When Gst Started In Malaysia

This means that businesses must continue to process and report gst and fulfil all compliance requirements including registering for gst issuing invoices using correct tax codes and submitting tax returns.

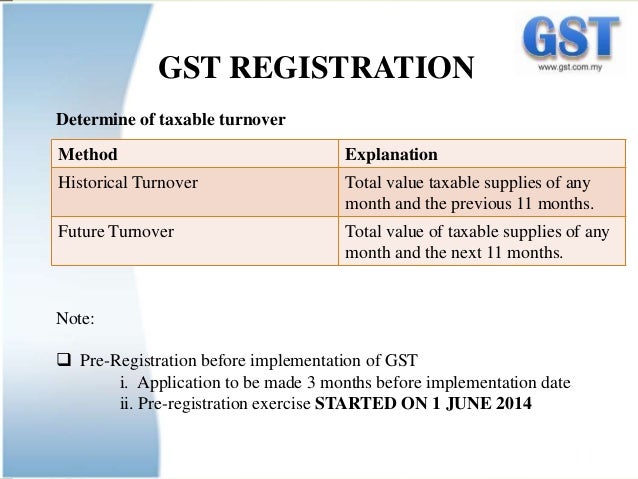

When gst started in malaysia. Sales and service tax sst in malaysia. Roughly 90 percent of the world s. Prime minister datuk seri najib tun razak said the sales and services taxes would be abolished and these. The existing standard rate for gst effective from 1 april 2015 is 6.

In fact during the transition period gst still applies across malaysia under existing regulations but at a rate of 0. The concept behind gst was invented by a french tax official in the 1950s. Malaysia s finance ministry said on wednesday may 16 that the 6 per cent goods and services tax gst will be zero rated from jun 1 effectively abolishing it until further notice. Today more than 160 nations including the european union and asian countries such as sri lanka singapore and china practice this form of taxation.

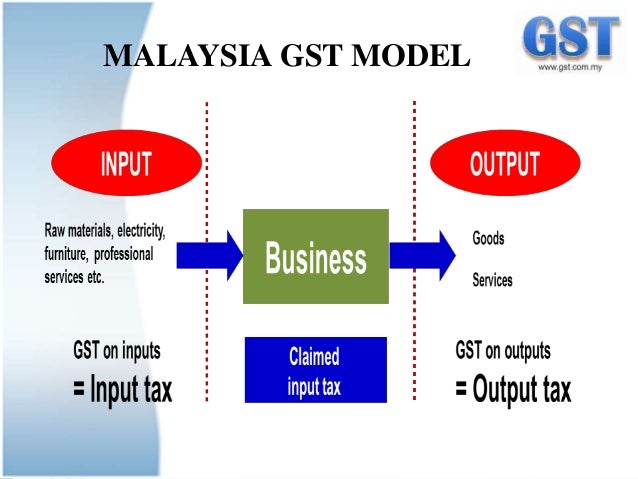

Goods and services tax lebih dikenali dengan akronim gst merupakan cukai nilai tambah yang telah dimansuhkan di malaysia setiap pihak kecuali pengguna akhir dalam rantaian bekalan layak menuntut semula kredit cukai input. The move of scrapping the 6 gst has paved the way for the re introduction of sst 2 0 which will come into effect in 1 september 2018. The goods and services tax gst will be introduced on april 1 2015 at a rate of 6. Gst is levied on most transactions in the production process but is refunded with exception of blocked input tax to all parties in the chain of production other than the final consumer.

Gst berkuatkuasa mulai 1 april 2015 melibatkan pembekalan berkadar standard sebanyak 6 pembekalan berkadar sifar. Malaysia replaced its sales and service tax regimes with the goods and services tax gst effective 1 april 2015. In some countries it is known as vat or value added tax. Kuala lumpur malaysia s goods and services tax gst will be reduced from 6 per cent to zero per cent on june the finance ministry said on wednesday may 16.

The implementation of gst system that has two rates of gst 6 and 0 and provides for the zero rating of exported goods international services basic food items and many books as a broad based tax gst is a consumption tax applied at each stage of the supply chain. The ministry of finance mof announced that sales and service tax sst which administered by the royal malaysian customs department rmcd will come into effect in malaysia on 1 september 2018.