Personal Income Tax Relief 2020 Malaysia

Companies are not entitled to reliefs and rebates.

Personal income tax relief 2020 malaysia. Thanks to the economic stimulus package 2020 announced by interim prime minister tun dr mahathir mohamad yesterday malaysian can now to claim up to rm1000 income tax relief on domestic travel. Hence the tax relief is claimable by resident individuals for ya2020 and ya2021. Now that you know about all the income tax reliefs rebates and deductions that are available for malaysia personal income tax 2020 ya 2019 make sure to get your tax filing in order so you don t miss out on any claims. Self and dependent special relief of rm2 000 will be given to tax payers earning on income of up to rm8 000 per month aggregate income of up to rm96 000 annually.

Medical expenses for parents. Don t miss out on maximising your income tax refund 2020. An individual whether tax resident or non resident in malaysia is taxed on any income accruing in or derived from malaysia. The prime minister announced that personal income tax relief in the amount of myr 1 000 on travel expenses incurred from 1 march 2020 to 31 august 2020 is to be extended to 31 december 2021.

Personal tax reliefs in malaysia. Because this is the most comprehensive and practical guide on income tax relief in malaysia for the non tax savvy you yes you. As the total amount of personal reliefs claimed by mrs wong exceeds the overall relief cap of 80 000 the total personal reliefs allowed to her is capped at 80 000 for ya 2020. Any individual earning more than rm34 000 per annum or roughly rm2 833 33 per month after epf deductions has to register a tax file.

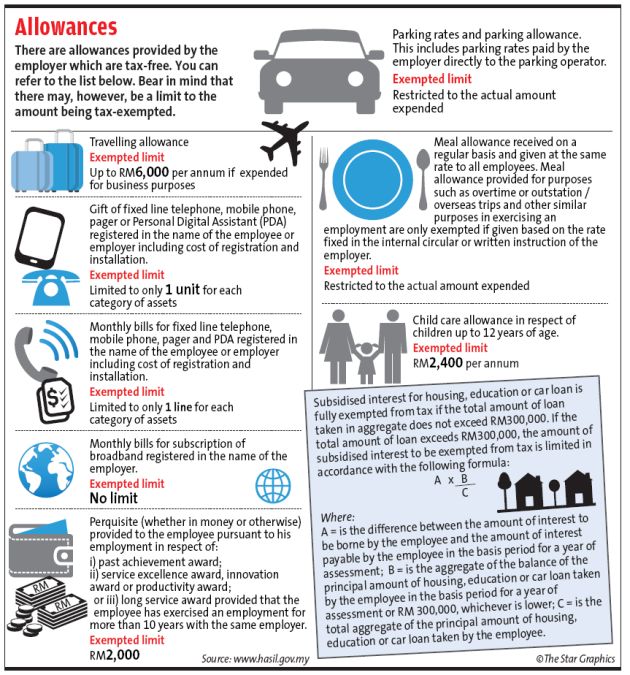

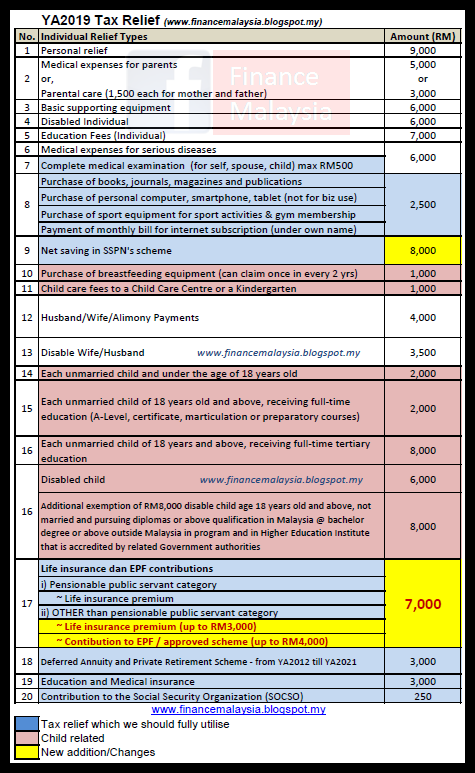

Below is the list of tax relief items for resident individual for the assessment year 2019. Amount rm 1. The conditions of entitlement for each relief must be satisfied in order to minimize the income tax liability. Reliefs are available to an individual who is a tax resident in malaysia in that particular ya to reduce the chargeable income and tax liability.

Personal tax relief malaysia 2020. If you digest this by dec 2019 then in april 2020 you don t need scramble around to find the receipts for items you purchased the year before. The relief amount you file will be deducted from your income thus reducing your taxable income make sure you keep all the receipts for the payments. The following rates are applicable to resident individual taxpayers for ya 2020.

On top of that you are also eligible to receive rm100 worth of digital voucher to use on any domestic travel in the country. Despite the relief cap as her chargeable income does not exceed 20 000 the tax payable by mrs wong remains at 0. 5 000 limited 3.