International Financial Reporting Standards Ifrs Pdf

Ias 39 is far reaching its requirements extend to virtually every area of business.

International financial reporting standards ifrs pdf. This edition has been updated in 2019 to reflect changes in ifrs and interpretations as at that date. In second part how ifrs and convergence of accounting standards adopted by internationally will be. International financial reporting standards ifrs. 44 0 20 7246 6410 email.

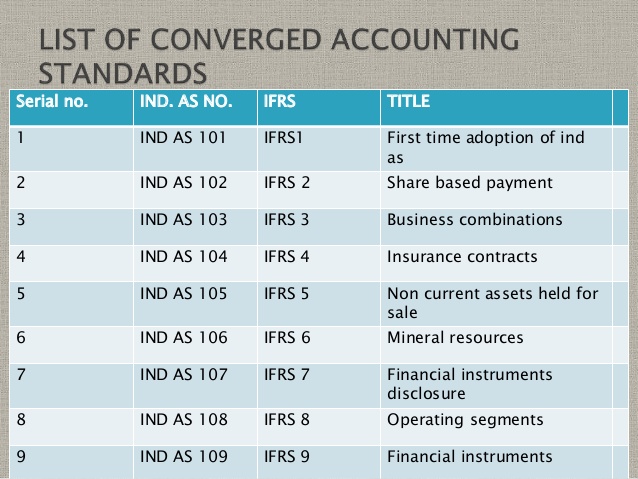

Download ifrs international financial reporting standards pdf in pdf and epub formats for free. Ifrs 2 share based payment. The number of countries that require or allow the use of ifrs for the preparation of financial statements by publicly held companies has continued to increase. Ifrs international financial reporting standards pdf book is also available for read online mobi docx and mobile and kindle reading.

The ifrs foundation s logo and the ifrs for smes logo the iasb logo the hexagon device eifrs ias iasb ifric ifrs ifrs for smes ifrs foundation international accounting standards international financial reporting standards niif and sic are registered trade marks of the ifrs foundation further details of which are available from the ifrs. This section also provides high level and non technical summaries for the. Ifrs 1 first time adoption of international financial reporting standards. The growing acceptance of international financial reporting standards ifrs as a basis for u s.

The first part of this report is to discuss about definition of ifrs and its development where included explanation of differences between ifrs. Of international financial reporting standards ifrs in this industry reflecting the practices of many practitioners in the pharmaceuticals and life sciences industry. Each solution is based on a specified set of circumstances. International financial reporting standards ifrs.

Ifrs 4 insurance contracts. Its application may require changes to systems processes and. Ifrs 5 non current assets held for sale and discontinued. Ifrs 3 business combinations.

One of the most challenging standards for many of those companies to understand and apply is ias 39 on financial instruments. Pros and cons for investors.

/paper-with-title-international-financial-reporting-standards--ifrs---850740234-6e303822ed5e4800b523b0ac24db396c.jpg)