Income Tax Rate Malaysia 2018

Companies incorporated in malaysia with paid up capital or limited liability partnerships resident in malaysia with a total capital contribution of myr 2 5 million or less and that are not part of a group containing an entity exceeding this capitalization.

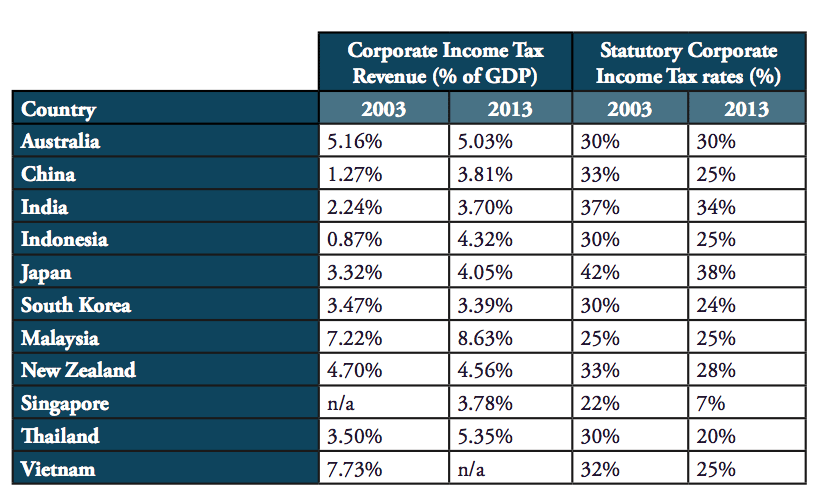

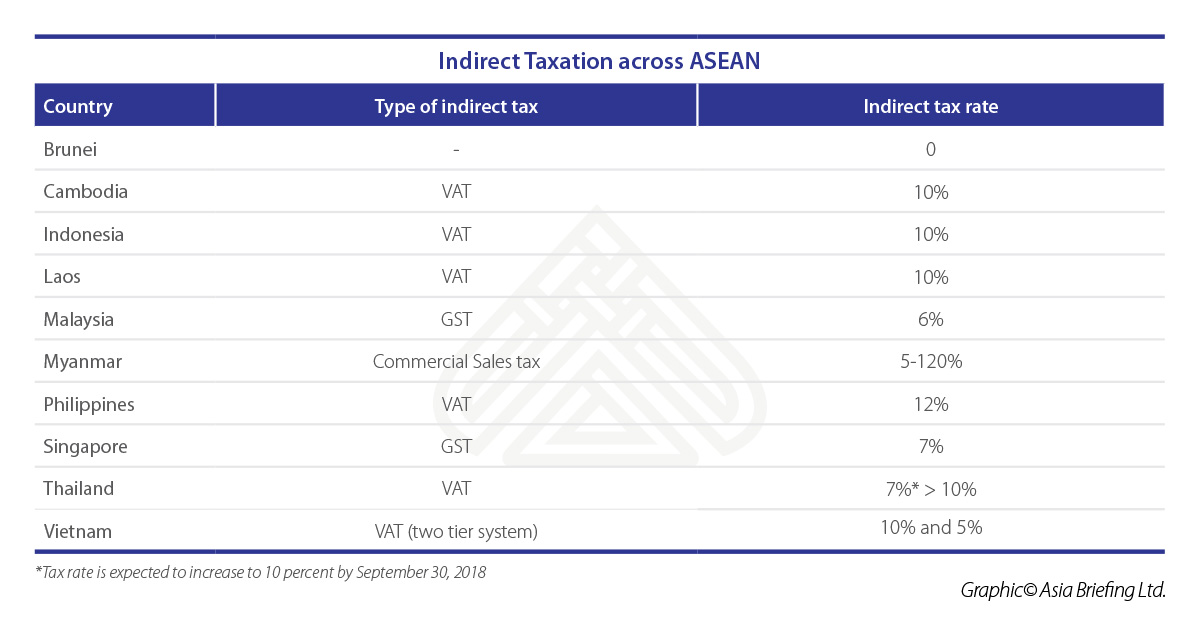

Income tax rate malaysia 2018. The standard corporate tax rate of 24 for a period of five years with a possible extension for another five years. Malaysia personal income tax rate. A graduated scale of rates of tax is applied to chargeable income of resident individual taxpayers starting from 0 on the first rm5 000 to a maximum of 30 on chargeable income exceeding rm2 000 000 with effect from ya 2020. Malaysia adopts a territorial system of income taxation a company whether resident or not is assessable on income accrued in or derived from malaysia.

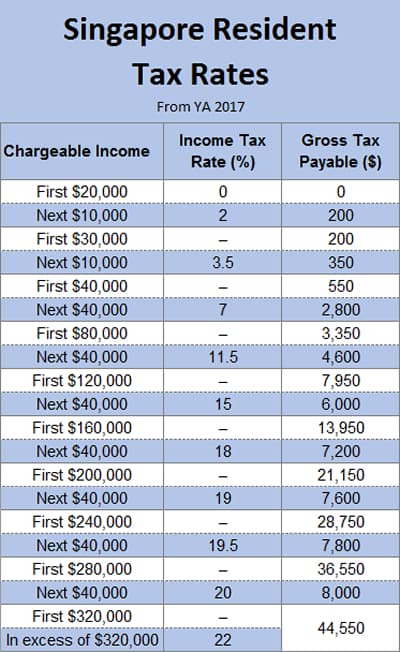

This page is also available in. 6 2 taxable income and rates 6 3 inheritance and gift tax 6 4 net wealth tax. Income tax in malaysia is imposed on income. A qualified knowledge worker in a specified area currently only iskandar malaysia is taxed at the concessionary rate of 15 on chargeable income from employment with a designated company engaged in a qualified activity e g.

However schedule 3 of the income tax act 1967 has laid down several allowable deductions in the form of allowances for the capital expenditures that have been incurred. On the first 5 000 next. With effect from ya 2020 a non resident individual is taxed at a flat rate of 30 on total taxable income. Green technology educational services.

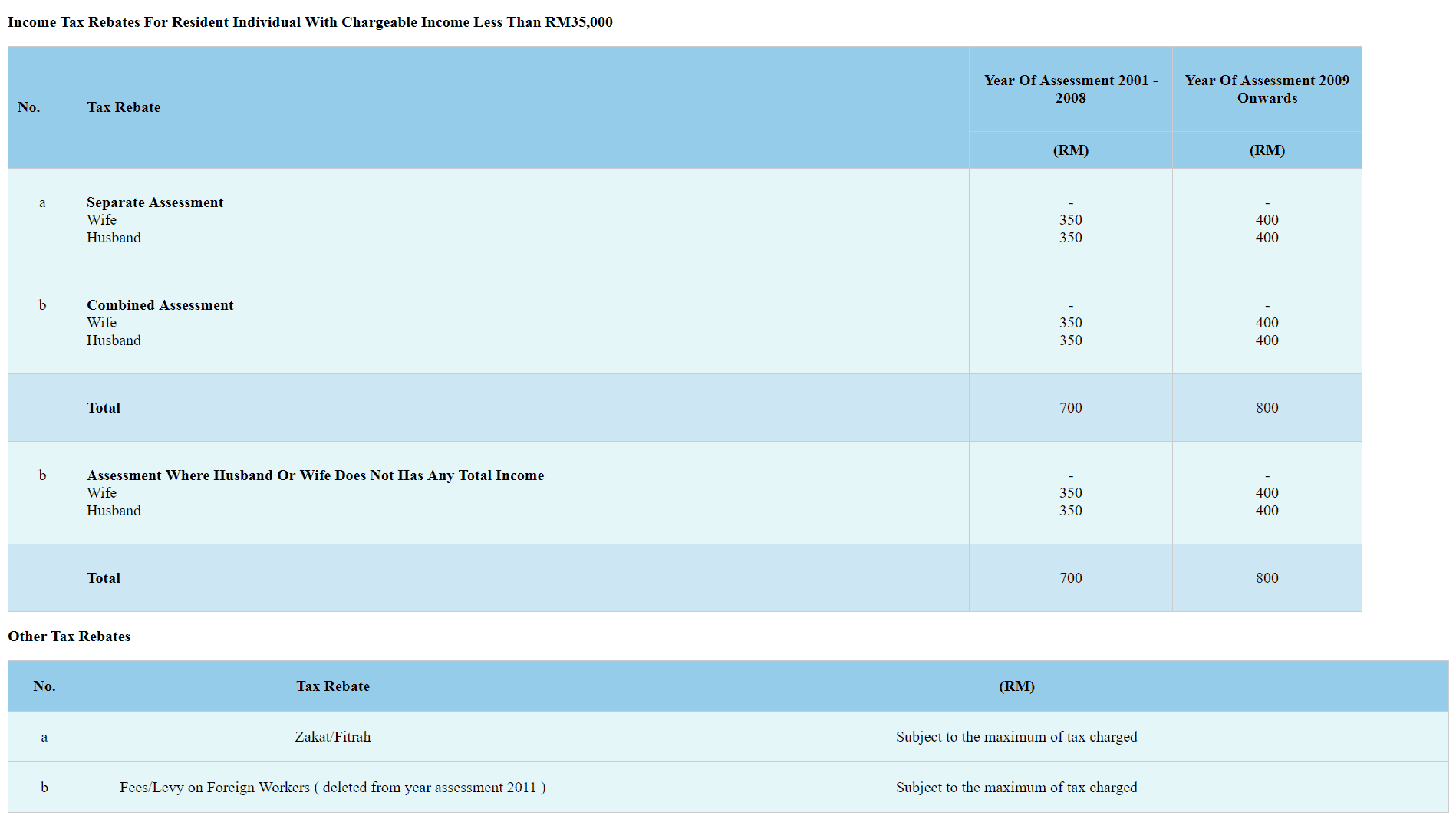

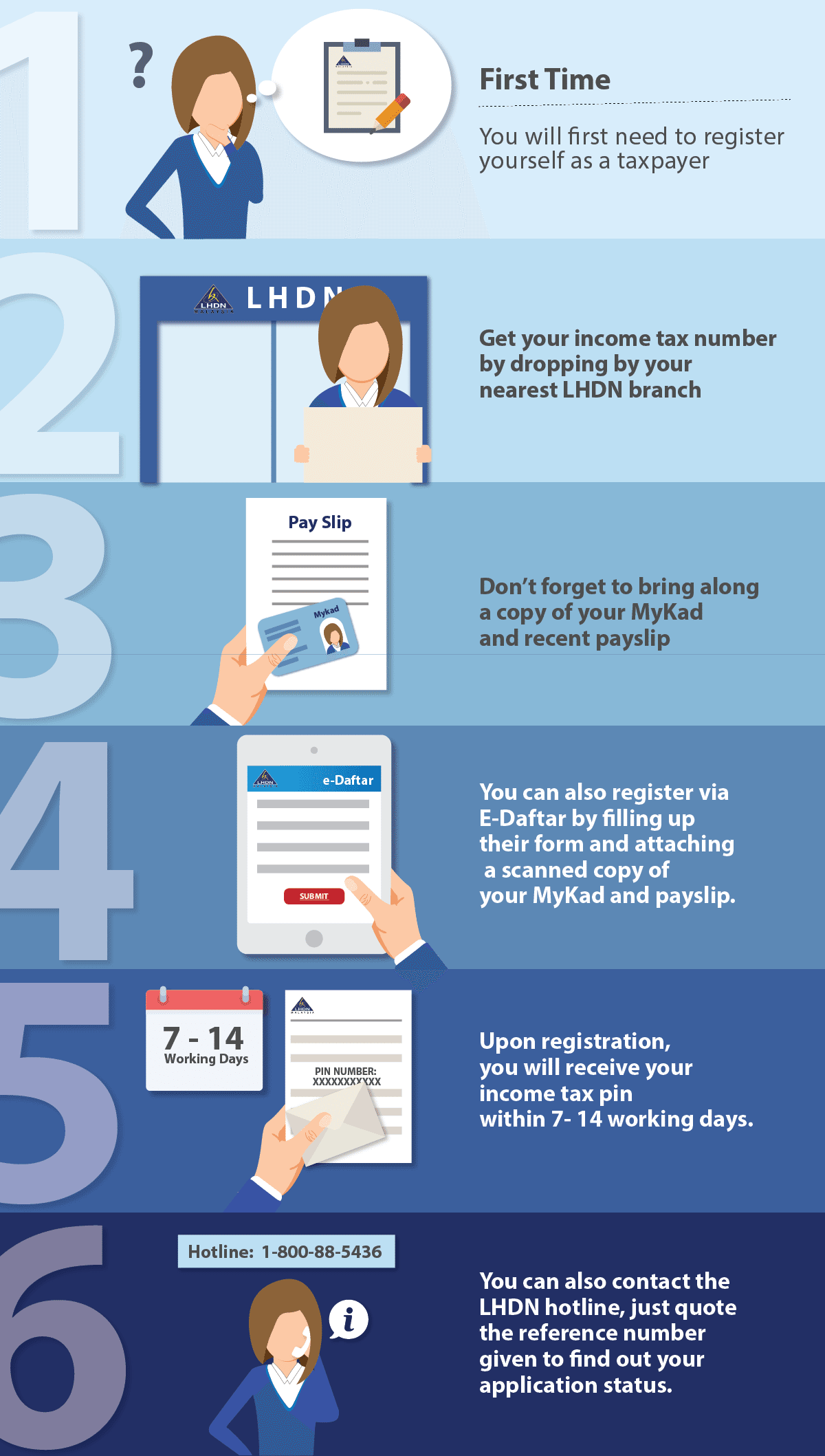

2018 2019 malaysian tax booklet 22 rates of tax 1. Calculations rm rate tax rm 0 5 000. If you have any questions about the whole process don t hesitate to ask us in the comments and we ll do our best to help you out. Inland revenue board of malaysia shall not be liable for any loss or damage caused by the usage of any.

Non resident individuals pay tax at a flat rate of 30 with. Calculations rm rate tax rm 0 5 000. Malaysia taxation and investment 2018 updated april 2018. More on malaysia income tax 2019.

Capital allowances consist of an initial allowance and annual allowance. On the first 5 000. Resident individuals chargeable income rm ya 2018 2019 tax rm on excess 5 000 0 1 20 000 150 3 35 000 600 8 50 000 1 800 14 70 000 4 600 21 100 000 10 900 24 250 000 46 900 24 5. Hopefully this guide has helped answer your main questions about filing personal income taxes in malaysia for ya 2018.

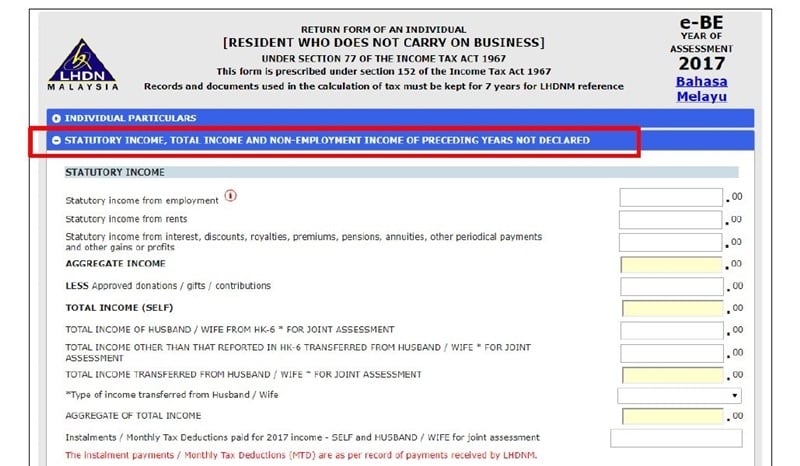

As the clock ticks for personal income tax deadline in malaysia 2018 like gainfully employed malaysians you may have started visiting the lhdn malaysia website to do your e filing as both a proactive and precautionary measure.