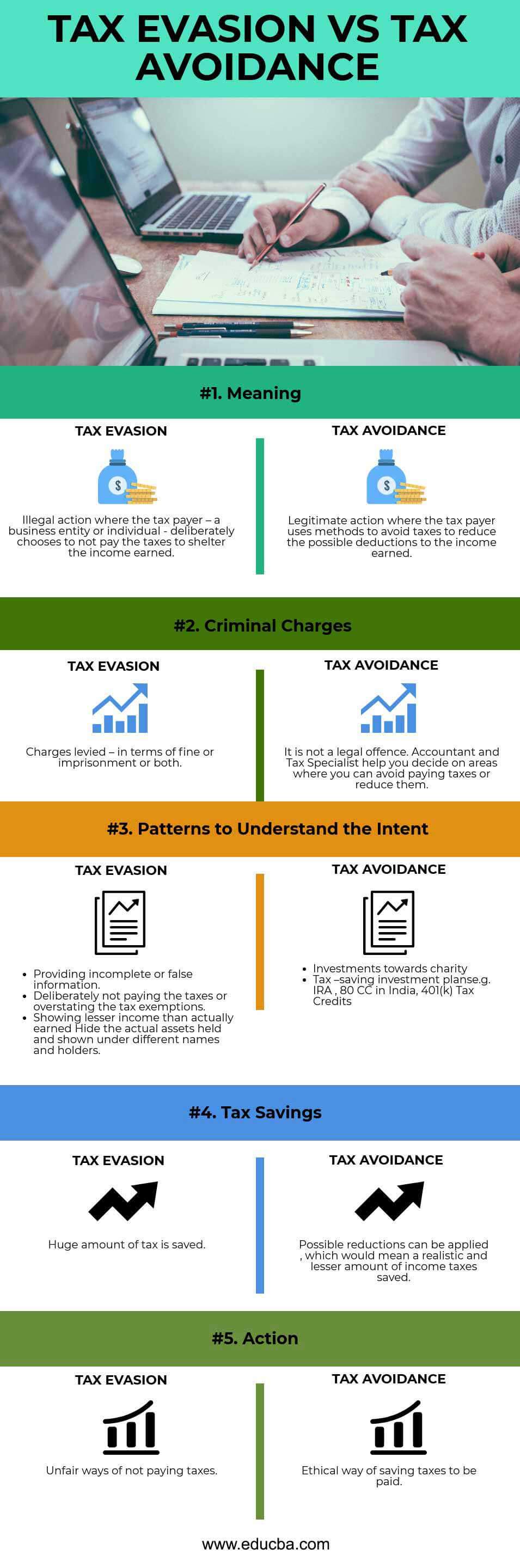

Tax Avoidance And Tax Evasion Difference

An unlawful act done to avoid tax payment is known as tax evasion.

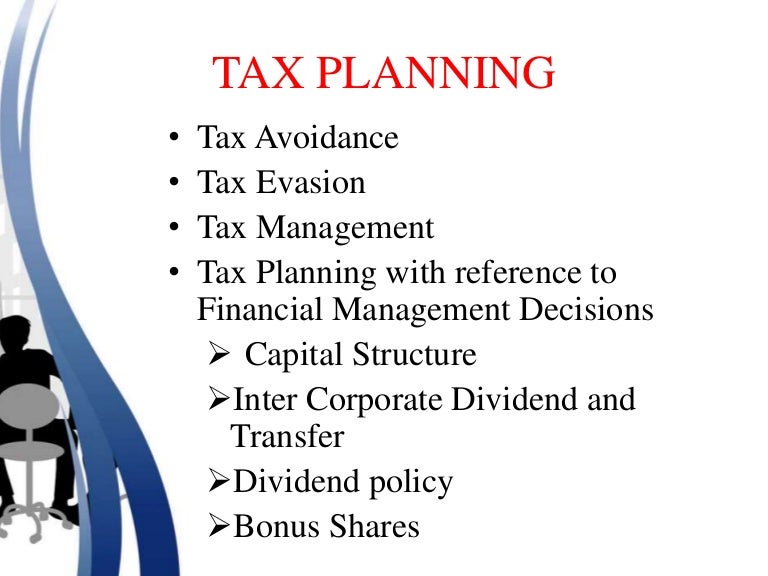

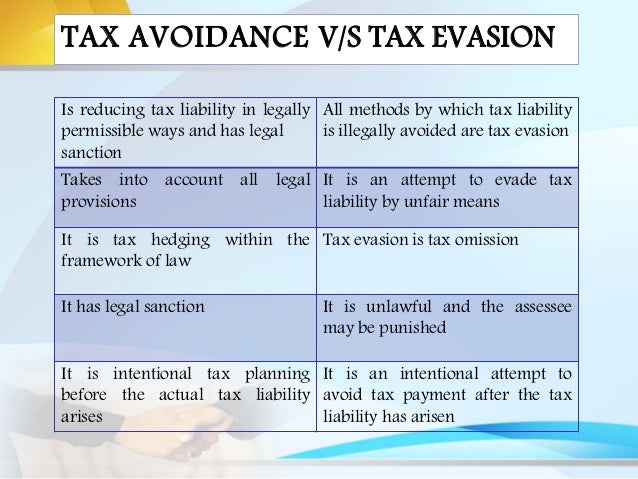

Tax avoidance and tax evasion difference. Tax avoidance is structuring your affairs so that you pay the least amount of tax due. One common tax evasion strategy is failing to pay turn over taxes you have collected from others to the proper federal or state agency. The difference between tax evasion and tax avoidance largely boils down to two elements. A planning made to reduce the tax burden without infringement of the legislature is known as tax avoidance.

Tax evasion vs tax avoidance as tax avoidance and tax evasion are both methods used by individuals and businesses to minimize or completely avoid the payment of taxes one should be able to recognize the difference between tax evasion and tax avoidance while these concepts may sound similar to one another there are a number of differences between tax evasion and tax avoidance.

/tax-avoidance-vs-evasion-397671-v3-5b71dfc846e0fb0025e54177.png)