Tax Avoidance And Tax Evasion Philippines

Tax evasion may be defined either as the understatement or concealment of a taxable object or as the failure to pay tax m time either by the assessee or his agent.

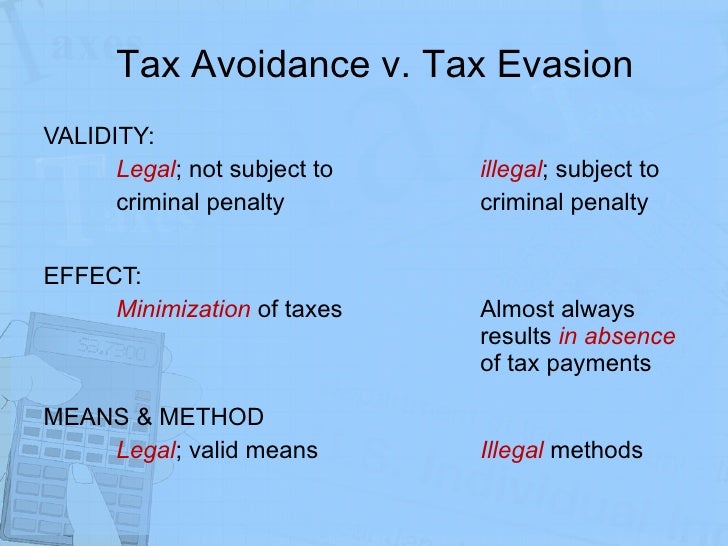

Tax avoidance and tax evasion philippines. Tax evasion vs tax avoidance as tax avoidance and tax evasion are both methods used by individuals and businesses to minimize or completely avoid the payment of taxes one should be able to recognize the difference between tax evasion and tax avoidance while these concepts may sound similar to one another there are a number of differences between tax evasion and tax avoidance. Tax avoidance and tax evasion are two terms that must be clearly understood by responsible individuals and companies who are earn money especially in the philippines. It is the illegal practice of not paying taxes by not reporting income reporting expenses not legally allowed or by not paying taxes owed. One common tax evasion strategy is failing to pay turn over taxes you have collected from others to the proper federal or state agency.

This method should be used by the taxpayer in good faith and at arm s length. Manila unfair for philippine corporate and tax regulators that s how tax expert mon abrea founding chairman of the asian consulting group described the tax avoidance allegations circulating online against the philippines top broadcaster abs cbn corporation which has been ordered to stop broadcast operations after the government allowed its franchise to expire. Tax evasion and trust fund taxes. Tax avoidance aka tax minimization is a way taxpayers minimize their taxes through legally permissible means meaning it is not punishable by law.

Anyone would like to pay less for taxes but it is a social and national responsibility to do so. The philippines general anti avoidance rules are largely based on principles arising from supreme court decisions which made a distinction between tax avoidance and tax evasion. Reasons for tax evasion and tax avoidance. Tax avoidance and tax evasion mean the same thing doing things to hide income and not reporting all of your worldwide income on your 1040 tax as you are required to do.

Among the familiar examples of tax avoidance in the philippines are the de minimis benefits that employers use to lower withholding taxes and increase the take home pay of their employees. Opting depreciation method in computing deductible expenses. Tax planning is totally legal meanwhile tax evasion must be subject to penalty and other kinds of punishment. Delaying or postponing the sale of a capital asset until after 12 months to reduce the tax on capital gains to 50.

Oppositely tax evasion is typically done after the tax liability has arisen. Tax avoidance is the tax saving device within the means sanctioned by law.

/tax-avoidance-vs-evasion-397671-v3-5b71dfc846e0fb0025e54177.png)