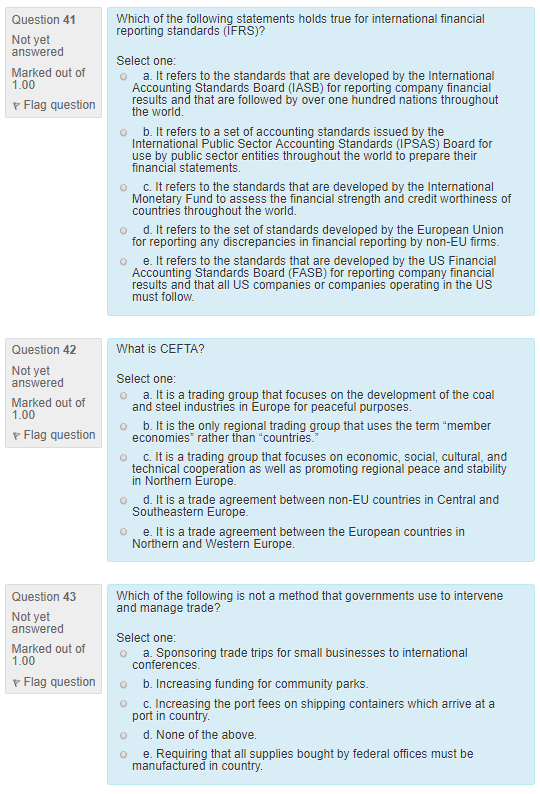

International Financial Reporting Standards Ifrs Were Developed Because

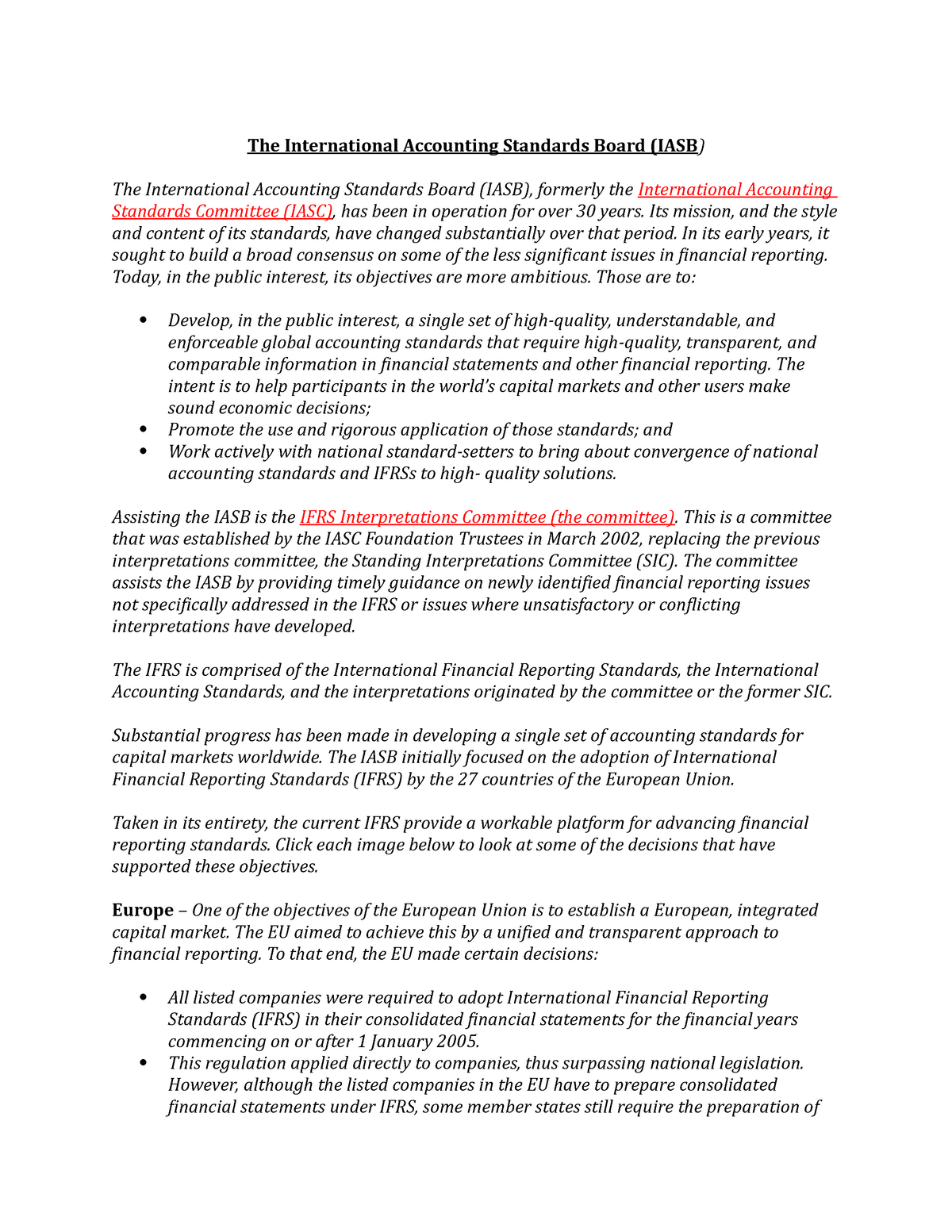

They were developed and are maintained by the international accounting standards board iasb.

International financial reporting standards ifrs were developed because. Ifrs 15 was issued in may 2014 and applies to an annual reporting period beginning on or. They constitute a standardised way of describing the company s financial performance and position so that company financial statements are understandable and comparable across international boundaries. International financial reporting standards ifrs. International financial reporting standards ifrs were developed by the international accounting standards committee iasc and its successor organization the international accounting standards board iasb.

Though these new requirements were introduced slowly. Ifrs 15 specifies how and when an ifrs reporter will recognise revenue as well as requiring such entities to provide users of financial statements with more informative relevant disclosures. Ifrs 10 was issued in may 2011 and applies to annual periods beginning on or after 1 january 2013. Control requires exposure or rights to variable returns and the ability to affect those returns through power over an investee.

Because of the standards identification with these bodies ifrs is sometimes referred to as ias gaap. Ifrs 10 outlines the requirements for the preparation and presentation of consolidated financial statements requiring entities to consolidate entities it controls. International financial reporting standards ifrs are a set of accounting standards developed by the international accounting standards board iasb that is becoming the global standard for the preparation of public company financial statements. This is primarily because often in order to do business with countries that require the use of ifrs for reporting external entities must use the method as well.

International financial reporting standards commonly called ifrs are accounting standards issued by the ifrs foundation and the international accounting standards board iasb. The growing influence of international financial reporting standards has. The standard provides a single principles based five step model to be applied to all contracts with customers. Since that point ifrs standards have gone on to become the de facto global language of financial reporting used extensively across developed emerging and developing economies.

Our research shows that 144 jurisdictions now require the use of ifrs standards for all or most publicly listed companies whilst a further 12 jurisdictions permit its use. International financial reporting standards ifrs are a set of international accounting standards stating how particular types of transactions.

/paper-with-title-international-financial-reporting-standards--ifrs---850740234-6e303822ed5e4800b523b0ac24db396c.jpg)