Tax Planning Tax Avoidance And Tax Evasion

Tax liability of an individual can be reduced through 3 different methods tax planning tax avoidance and tax evasion.

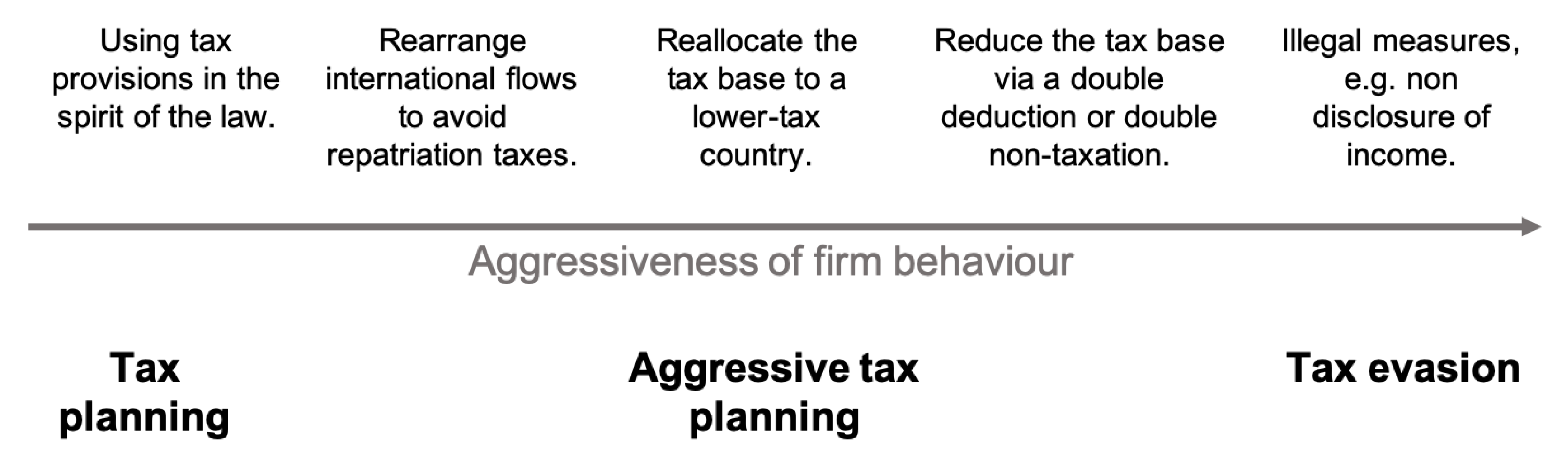

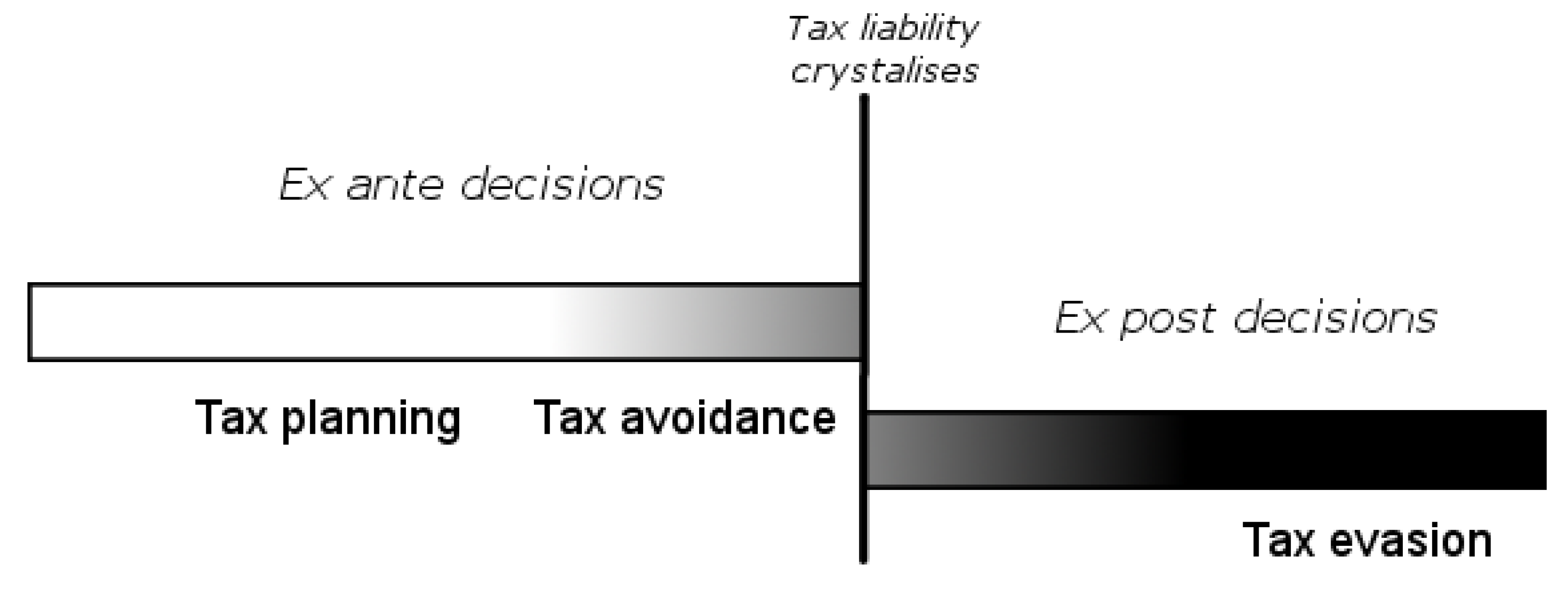

Tax planning tax avoidance and tax evasion. Commercial tax officer wherein justice reddy stated much legal sophistry and judicial exposition both in england and india have gone into the. Tax planning is an art to reduce your tax outgo by making sure that all the applicable provisions of our income tax act as designed to reduce your tax liability has been availed of. Tax evasion is undertaken by employing unfair means iii tax avoidance is done through not malafied intention but complying the provision of law. Iv tax avoidance looks like a tax planning and is done before the tax liability arises.

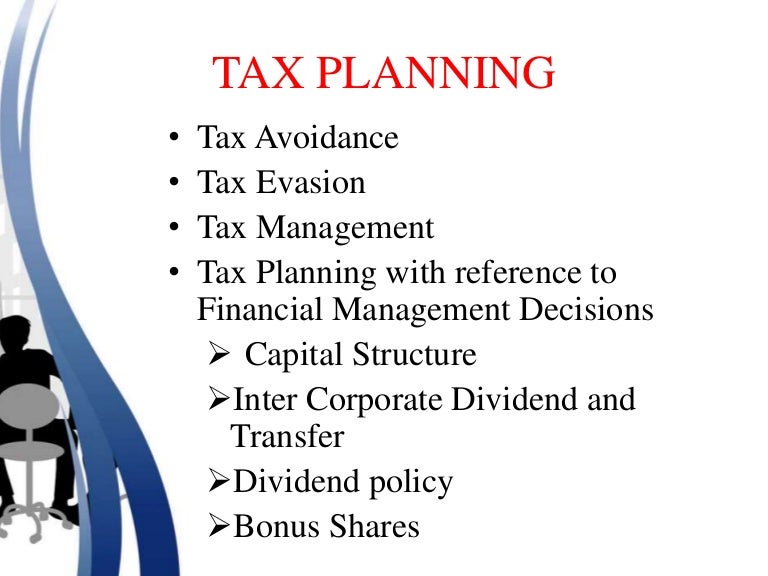

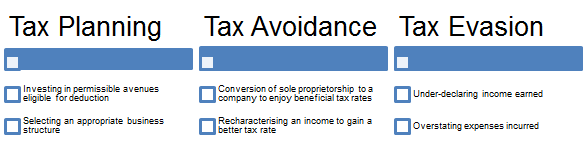

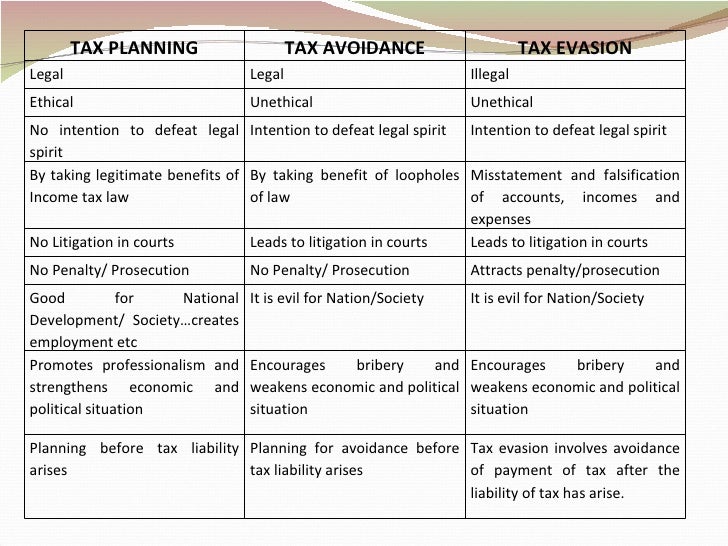

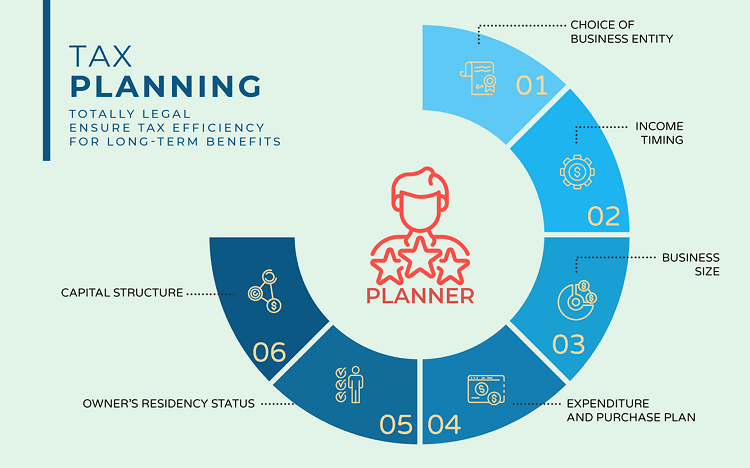

Unlike tax avoidance tax planning is the practice of minimising tax liability with no intention of deceit while some practices of tax avoidance have been found to have the intention to deceive. Tax planning is done to reduce the liability of tax by applying the provision and moral of law. Tax planning and tax avoidance are permissible whereas tax evasion is not permissible. Tax planning can neither be equated to tax evasion nor to tax avoidance with reference to a company it is the scientific planning of the company s operations in such a way so as to attract minimum liability to tax or postponement or for the matter of deferment of the tax liability for the subsequent period by availing various incentives concessions allowances rebates and relief s.

One common tax evasion strategy is failing to pay turn over taxes you have collected from others to the proper federal or state agency. The distinction between tax planning avoidance and evasion has been a long discussed topic in the field of taxation law and one of the foremost indian case in which the discussion was taken up was in the landmark case of mcdowell co. Formerly tax avoidance is considered legitimate but with the passage of time tax avoidance is as evil as tax evasion and even attracts penality when discovered. Tax evasion is most commonly thought of in relation to income taxes but tax evasion can be practiced by businesses on state sales taxes and on employment taxes.

On the other hand tax planning is completely legal because it does not involve taking any advantage of the loopholes in the law and so it is permissible. Tax planning is the process of elaborating the company s financial related matters to maximize the tax benefits under eligible provisions of the tax framework. Difference between tax planning tax avoidance tax evasion. Tax avoidance tax evasion and tax planning.

Tax evasion and trust fund taxes. Tax evasion is an unlawful way of paying tax and defaulter may punished.

/tax-avoidance-vs-evasion-397671-v3-5b71dfc846e0fb0025e54177.png)