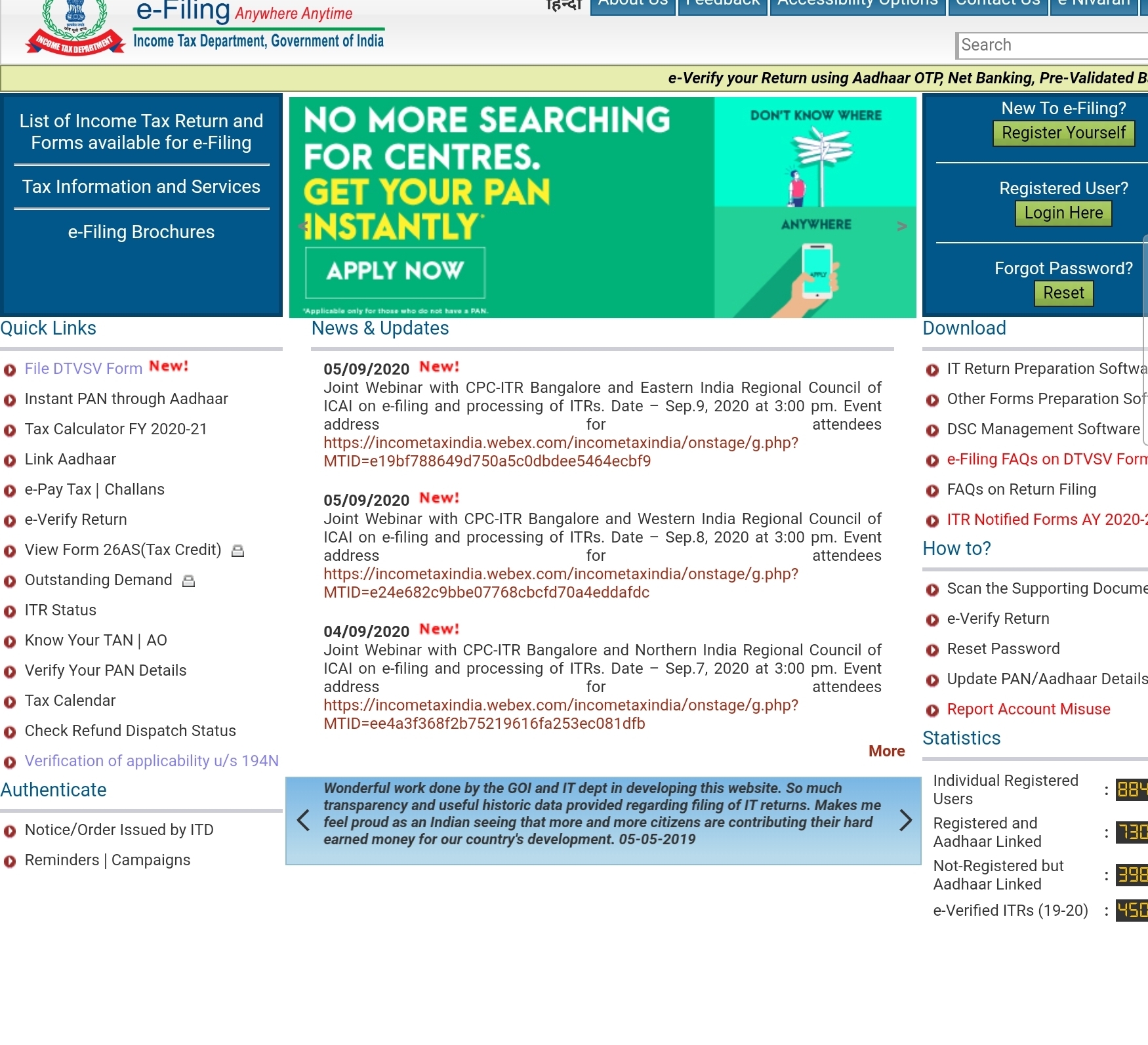

During processing the tax department checks if there are any discrepancies between the income declared and the tax paid by you and the data available with. If you are not registered with the e filing portal use the register. For more details please refer to the faq pdf 56kb. First things first log on the official website of the income tax department of india www incometaxindiaefiling gov in now enter your pan number dob and password.

Itr v reciept status processing of income tax return. Check your income tax refund status return processing status status of refund dispatched by post. When an individual files his online return without using a digital signature this form gets generated at successful e filing of income tax return. Check whether iras has received your tax return.

Don t worry if you missed the bus you can still file belated late return under section 139 4 and you re good to go. I forgot to file my income tax return within the due date can i claim my refund now. Select view filing status. Log on to e filing portal at https incometaxindiaefiling gov in.

To know more about belated return refer to our blog the filing for financial year fy 2019 20 assessment year ay 2020 21 will begin from 1st april 2020. You will receive another email from it department once your income tax return gets processed. After e verification of itr wait for around one month to get the intimation from it department under section 143 1. This is to inform that by clicking on the hyper link you will be leaving e filing portal and entering website operated by other parties.

Here s the process of checking the income tax status on the e filing website of the income tax department of india. Such links are provided only for the convenience of the client and e filing portal does not control or endorse such websites and is not responsible for their contents.