Income Tax Relief Malaysia Education

Every individual are eligible to claim a rm5 000 relief each in respective tax returns provided that the post graduate studies.

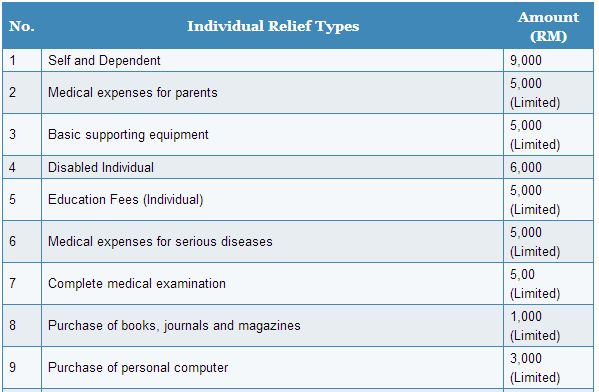

Income tax relief malaysia education. Basic supporting equipment. To promote a culture of lifelong learning among malaysians the government proposes tax relief of up to rm5 000 on education fees be extended to all post graduate studies masters and doctorate leve effective from year of assessment 2008. Special relief of rm2 000 will be given to tax payers earning on income of up to rm8 000 per month aggregate income of up to rm96 000 annually. Education and medical insurance premium rm3 000 rm6 000 purchase of personal computer for individual allow once in 3 years rm3 000 resident individual in malaysia entitles to claim tax relief deduction and rebate tax relief tax deduction housing loan interest rm10 000 fulfill the requirement tax deduction relief and rebate.

The tax incentives are being provided for under the following legislations. Parental care relief per parent for up to two parents from ya 2016 to ya 2020 subject to the following conditions. The government allows up to rm500 income tax relief for a complete medical check ups annually so if you haven t had one this year make use that benefit and make an appointment with your doctor today. Additional relief if that child is over 18 and receiving higher education or studying under articles or indentures in a trade or profession.

I promotion of investment act 1986 ii income tax act 1967 iii customs. I 5 000 limited year of assessment. 5 000 limited 3. Medical expenses for parents.

Scenario 1 you only have a medical card which you are paying rm 2 000 annually and you put in the entire rm 2 000 under the insurance premium for medical benefit tax relief. Tax rebate for self if your chargeable income after tax reliefs and deductions does not exceed rm35 000 you will be granted a rebate of rm400 from your tax charged. You should continue to claim the personal reliefs if you have met the qualifying conditions. The easiest mistake to make in claiming income tax relief.

If knocks on wood you are diagnosed with a serious disease you can claim up to rm6 000 income tax relief for your medical expenses. A tax rebate directly reduced your amount of tax charged and there are currently four types of tax rebates for income tax malaysia ya 2019. There really are a lot of tax reliefs and if you plan your reliefs effectively every year you could be saving thousands in taxes every year. However please evaluate whether you would benefit from the tax relief and make an informed decision.

Tax incentives offer relief from payment of direct or indirect tax partially or fully. Parent is a malaysian tax resident and at any time in that year aged sixty and. This relief is applicable for year assessment 2013 and 2015 only.