Tax Planning Tax Avoidance And Tax Evasion With Examples

Speak to one of our advisors on 020 3355 4047 or use the live chat button screen.

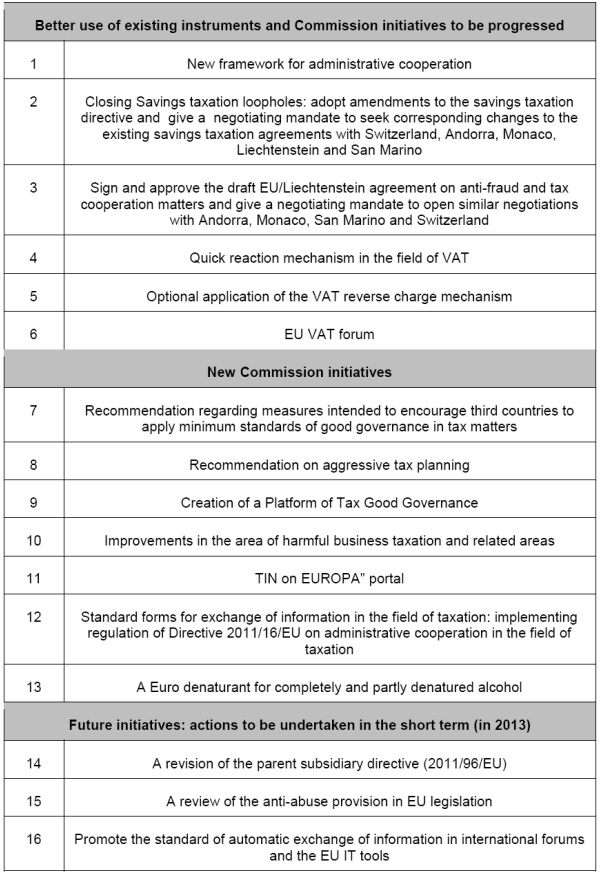

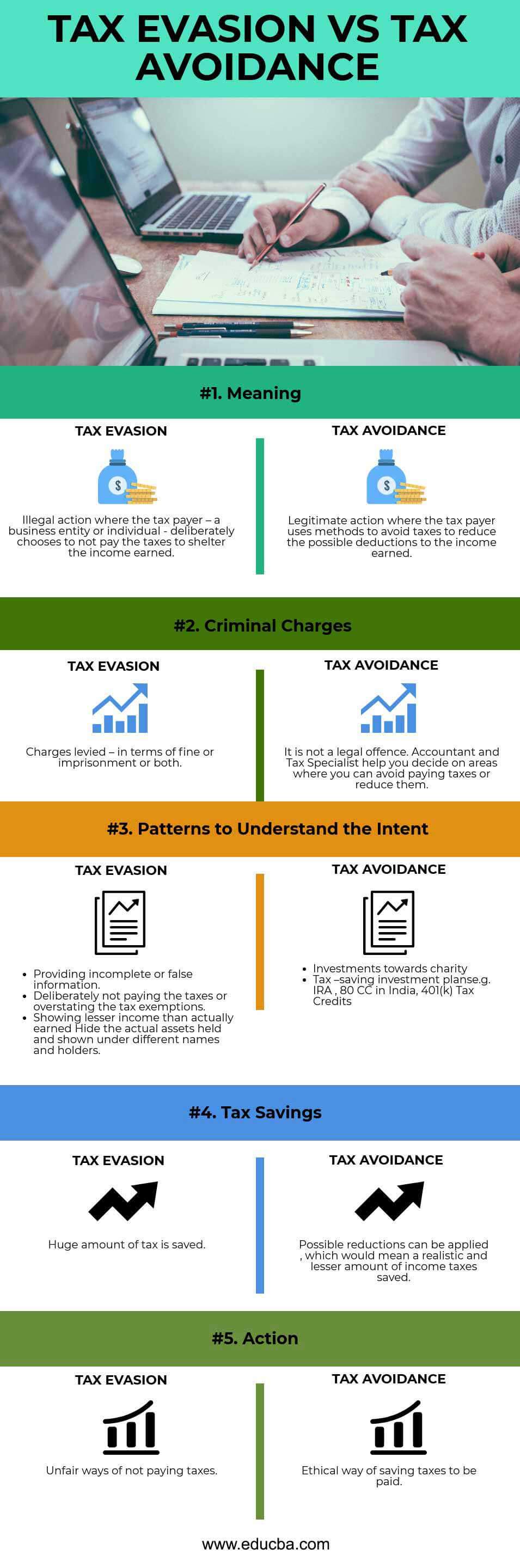

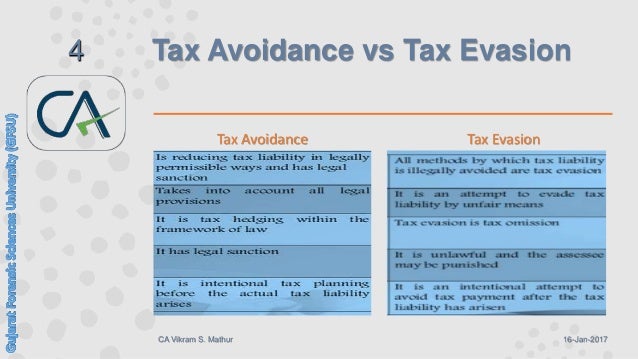

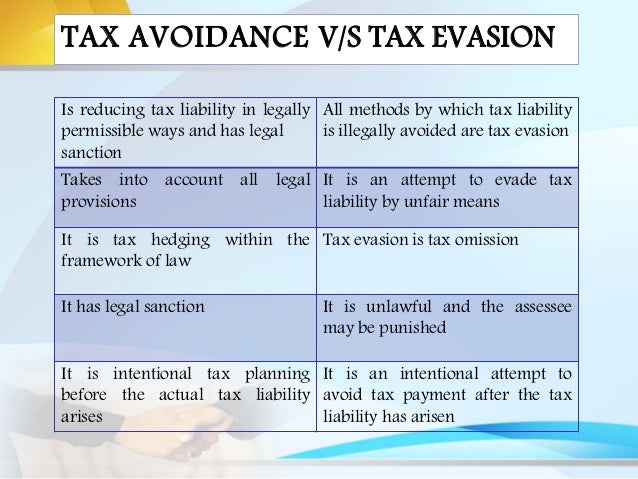

Tax planning tax avoidance and tax evasion with examples. Commercial tax officer wherein justice reddy stated much legal sophistry and judicial exposition both in england and india have gone into the. Formerly tax avoidance is considered legitimate but with the passage of time tax avoidance is as evil as tax evasion and even attracts penality when discovered. Businesses in search of saving tax often come up with those couples of terms. Tax planning and tax avoidance are permissible whereas tax evasion is not permissible.

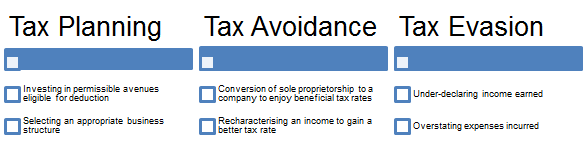

Tax evasion is undertaken by employing unfair means iii tax avoidance is done through not malafied intention but complying the provision of law. Tax liability of an individual can be reduced through 3 different methods tax planning tax avoidance and tax evasion. Below are key differences between tax evasion tax avoidance and tax planning to help you get better understanding. Failing to file a tax return failing to declare full income and hiding taxable assets.

Contribution towards retirement benefits in most of the countries the contribution made towards retirement benefits are deducted from gross income before arriving at taxable income. Setting up a tax deferral plan such as an ira sep ira or 401 k plan to delay taxes until a later date. Tax evasion is an unlawful way of paying tax and defaulter may punished. Differences between tax evasion tax avoidance and tax planning.

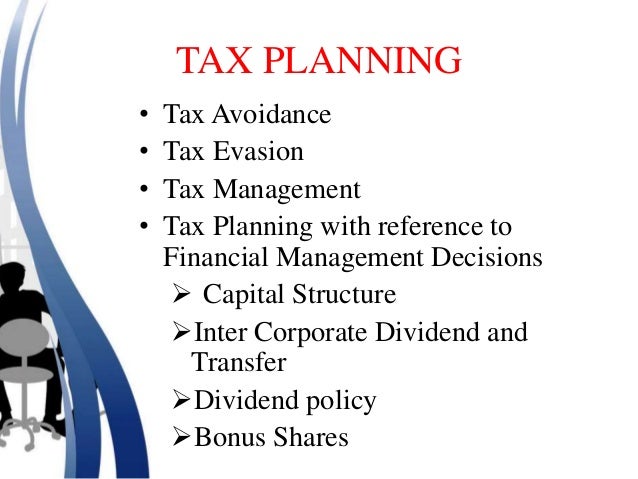

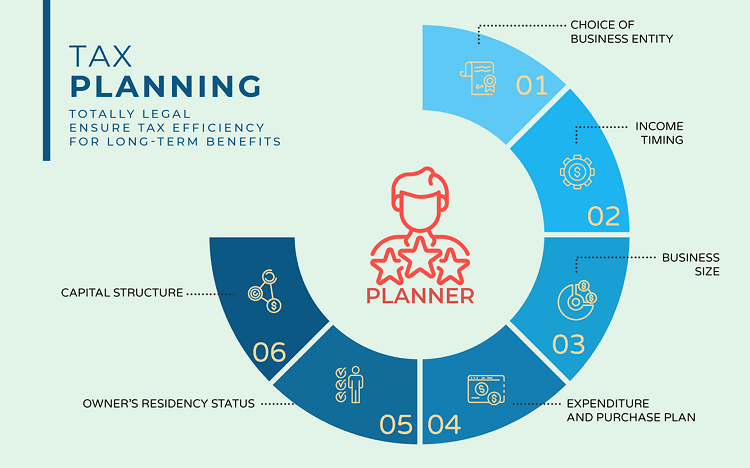

For example in the united states one can contribute up to 19 000 to a 401 k if you re under 50. Some examples of tax avoidance strategies taking legitimate tax deductions to minimize business expenses and lower your business tax bill. Still not sure about tax evasion and avoidance. Tax planning can neither be equated to tax evasion nor to tax avoidance with reference to a company it is the scientific planning of the company s operations in such a way so as to attract minimum liability to tax or postponement or for the matter of deferment of the tax liability for the subsequent period by availing various incentives concessions allowances rebates and relief s.

Tax planning is done to reduce the liability of tax by applying the provision and moral of law. Tax avoidance tax evasion and tax planning. On the other hand tax planning is completely legal because it does not involve taking any advantage of the loopholes in the law and so it is permissible. Examples of not paying the full amount of tax include.

Components of tax avoidance.

/tax-avoidance-vs-evasion-397671-v3-5b71dfc846e0fb0025e54177.png)