Tax Planning Tax Avoidance And Tax Evasion Ppt

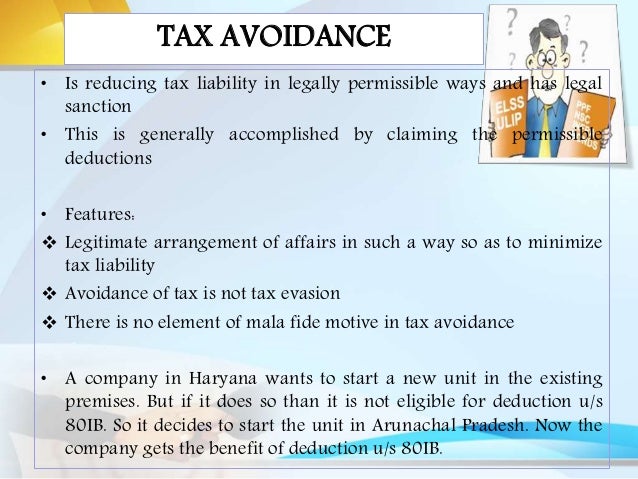

Iv tax avoidance looks like a tax planning and is done before the tax liability arises.

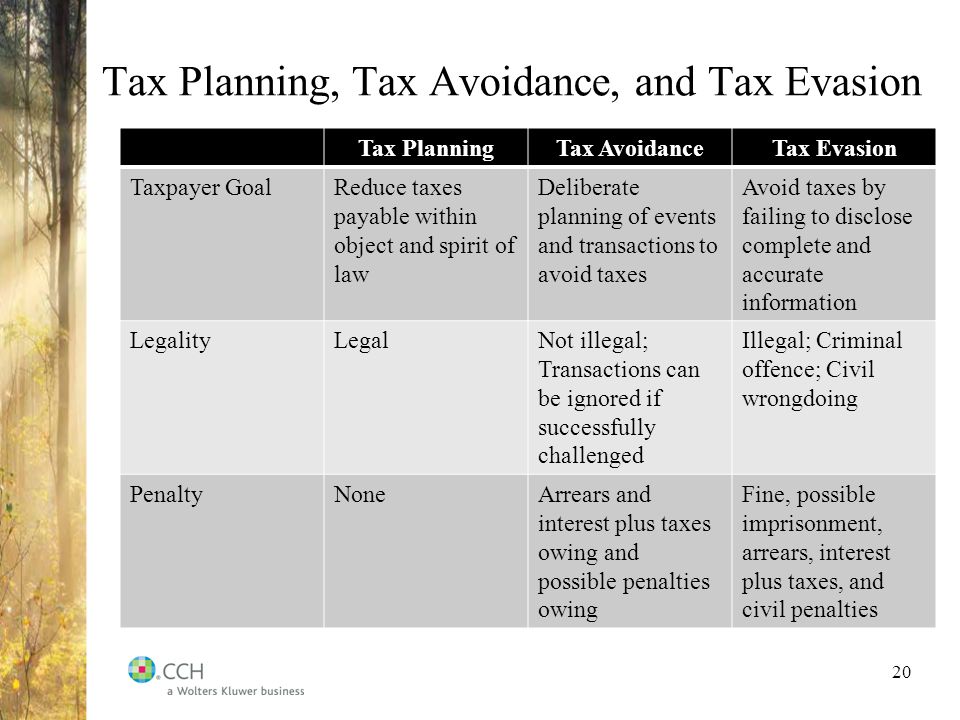

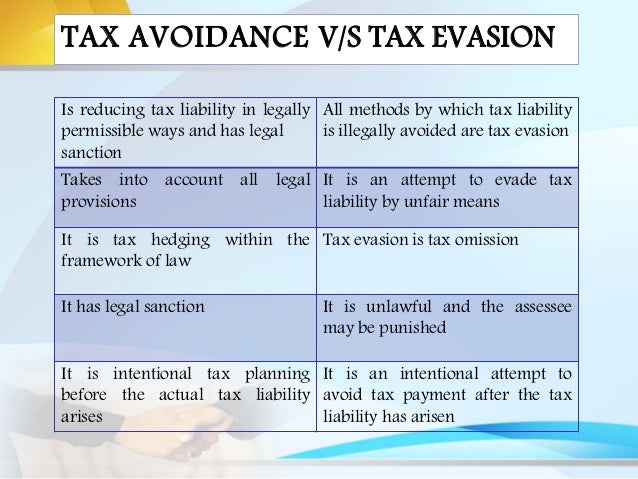

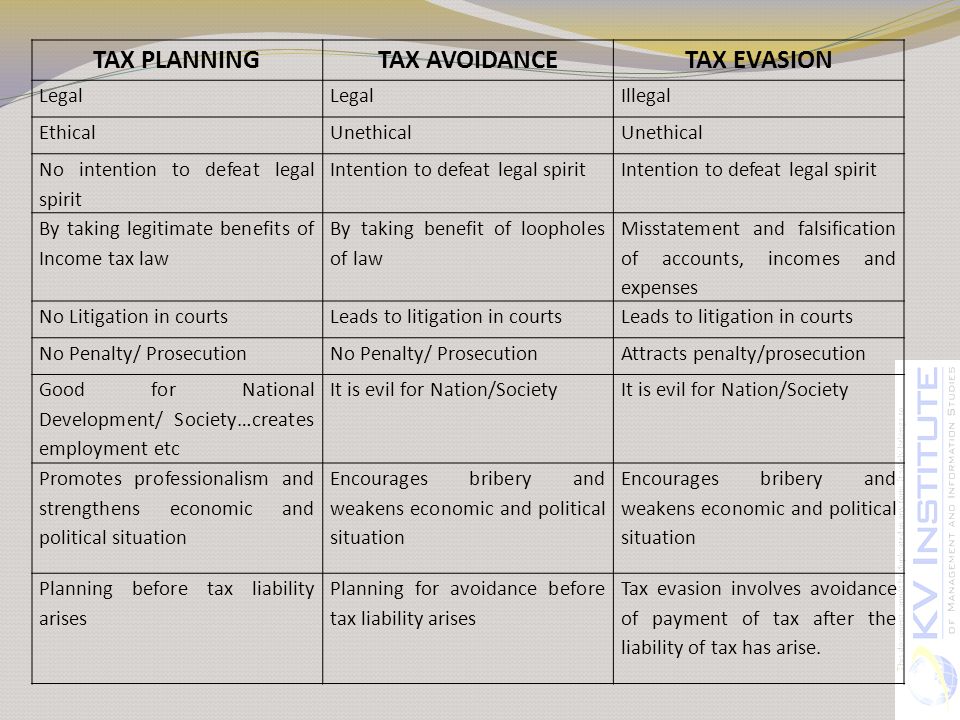

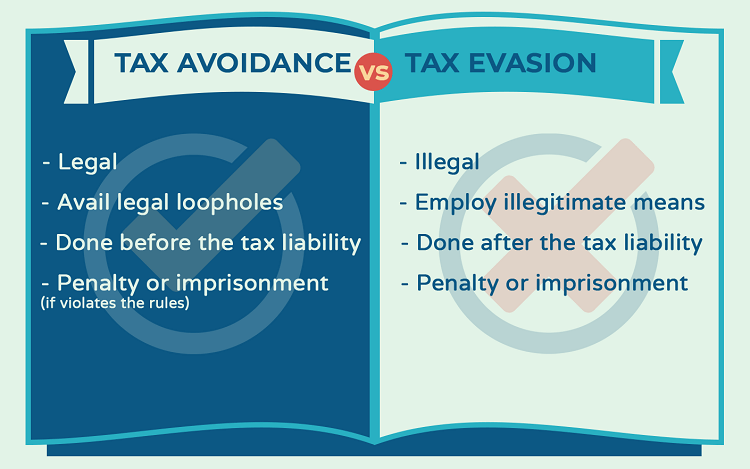

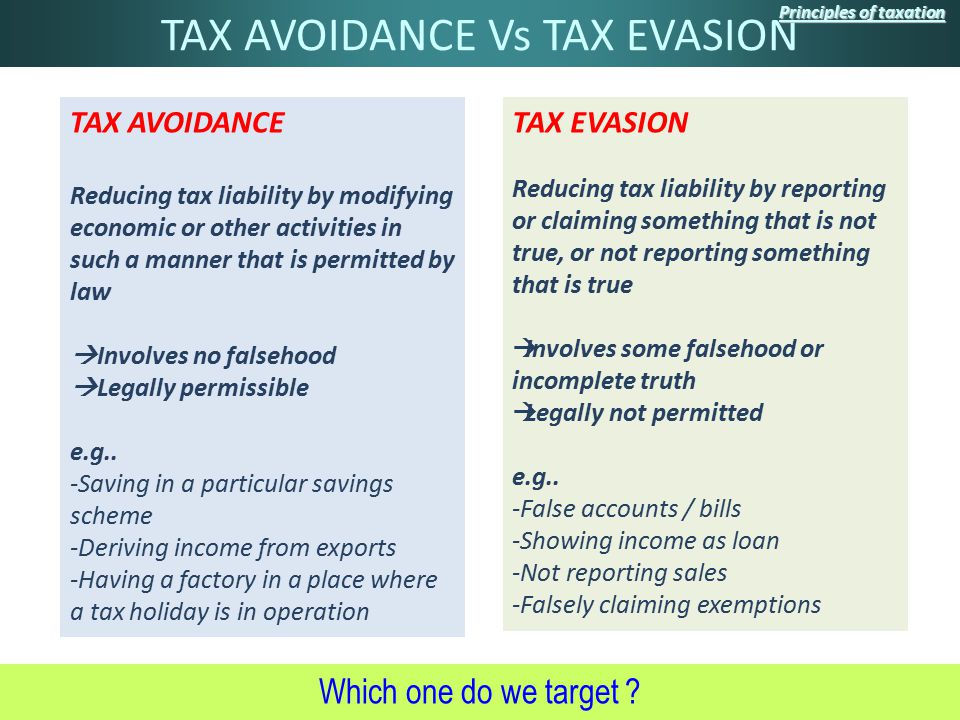

Tax planning tax avoidance and tax evasion ppt. Tax liability of an individual can be reduced through 3 different methods tax planning tax avoidance and tax evasion. Ho 1 tax avoidance v. Tax avoidance tax evasion and tax planning. Tax evasion is an unlawful way of paying tax and defaulter may punished.

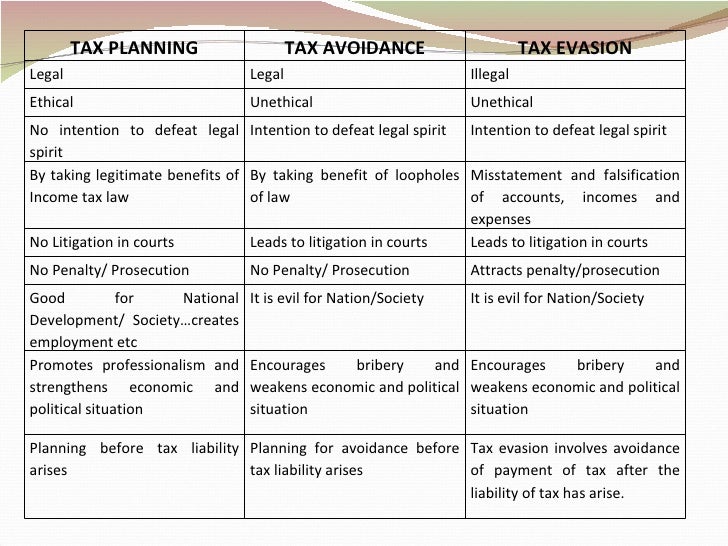

Tax evasion and tax avoidance. Tax planning and tax avoidance are the legal ways to reduce tax liabilities but tax avoidance is not advisable as it manipulates the law for one s own benefit. Introduction the avid goal of every taxpayer is to minimize his tax liability. Key differences between tax avoidance and tax evasion the following are the major differences between tax avoidance and tax evasion.

All the methods are different and interchangeable. Held legal documents could not be overturned merely because the motive was to save tax. Businesses in search of saving tax often come up with those couples of terms. Below are key differences between tax evasion tax avoidance and tax planning to help you get better understanding.

Differences between tax evasion tax avoidance and tax planning. Nightingale chapter 6. Pummy wadhawan bba 4th sem meaning of tax planning tax planning is an art and the exercise of arranging financial affairs of tax payers so as to reduce or delay the tax payment which would be necessary if the words if tax laws were to be followed in the obvious manner. View notes tax avoidance 17 6 20 ppt from culture 2049 at hong kong shue yan university.

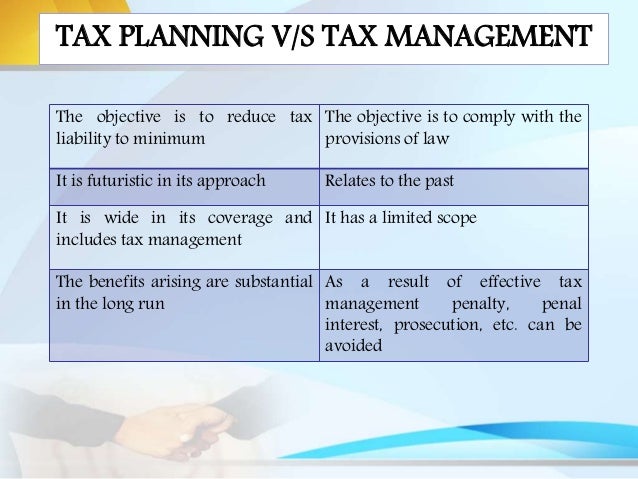

Tax planning management lecture outline 11 anti avoidance dr. Each term has been clarified quite obviously in our above mentioned sections. Tax planning can neither be equated to tax evasion nor to tax avoidance with reference to a company it is the scientific planning of the company s operations in such a way so as to attract minimum liability to tax or postponement or for the matter of deferment of the tax liability for the subsequent period by availing various incentives concessions allowances rebates and relief s. Tax planning tax avoidance tax evasion tax management tax planning with reference to financial management decisions capital structure inter corporate dividend and transfer dividend policy bonus shares 2.

An unlawful act done to avoid tax payment is known as tax evasion.

/tax-avoidance-vs-evasion-397671-v3-5b71dfc846e0fb0025e54177.png)