Differentiate Between Tax Planning Tax Avoidance And Tax Evasion

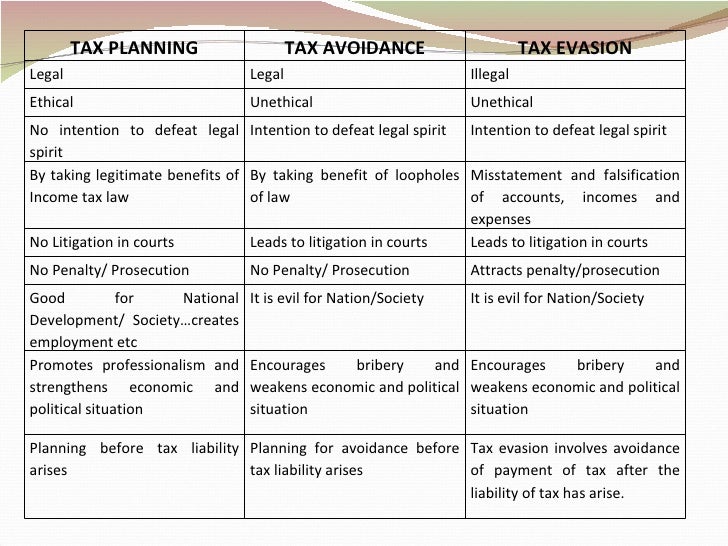

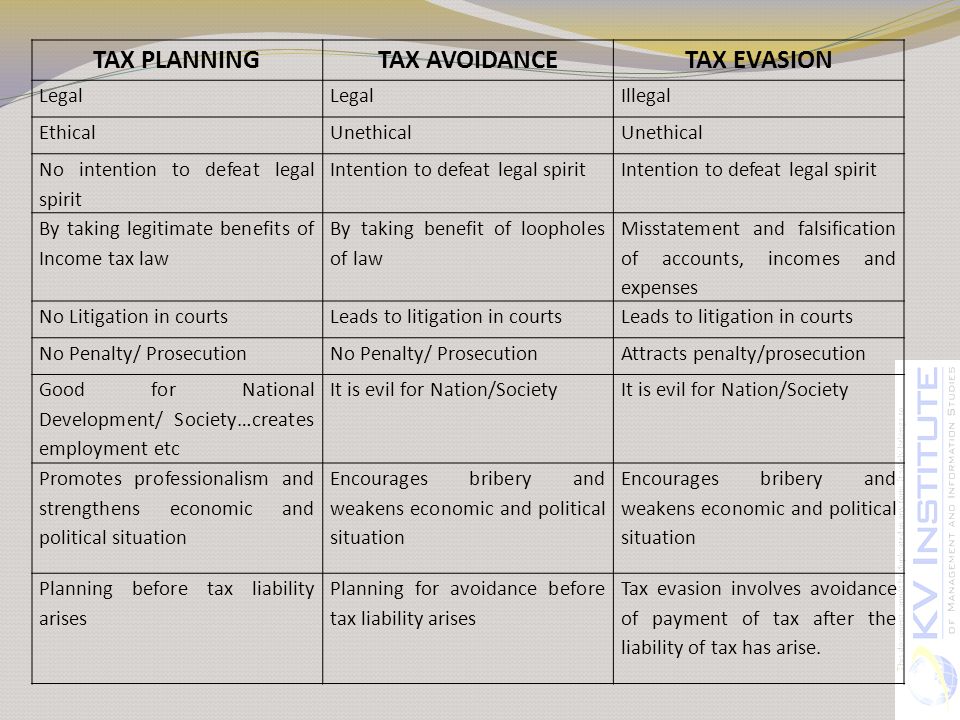

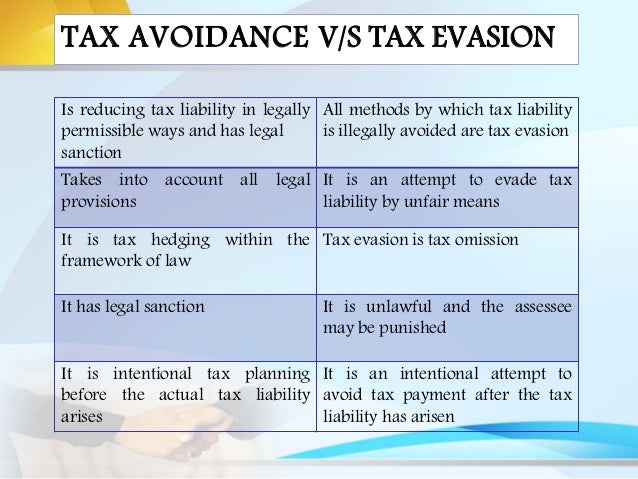

A planning made to reduce the tax burden without infringement of the legislature is known as tax avoidance.

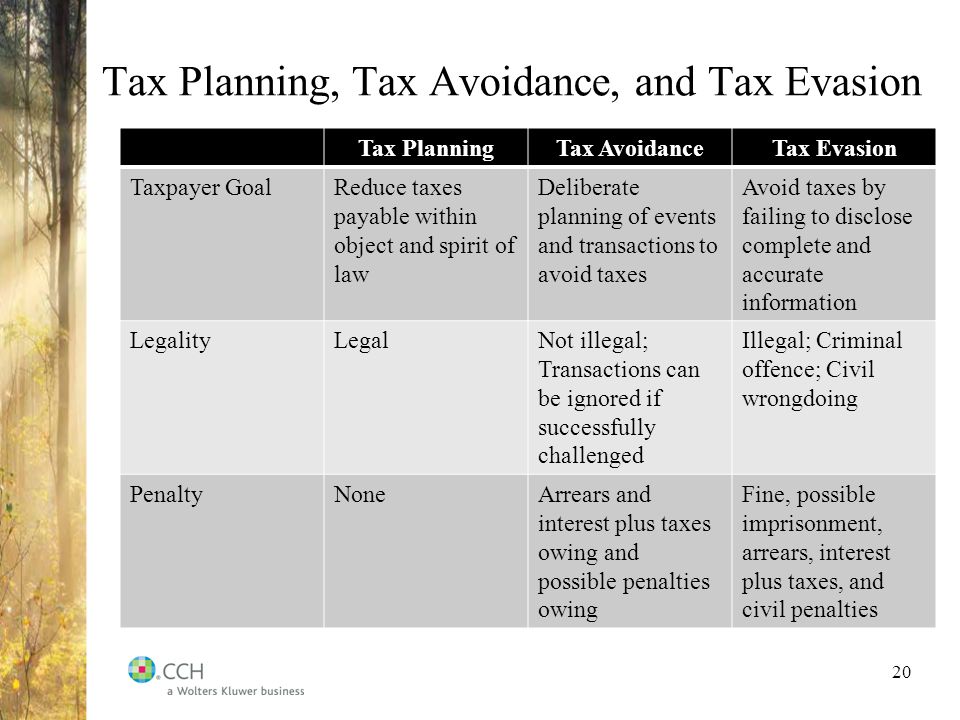

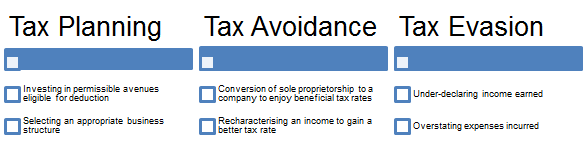

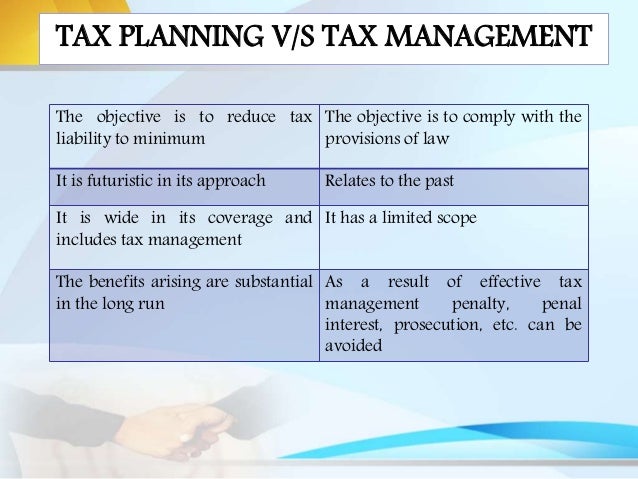

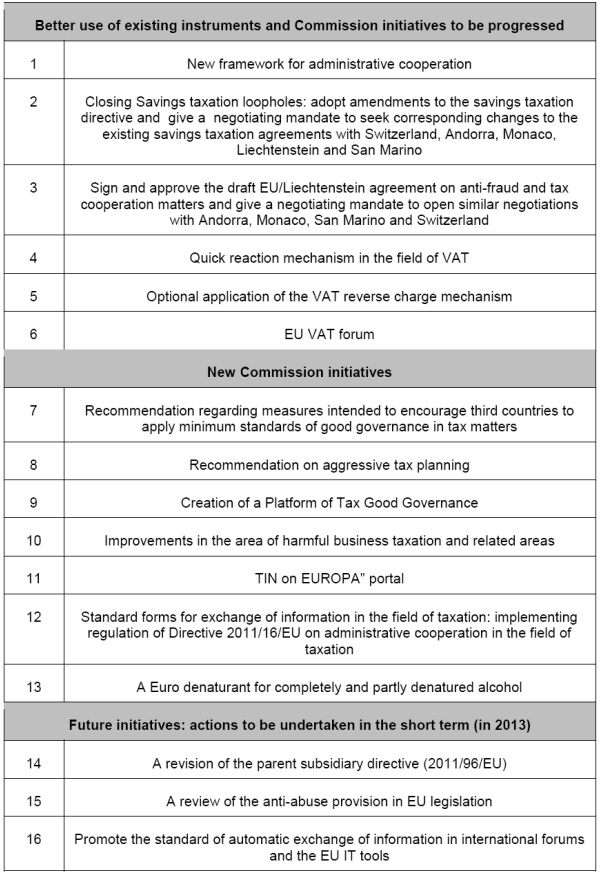

Differentiate between tax planning tax avoidance and tax evasion. Criminal offence which involves the reduction of one s tax liability or obtainment of tax credits or refunds through illegal means such as the claim for fictitious or non existent expense or failure to declare taxable income. The difference between tax avoidance and tax evasion accessed apr. Difference between tax planning tax avoidance tax evasion. Tax planning is an art to reduce your tax outgo by making sure that all the applicable provisions of our income tax act as designed to reduce your tax liability has been availed of.

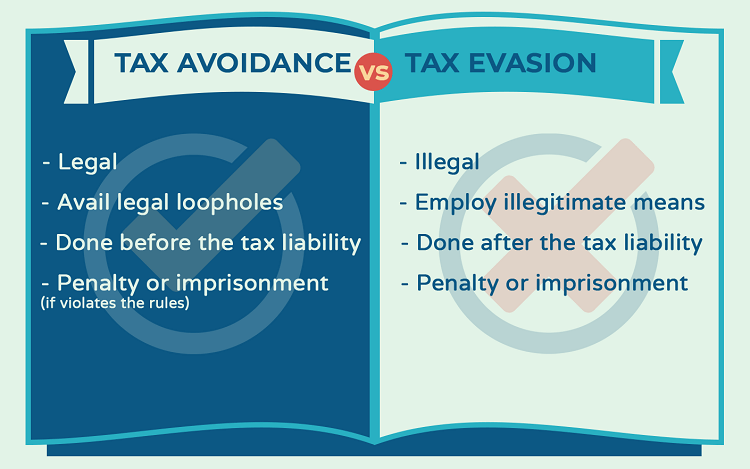

Features and differences between tax evasion tax avoidance and tax planning. Tax avoidance is lawful but in some cases it could come in the category of crime. Tax crimes handbook page 2. Tax evasion is an unlawful way of paying tax and defaulter may punished.

Businesses in search of saving tax often come up with those couples of terms. Below are key differences between tax evasion tax avoidance and tax planning to help you get better understanding. Accessed april 27 2020. Tax avoidance can be done by adjusting the accounts in such a manner that there will be no violation of tax rules.

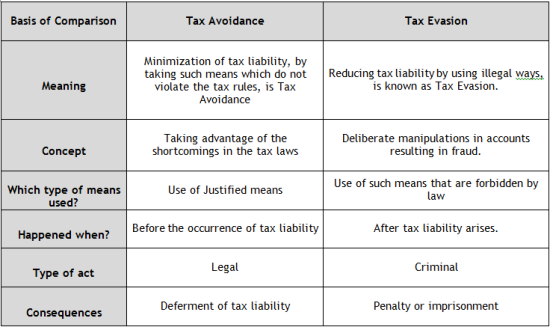

Cornell legal information institute. An unlawful act done to avoid tax payment is known as tax evasion. The dividing line amidst the two concepts is thin and blur. Tax avoidance refers to hedging of tax but tax evasion implies the suppression of tax.

Iii tax avoidance is done through not malafied intention but complying the provision of law. Differences between tax evasion tax avoidance and tax planning. Each term has been clarified quite obviously in our above mentioned sections. On the other hand the tax avoidance is a technique of refraining from tax liability through just and fair means but intends to defeat the fundamental motive of the legislature.

Iv tax avoidance looks like a tax planning and is done before the tax liability arises. The difference between tax planning and tax avoidance is that tax avoidance always increases your tax risk while tax planning either reduces it or does not increase your tax risk. Tax evasion is blatant fraud and is done after the tax liability has arisen. Tax evasion vs tax avoidance as tax avoidance and tax evasion are both methods used by individuals and businesses to minimize or completely avoid the payment of taxes one should be able to recognize the difference between tax evasion and tax avoidance while these concepts may sound similar to one another there are a number of differences between tax evasion and tax avoidance.

The difference between tax planning and tax avoidance primarily depends on the difference in benefits that are availed to minimise tax burden. Tax evasion accessed april 27 2020. The following are the major differences between tax avoidance and tax evasion.

/tax-avoidance-vs-evasion-397671-v3-5b71dfc846e0fb0025e54177.png)