Section 33 1 Income Tax Act 1967 Malaysia

Short title and commencement 2.

Section 33 1 income tax act 1967 malaysia. Laws of malaysia act 53 income tax act 1967 arrangement of sections part i preliminary section 1. Year of assessment 2006 ya 2006 onwards rm. As such there s no better time for a refresher course on how to lower your chargeable income. Generally you are only taxed for the profit that you or your business earns.

3 1 immediate family members means an employee s wife or wives and his children or an employee s husband and her children. Malaysia s tax season is back with businesses preparing to file their income tax returns. Section 33 1 of the income tax act 1967 ita reads as follows. Akta cukai pendapatan 1967 versi dalam talian pada 1 januari 2019 atau akta cukai pendapatan 1967.

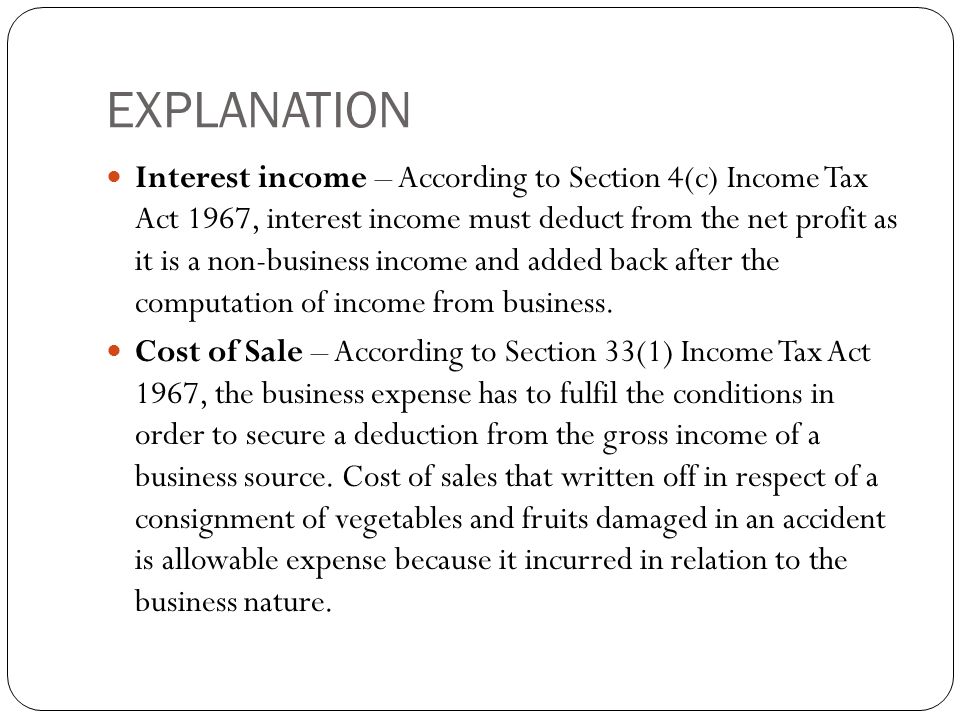

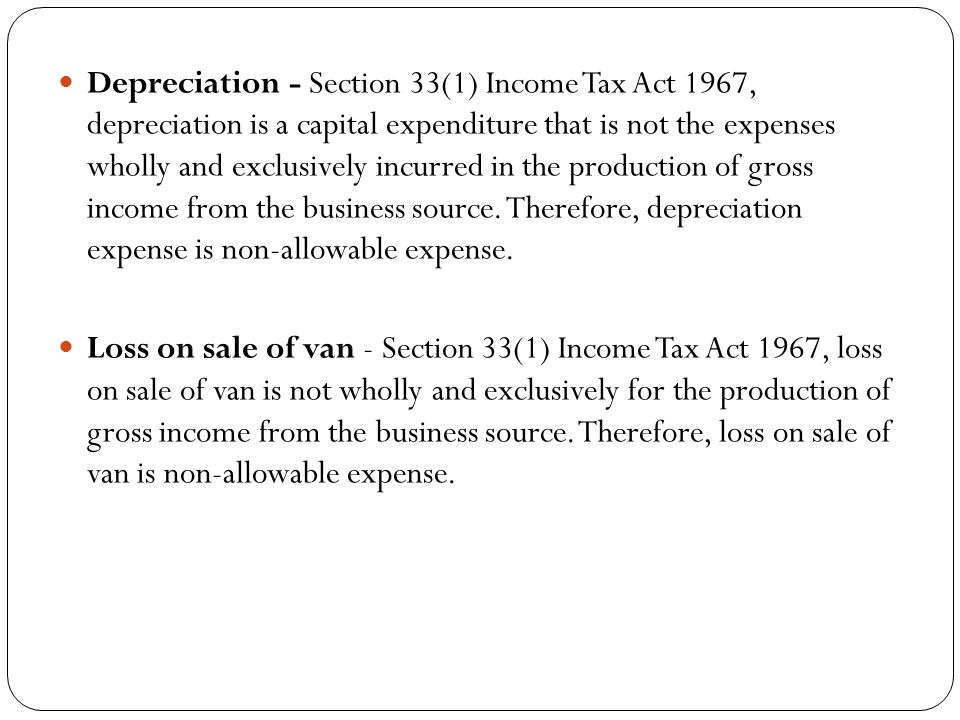

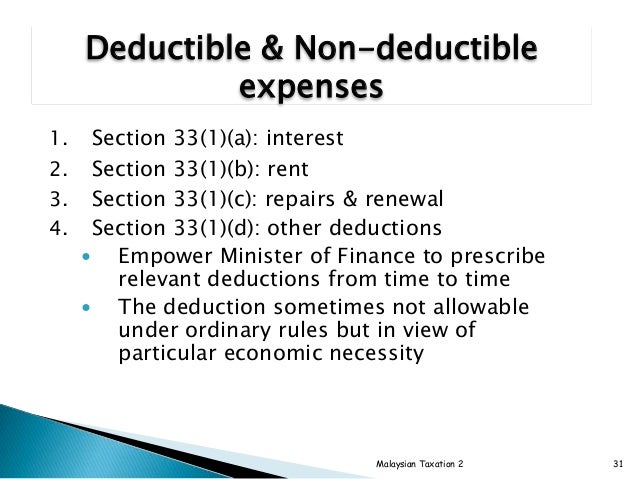

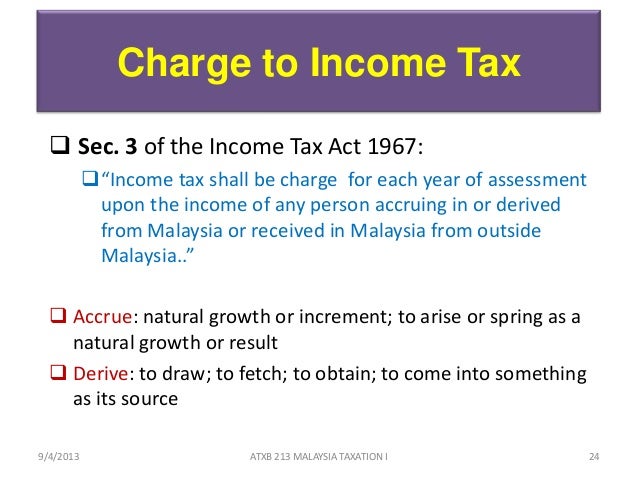

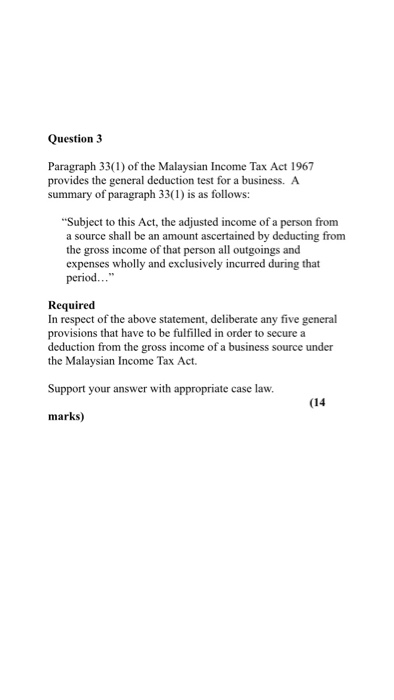

The words used in this ruling have the following meanings. The phrase expenses wholly and exclusively incurred in the production of gross income incorporates the basic rule which spells out the conditions for allowing a tax deduction. What are the types of income which are taxable and subject to monthly tax deduction mtd or in bahasa malaysia potongan cukai berjadual pcb. Sec 33 1 adjusted income gross income deductible expenses deducting from the gross income of that person from that source for that period all outgoings and expenses wholly and exclusively incurred during that period.

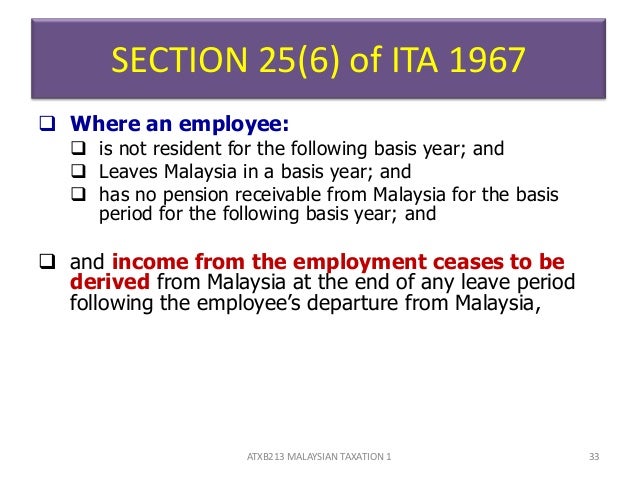

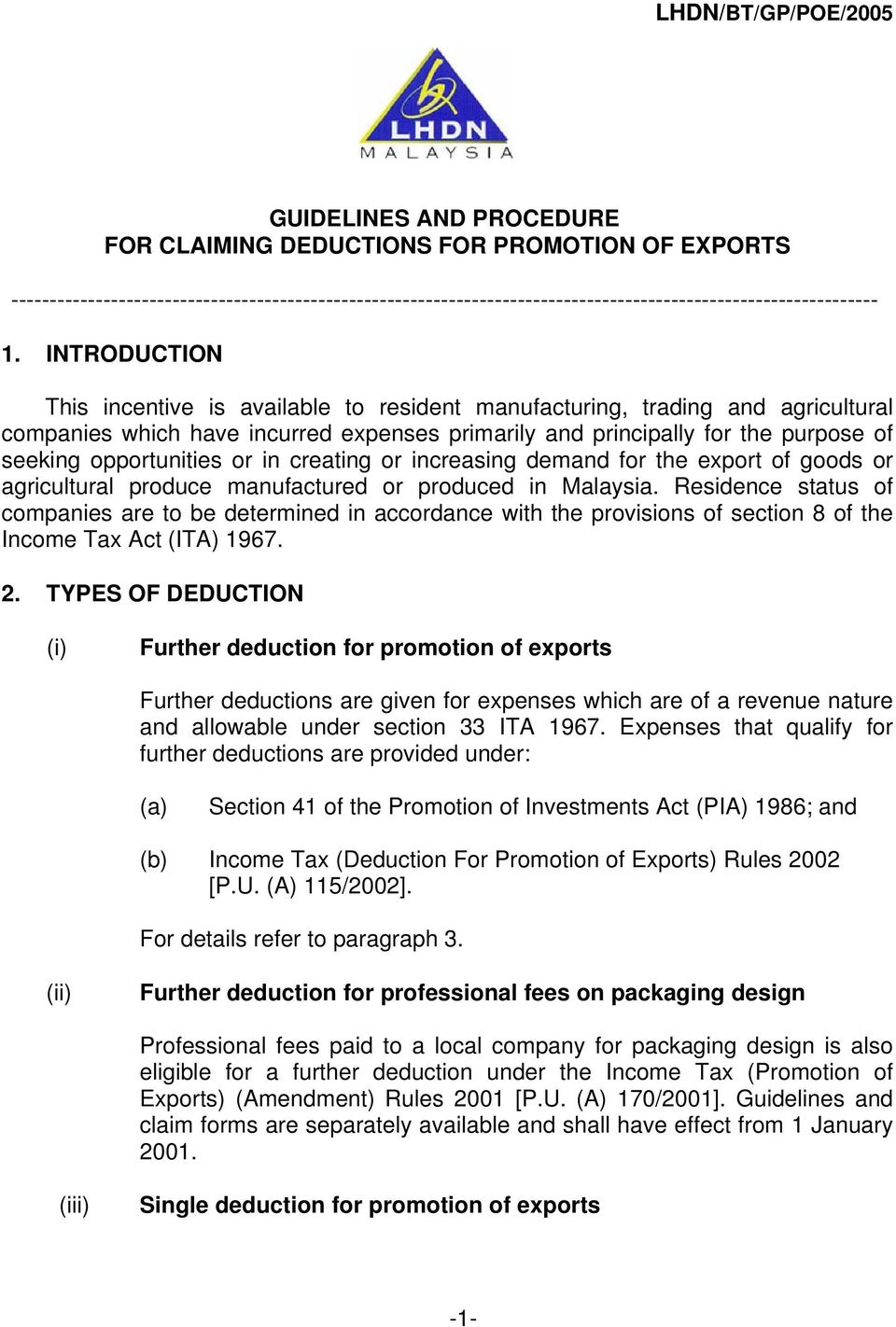

Malaysian tax guide 2008. Section 140c of the income tax act 1967 and the income tax restriction on deductibility of interest rules 2019 it is stipulated in the rules that the phrase maximum amount of interest referred to in section 140c shall be an amount equal to 20 of the amount of tax ebitda of that person from each of his business sources for the basis period for a y a. Income tax act 1967. Akta cukai pendapatan 1967 is a malaysian laws which enacted for the imposition of income tax.

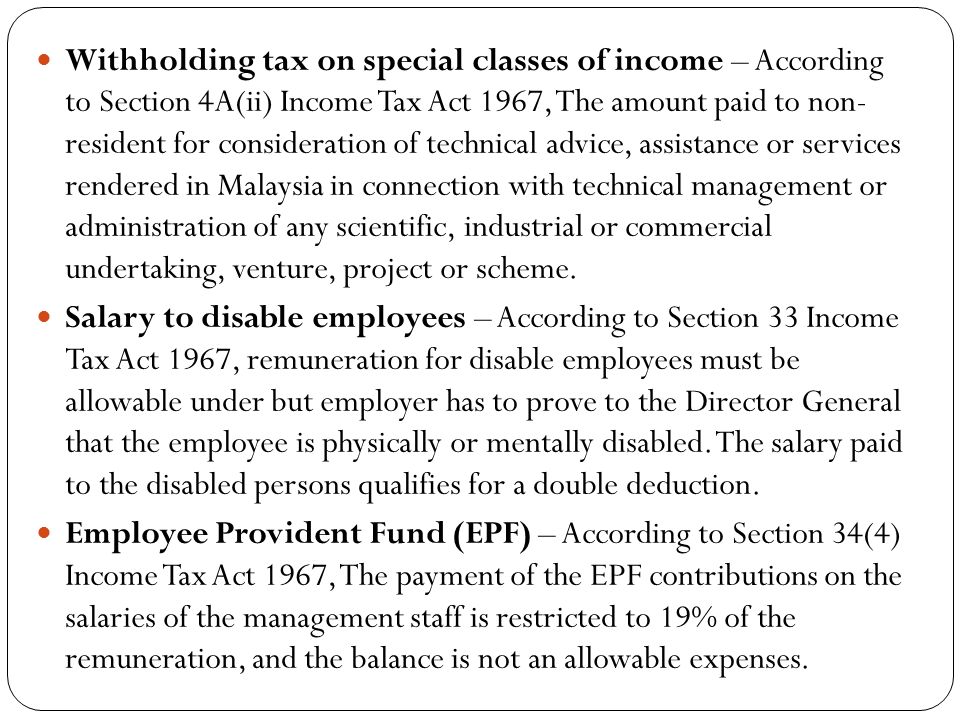

The income tax act 1967 in its current form 1 january 2006 consists of 10 parts containing 156 sections and 9 schedules including 77 amendments. The income tax act 1967 malay. Non chargeability to tax in respect of offshore business activity 3 c. In malaysia the deductibility of expenses is governed by section 33 of the income tax act 1967 ita and the general rule for deduction of an expense is contained in subsection 1.

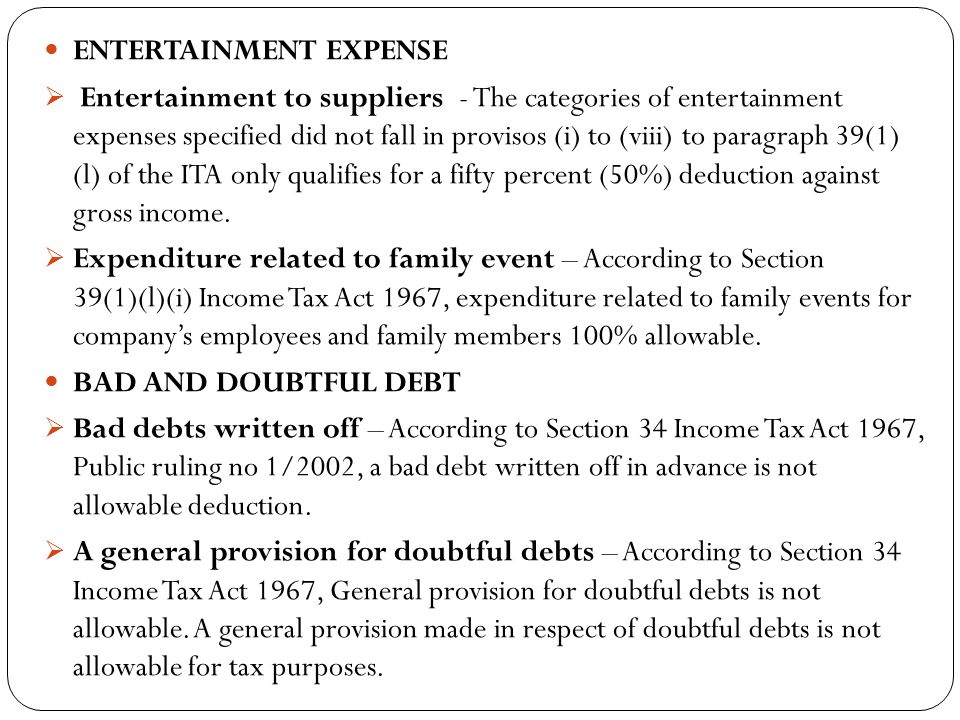

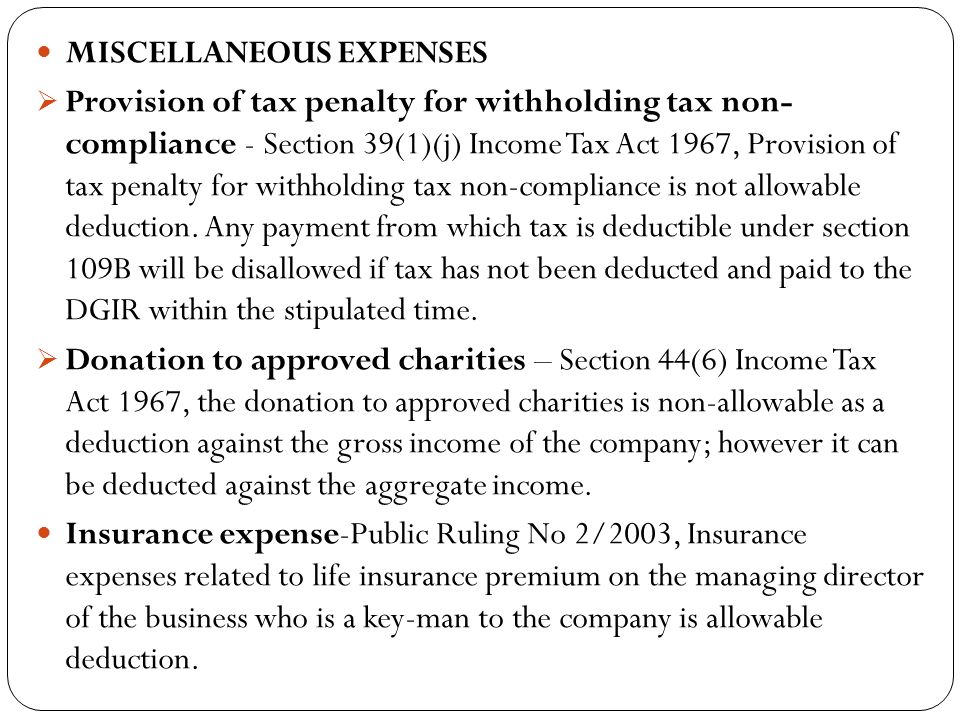

Interpretation part ii imposition and general characteristics of the tax 3. Cannot be deducted from gross income section sec 39 1 a. Lembaga hasil dalam negeri malaysia tidak bertanggungjawab terhadap sebarang kehilangan atau kerosakan yang dialami kerana menggunakan maklumat dalam laman ini. Foreign account tax compliance act fatca common reporting standard crs.

1 subject to this act the adjusted income of a person from a source for the basis period for a year of assessment shall be an amount ascertained by deducting from the gross income of that person from that source for that period all outgoings and expenses wholly and exclusively incurred during that period by that person in. Section 33 1 of the income tax act 1967 ita reads as follows. Charge of income tax 3 a.