Private Exempt Company Malaysia Criteria

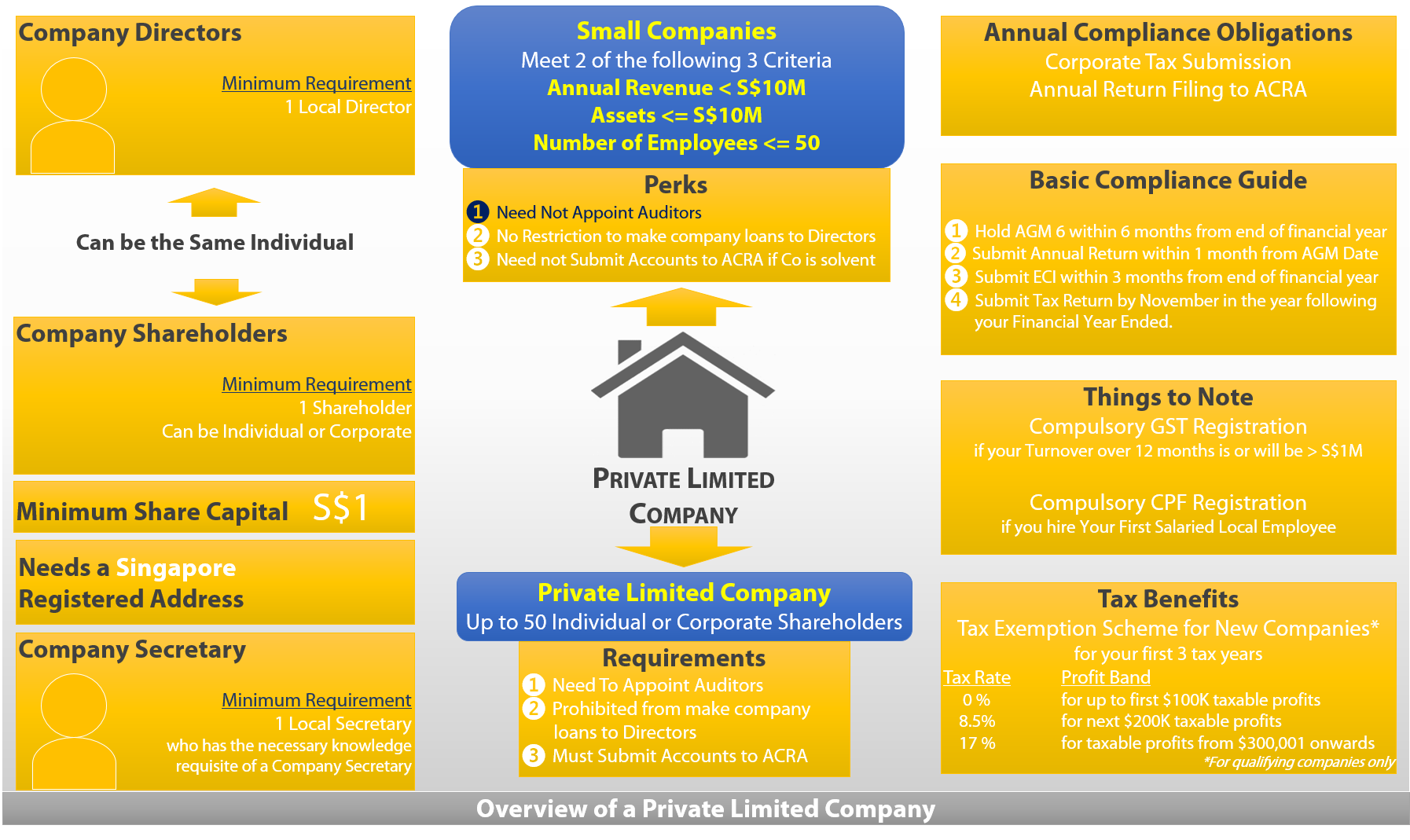

And which has not more than 20 members none of whom is a corporation.

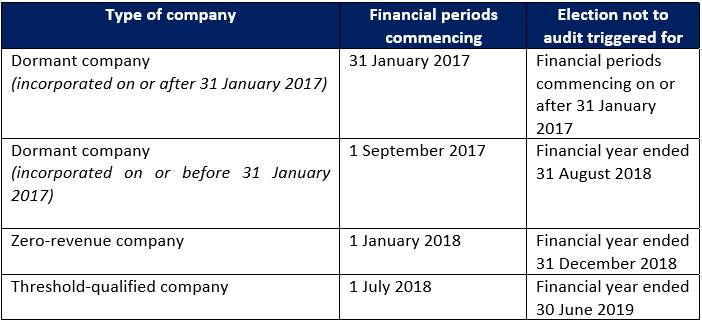

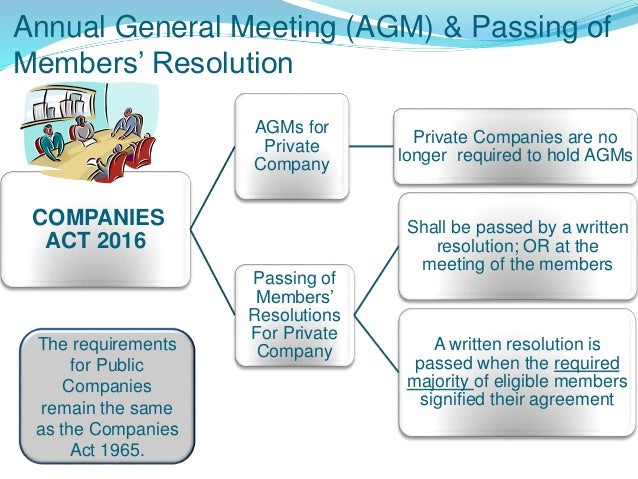

Private exempt company malaysia criteria. How do i apply for audit exemption in malaysia. 603 7785 2624 603 7785 2625. Qualifying criteria for audit exemption for certain categories of private companies 1. There are however two different types of private company limited by shares namely a private company and an exempt private company.

Level 4 lot 6 jalan 51 217 46050 petaling jaya selangor malaysia. And b it meets at least 2 of 3 following criteria for immediate past two consecutive financial years. This practice directive is issued pursuant to section 20c of the companies commission of malaysia act 2001 and subsection 267 2 of the companies act 2016 ca 2016. Ii total value of the company s total assets at the end of each financial year does not exceed rm500 000.

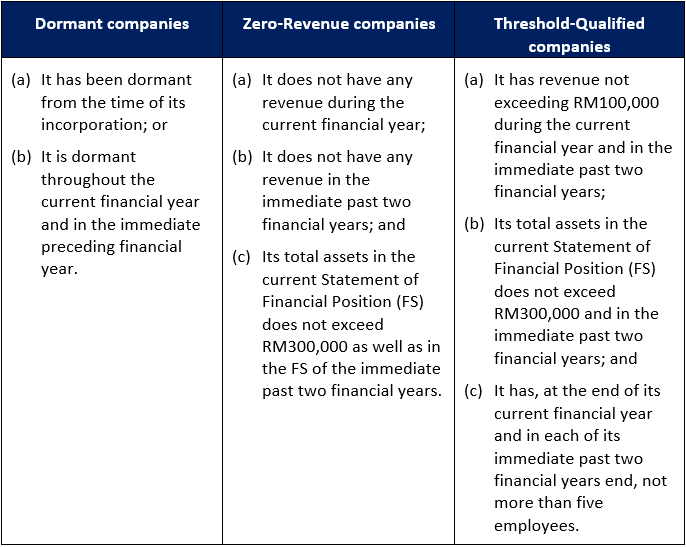

A threshold qualified company is a private entity as defined by the malaysian accounting standards board masb and the company is qualified for an audit exemption if it has revenue includes revenue receivable during the year not exceeding rm100 000 during the current financial year and in the immediate past two 2 financial years. Iii it has at the end of each financial year not more than 5 employees. If the company has more than 20 but less than 50 shareholders it s called a private company. Exempt private company limited by shares an exempt private company limited by shares is a private company which has at most 20 shareholders.

Also none of the shareholders is a corporation. A threshold qualified company is qualified for an audit exemption if it fulfills the following criteria it has revenue not exceeding rm100 000 during the current financial year and in the immediate past two 2 financial years. Does this mean companies don t have to do anymore accounting. Nope one of the requirements to apply for audit exemption is that the private company must submit their unaudited financial statement.

An exempt private company is a private limited company. This practice directive sets out the qualifying criteria for. An exempt private company cannot have more than 20 members. The shares of an exempt private company should not be held and are not held directly or indirectly by any corporation.

I the revenue of the company for each financial year does not exceed rm300 000. Let them guide you through the application process. A company qualifies as a small company if a it is a private company in the financial year in question. If the number of shareholders exceeds 50 it becomes a public company.

Where beneficial interest of shares in the company are not held directly or indirectly by any corporation ie. Finally if the number of shareholders is 20 or less with no corporation holding any beneficial interest in the company s shares it is known as an exempt private company epc.