E Filing Income Tax Malaysia

Tac akan dihantar kepada no.

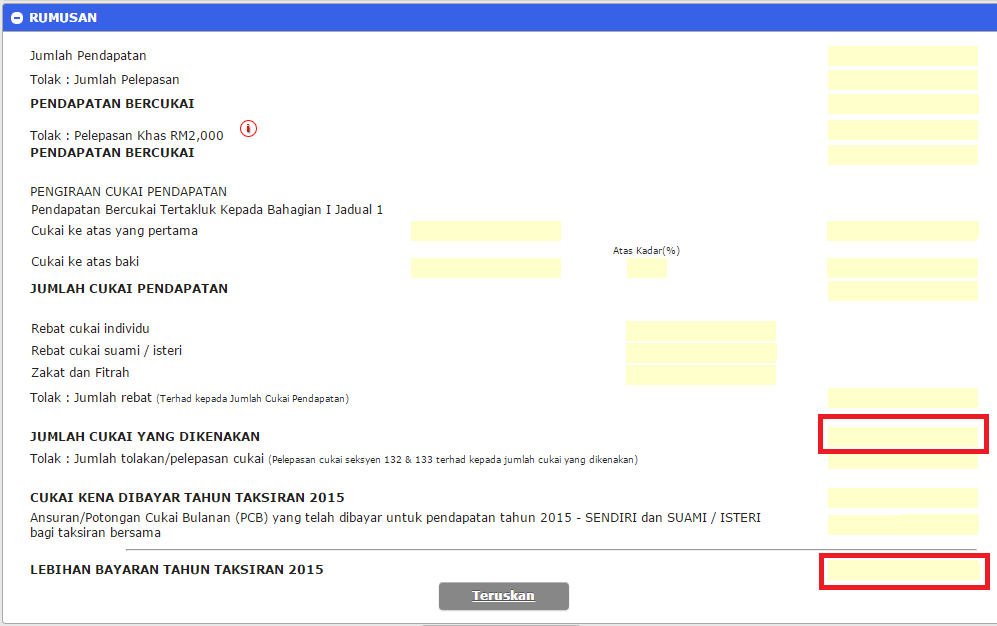

E filing income tax malaysia. E permohonan pindaan be adalah permohonan pindaan atas kesilapan atau khilaf bagi borang nyata cukai pendapatan yang telah dikemukakan secara e filing atau m filing dalam tempoh semakan pengesahan semakan semula pengesahan penerimaan borang yang telah dihantar secara e filing. Lhdnm menyediakan kemudahan m filing dengan menggunakan peranti mudah alih bagi individu pemastautin yang tidak menjalankan perniagaan untuk menghantar borang be m be. Finally pay your income tax or claim a tax refund for those who do still have outstanding taxes to pay you can do so through many channels in malaysia such as. How to file your personal income tax online in malaysia.

Subscribe to mypf youtube q1. Visit your nearest irb branch if you need help to complete your income tax return form or call the hasil care line at the hotline 03 89111000 603 89111100 overseas. Telefon bimbit yang berdaftar dengan lhdnm. Gone are the days of queuing up in the wee hours of the morning at the tax office to complete your filing.

6 commonly asked questions with regards to personal income tax e filing for first time tax payers. 2 30 jun 2020 merupakan tarikh akhir untuk penghantaran borang be tahun taksiran 2019. Click on borang pendapatan online in the first step of e daftar and then you will have to fill up the form for registration. You must pay income tax on all types of income including income from your business or profession employment.

If you have never filed your taxes before on e filing income tax malaysia 2019 go to http edaftar hasil gov my where you can apply online for the registration of income tax file for individuals and companies. Dimaklumkan bahawa pembayar cukai yang pertama kali melaporkan pendapatan menyamai atau melebihi rm 450 000 melalui hantaran borang secara e filing perlu memohon tac.