Section 33 1 Income Tax Act

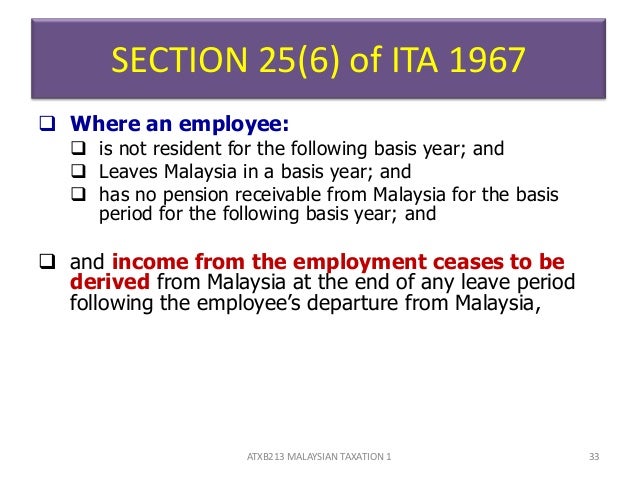

Interpretation part ii imposition and general characteristics of the tax 3.

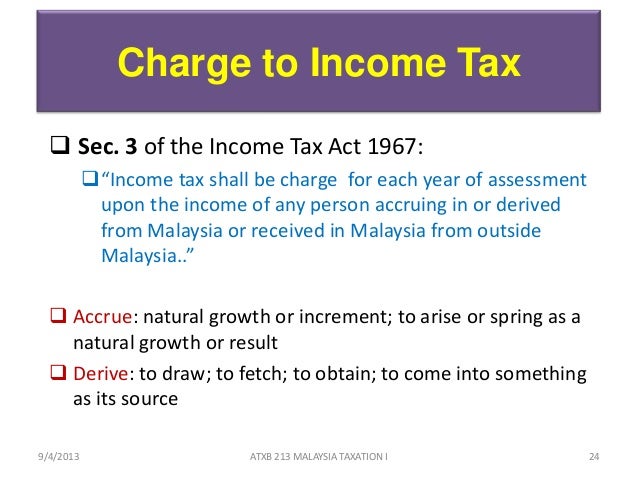

Section 33 1 income tax act. 2 any penalty imposed under section 13ca 2 4 or 6 13r 3 or 5 37 18b 45 4 87 1 or 91 4 or section 44 19 in force immediately before 1st january 2014 shall be deemed to be interest on tax for the purposes of section 33 2 of the limitation act cap. And ii second it provides some examples on arrangements which in cit s view have the purpose or effect of tax avoidance within the meaning of section 33 1 of the ita. Section 33 1 of the income tax act 1967 ita reads as follows. Comptroller means the comptroller of income tax appointed under section 3 1 and includes for all purposes of this act except the exercise of the powers conferred upon the comptroller by sections 34f 9 37ie 7 37j 5 67 1 a 95 96 96a and 101 a deputy comptroller or an assistant comptroller so appointed.

Non chargeability to tax in respect of offshore business activity 3 c. Tax on income of individuals and hindu undivided family. Income tax act act income tax act subsidiary legislation legislation is reproduced on this website with the permission of the government of singapore. Classes of income on which tax.

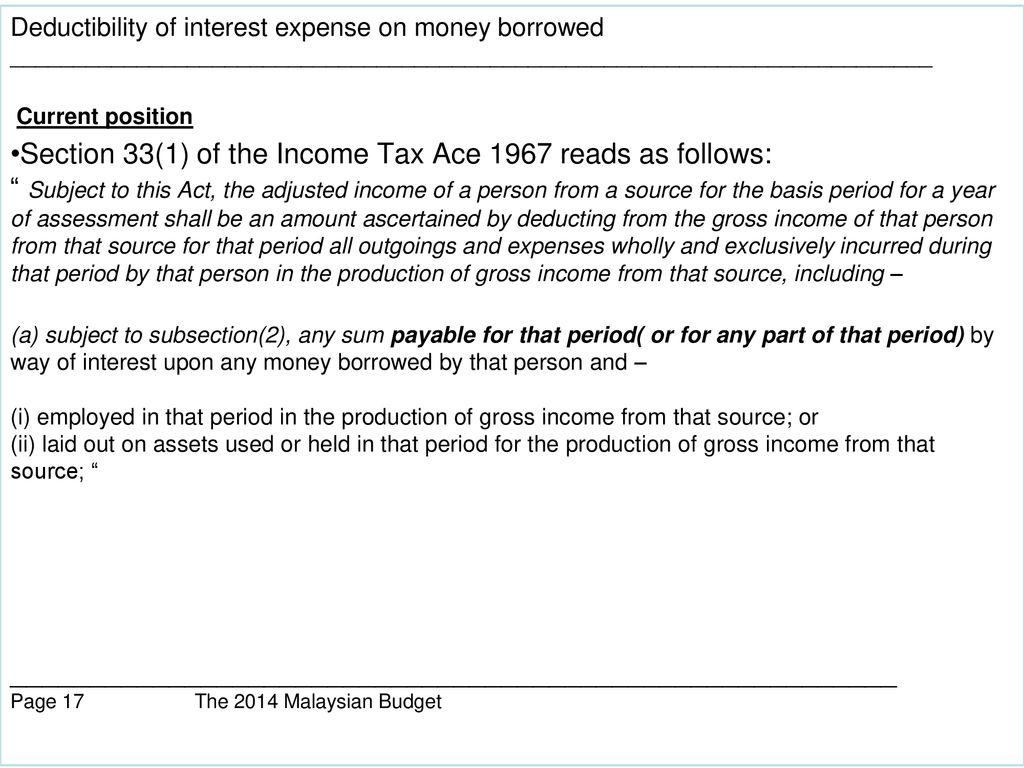

1 subject to this act the adjusted income of a person from a source for the basis period for a year of assessment shall be an amount ascertained by deducting from the gross income of that person from that source for that period all outgoings and expenses wholly and. Acts of parliament are available without charge and updated monthly at the singapore statutes online website. Tax on income of new manufacturing domestic companies. Act 53 income tax act 1967 arrangement of sections part i preliminary section 1.

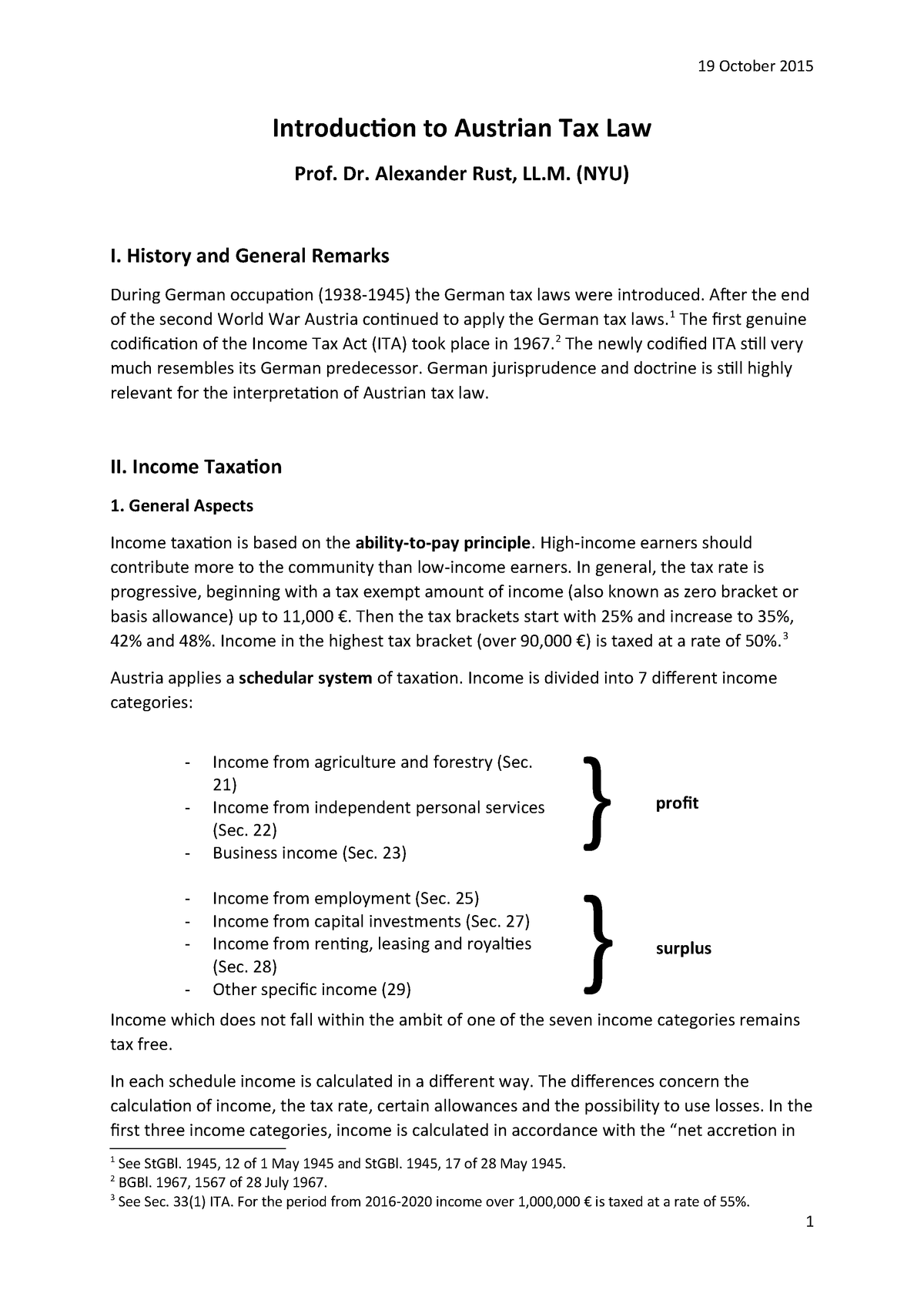

Short title and commencement 2. The related provisions are section 18 subsection 33 1 and paragraph 39 1 l of the income tax act 1967 ita. 1961 income tax department all acts income tax act 1961. Chapter 4 adjusted income and adjusted loss section.

A the tax treatment of entertainment expense as a deduction against gross income of a business. To which all of the following provisions apply. And b steps to determine the amount of entertainment expense allowable as a deduction. The income tax department never asks for your pin numbers.

1 subject to this act the adjusted income of a person from a source for the basis period for a year of assessment shall be an amount ascertained by deducting. Part iii ascertainment of chargeable income chapter. Construction of the general anti avoidance provision in section 33 of the income tax act ita. Charge of income tax 3 a.