Tax Avoidance And Tax Evasion

If a state or federal agency has already contacted you about an issue with your taxes it s important to have an skilled advocate on your side.

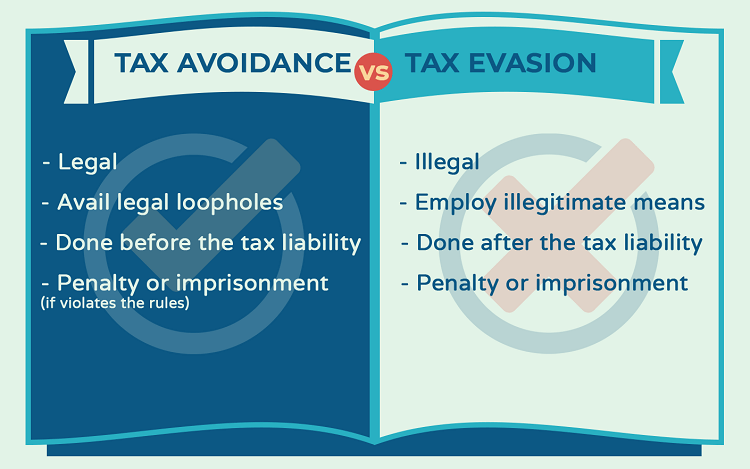

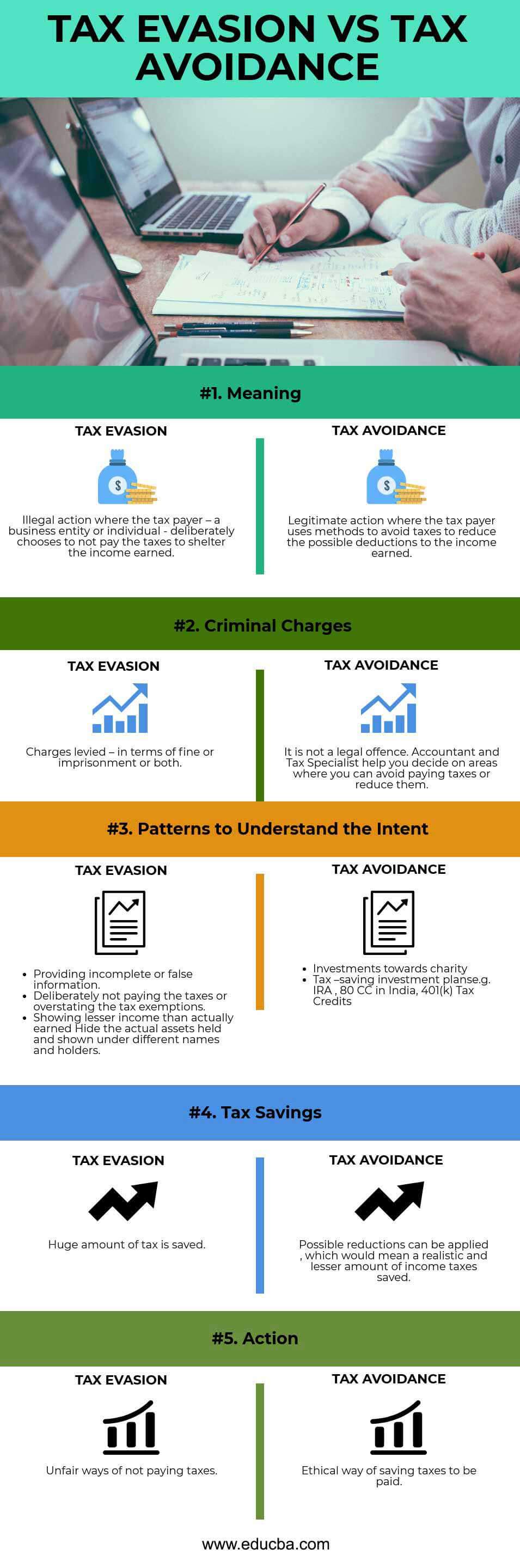

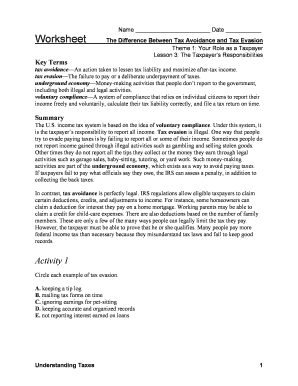

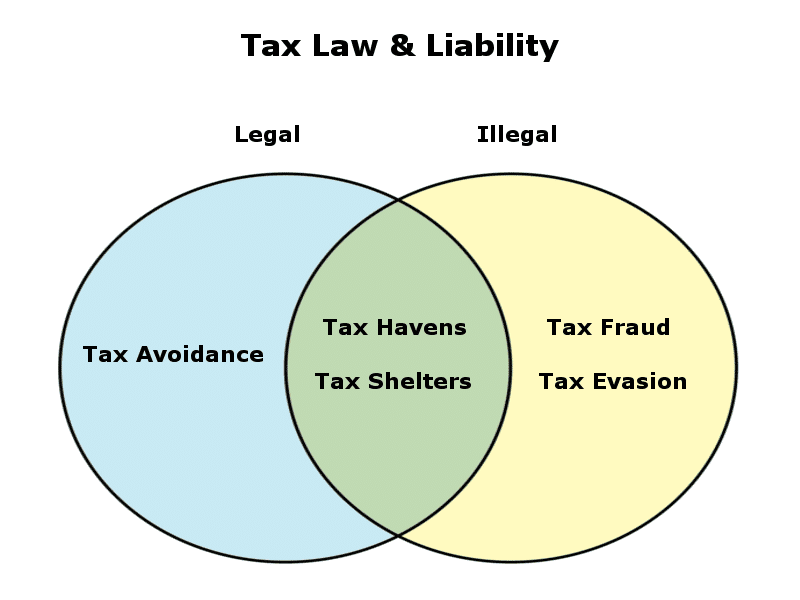

Tax avoidance and tax evasion. What is tax avoidance. The level of tax evasion globally is huge based mainly around criminal activities but includes sums not paid by firms of all sizes and by individuals. Tax evasion and trust fund taxes. In other words tax avoidance is completely lawful because only those means are employed which are legal while tax evasion is considered as a crime in the whole world as it resorts to various kinds of deliberate manipulations.

Tax avoidance is subject to penalty or imprisonment if it violates the tax regulations. It s always best to discuss any questions or concerns with a tax professional before filing your taxes. Tax evasion is most commonly thought of in relation to income taxes but tax evasion can be practiced by businesses on state sales taxes and on employment taxes. Tax planning is totally legal meanwhile tax evasion must be subject to penalty and other kinds of punishment.

Tax evasion is the non payment or underpayment of tax. It is concluded from the above discussion that tax avoidance and tax evasion are those concepts which enables a person to avoid liability on his income tax charged. Tax evasion vs tax avoidance as tax avoidance and tax evasion are both methods used by individuals and businesses to minimize or completely avoid the payment of taxes one should be able to recognize the difference between tax evasion and tax avoidance while these concepts may sound similar to one another there are a number of differences between tax evasion and tax avoidance. On the contrary tax evasion is a practice of reducing tax liability through illegal means i e.

Tax evasion in europe is estimated to be almost 20 percent of gdp. Tax evasion is the use of illegal methods of concealing income or information from the irs or other tax authority. Oppositely tax evasion is typically done after the tax liability has arisen. By suppressing income or inflating expenses or by showing lower income.

One concept is completely legal as provided under income tax act 1961 and another is a complete illegal. One common tax evasion strategy is failing to pay turn over taxes you have collected from others to the proper federal or state agency.

/tax-avoidance-vs-evasion-397671-v3-5b71dfc846e0fb0025e54177.png)