Pioneer Status And Investment Tax Allowance Malaysia

New existing fixed assets and other conditions.

Pioneer status and investment tax allowance malaysia. Ibu pejabat lembaga hasil dalam negeri malaysia menara hasil persiaran rimba permai cyber 8. Approval of pioneer status by a company producing a product or participating in an activity of national and strategic importance to malaysia. Unabsorbed losses not to be carried forward to post pioneer period. Pioneer status and investment tax allowance are two of the main tax incentives available in malaysia.

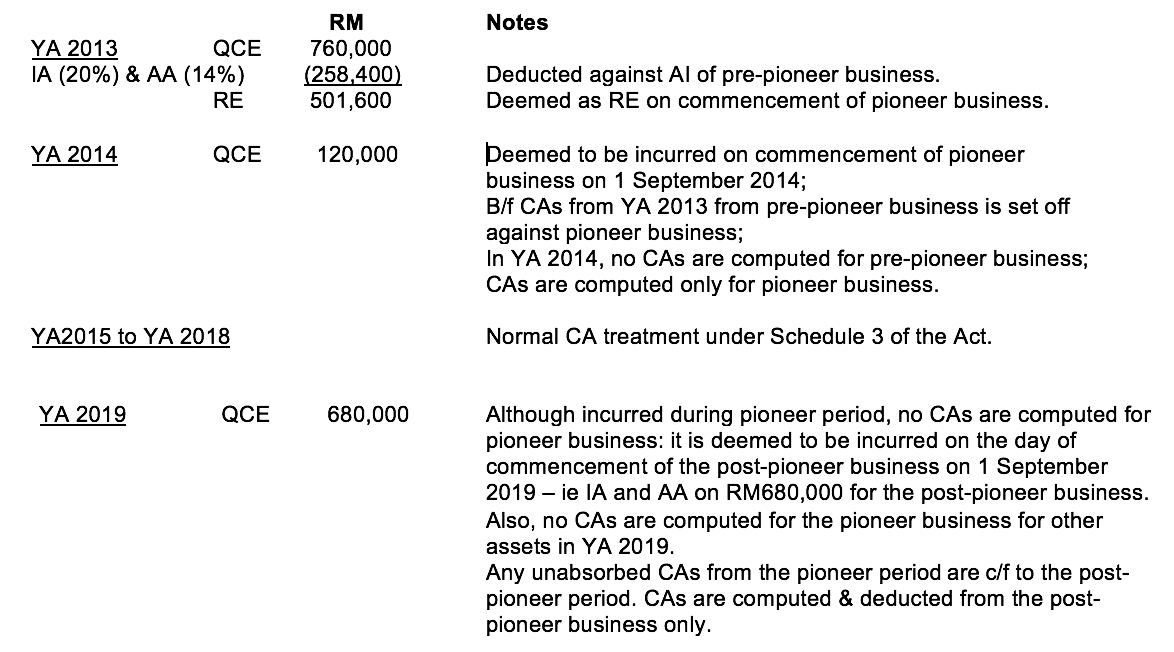

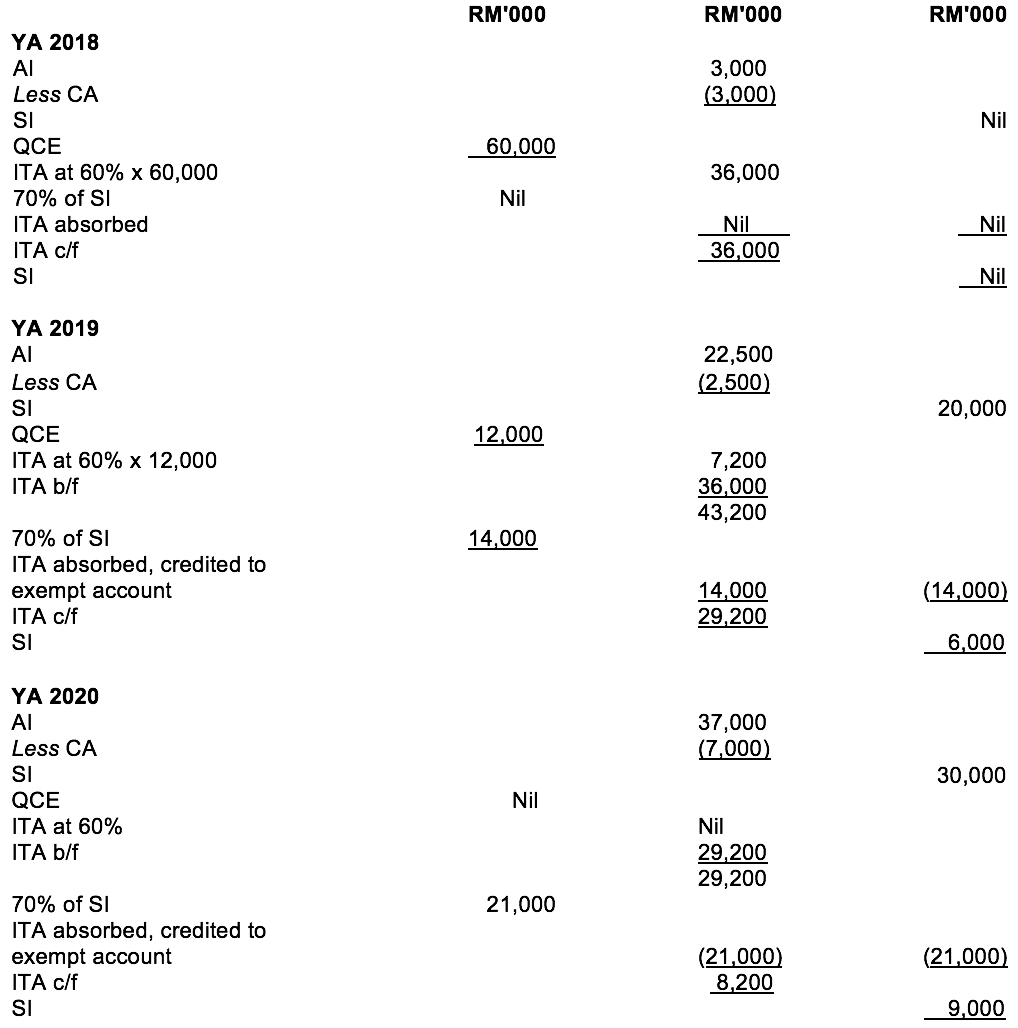

Utama investment tax allowance. Malaysia offers a wide range of tax incentives ranging from tax exemptions allowances to enhanced tax deductions. Or investment tax allowance of 60 on qualifying capital expenditure incurred for 5 years. Unabsorbed capital allowances not to be carried forward to post pioneer period.

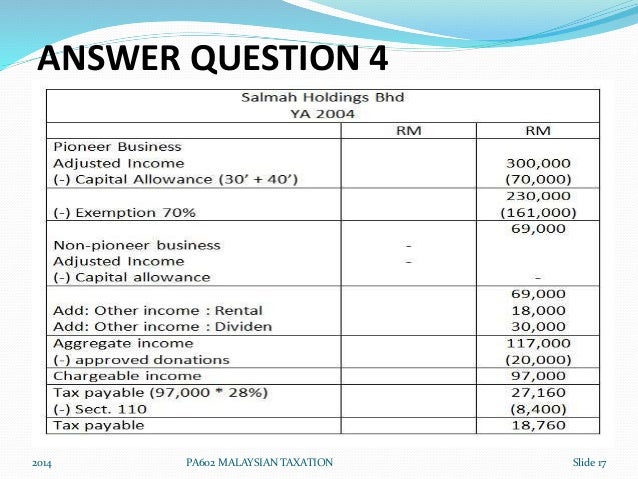

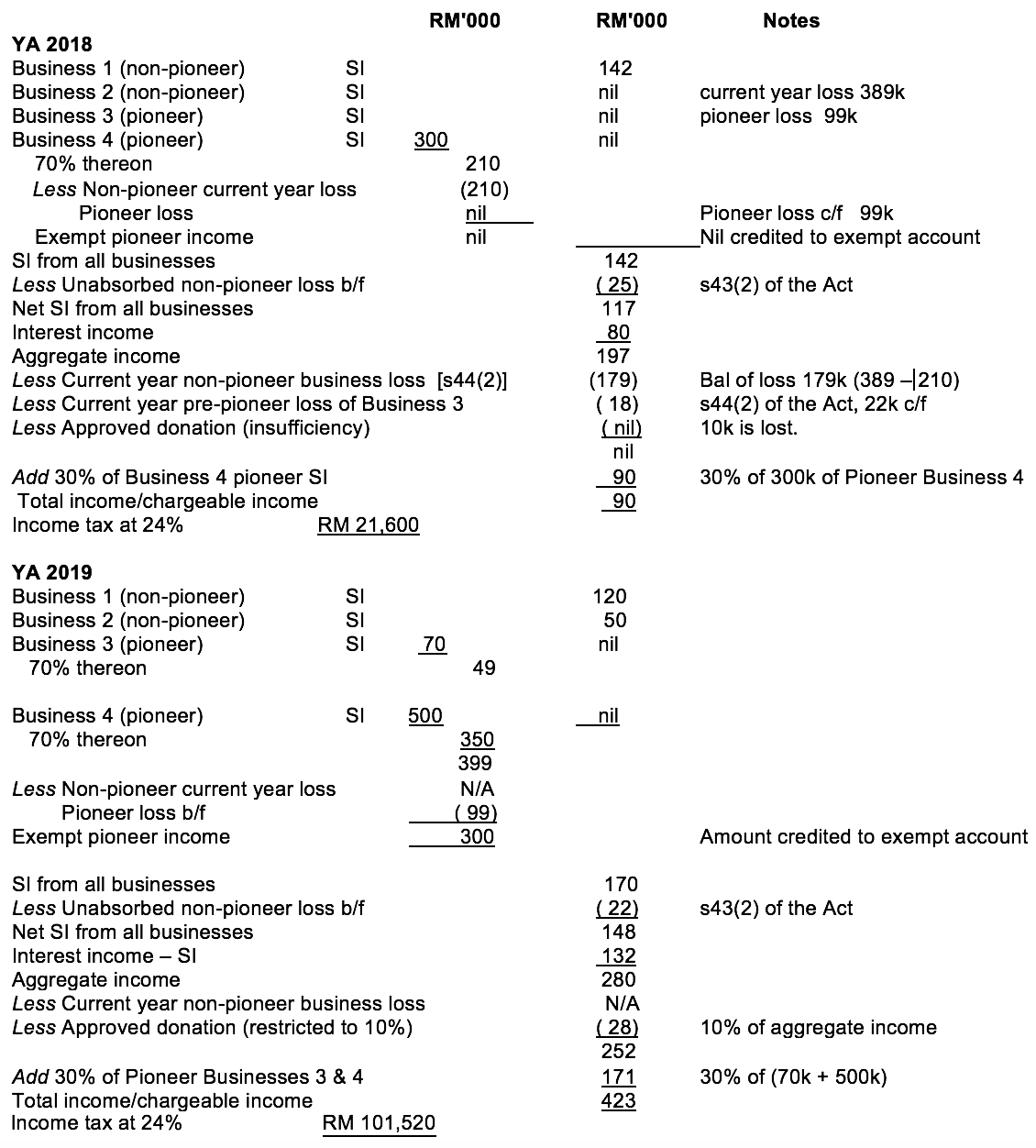

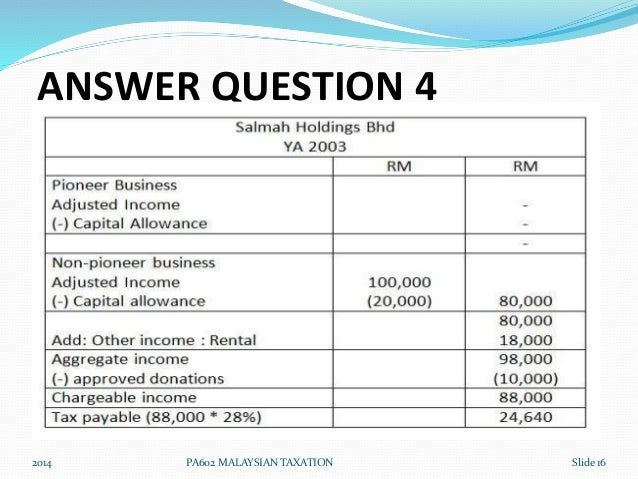

Offset against 70 of the statutory income for each assessment year. Pioneer status ps is an incentive in the form of tax exemption which is granted to companies participating in promoted activities or producing promoted products for a period of 5 or 10 years. Candidates must first study closely the source authority for these incentives ie the relevant laws and the respective irb public rulings or guidelines where available to obtain a good general understanding. Pioneer status ps and investment tax allowance ita companies in the manufacturing agricultural hotel and tourism sectors or any other industrial or commercial sector that participate in a promoted activity or produce a promoted product may be eligible for either ps.

Tax exemption of statutory income for 10 years. Iii pioneer status iv investment tax allowance and v reinvestment allowance. We hear that these companies are given financial or fiscal incentives. A company approved with a pioneer status certificate can enjoy income tax exemption between 70 100 of statutory income for 5 to 10 years whereas for investment tax allowance a company can get allowances between 60 100 on qualifying capital expenditure incurred within a period of 5 to 10 years.

Understanding malaysia pioneer status and investment tax allowance for your business june 17 2009 by sabrie for those who are aware of the malaysian government s effort in promoting a selected industry ict for msc companies for example. Pioneer status often provides a 70 exemption of statutory income for a period of 5 years. Similar lists of promoted products or activities as applied for pioneer status would also be applied for ita. Akta penggalakan pelaburan 1986.

The following are the major types of incentives available in malaysia.