Tax Rate Malaysia 2017

Average lending rate bank negara malaysia schedule section 140b restriction on deductibility of interest section 140c income tax act 1967 study group on asian tax administration and research sgatar.

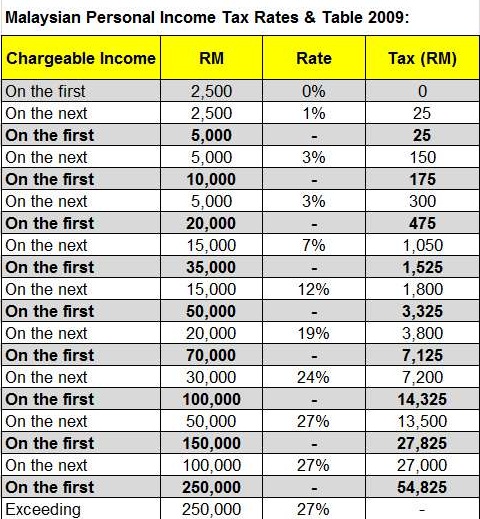

Tax rate malaysia 2017. Corporate tax rates in malaysia the corporate tax rate is 25. A firm registered with the malaysian institute of accountants. Malaysia personal income tax rate is applied to chargeable income of resident individual taxpayers starting from 0 on the first rm5 000 to a max of 28. Reduction in corporate tax rate from 19 to 18 for small and medium sized enterprises smes on the first myr500 000 of chargeable income.

A qualified knowledge worker in a specified area currently only iskandar malaysia is taxed at the concessionary rate of 15 on chargeable income from employment with a designated company engaged in a qualified activity e g. Income tax rate malaysia 2018 vs 2017. Malaysia brands top player 2016 2017. Malaysia personal income tax guide 2017.

Resident companies with a paid up capital of myr 2 5 million and below as defined at the beginning of the basis period for a year of assessment ya are subject to a corporate income tax rate of 20 on the first myr 500 000 of chargeable income. Pwc 2016 2017 malaysian tax booklet personal income tax tax residence status of individuals an individual is regarded as tax resident if he meets any of the following conditions i e. No guide to income tax will be complete without a list of tax reliefs. It s always a percentage of your chargeable income more on that later.

With effect from ya 2020 a non resident individual is taxed at a flat rate of 30 on total taxable income. It s income tax season once again. As featured in channel newsasia. What a nightmare for malaysian.

Know the tax rates. Technical or management service fees are only liable to tax if the services are rendered in malaysia. While the 28 tax rate for non residents is a 3 increase from the previous year s 25. The more you earn the higher the percentage of tax you need to pay.

Malaysia corporate income tax rate for a company whether resident or not is assessable on income accrued in or derived from malaysia. In malaysia for at least 182 days in a calendar year.