Good And Service Tax Meaning

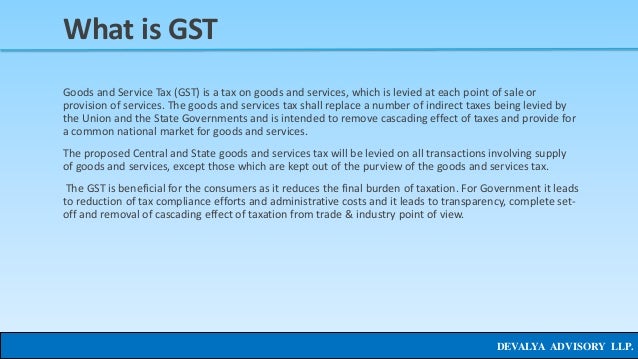

Goods and services tax or gst is a broad based consumption tax levied on the import of goods collected by singapore customs as well as nearly all supplies of goods and services in singapore.

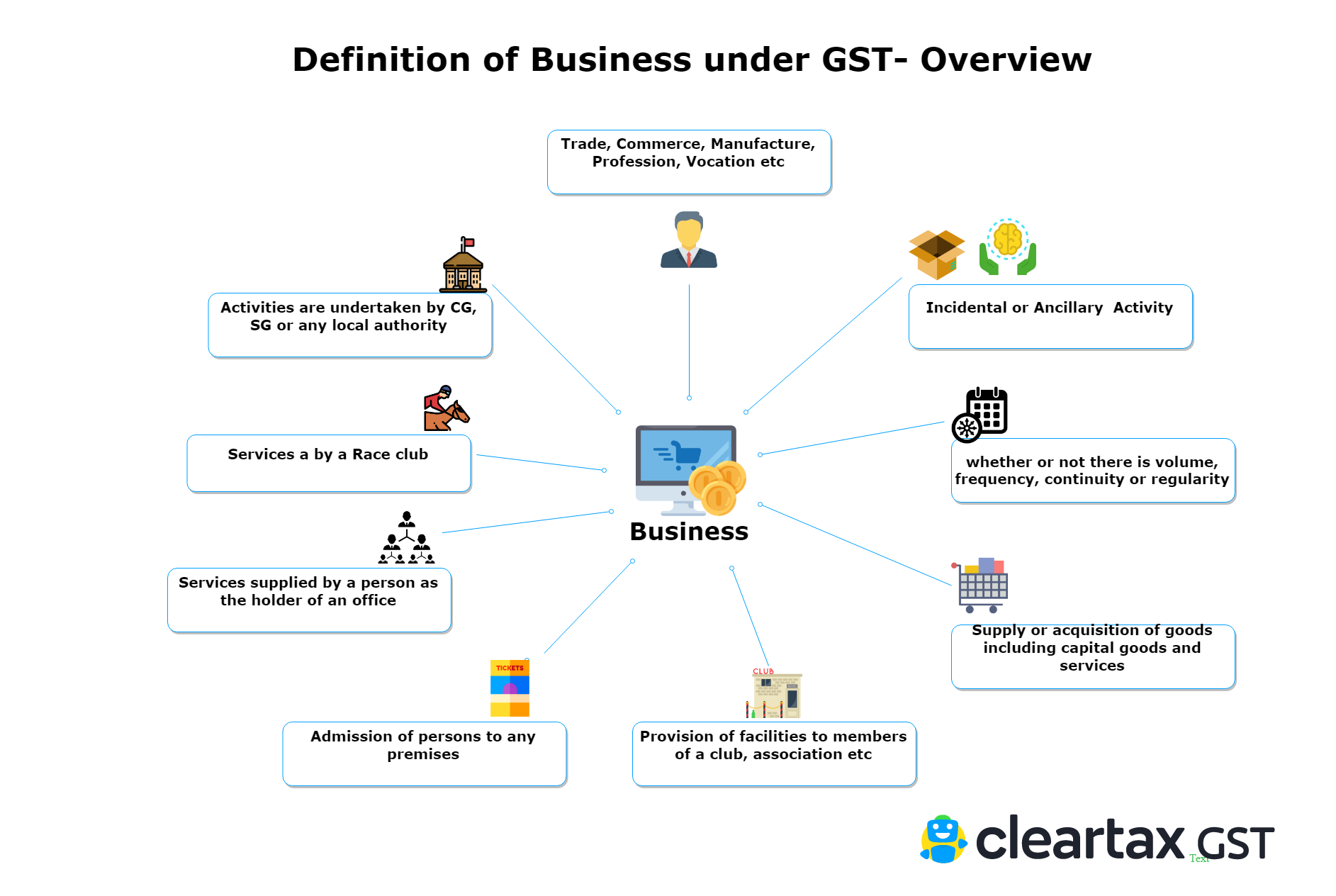

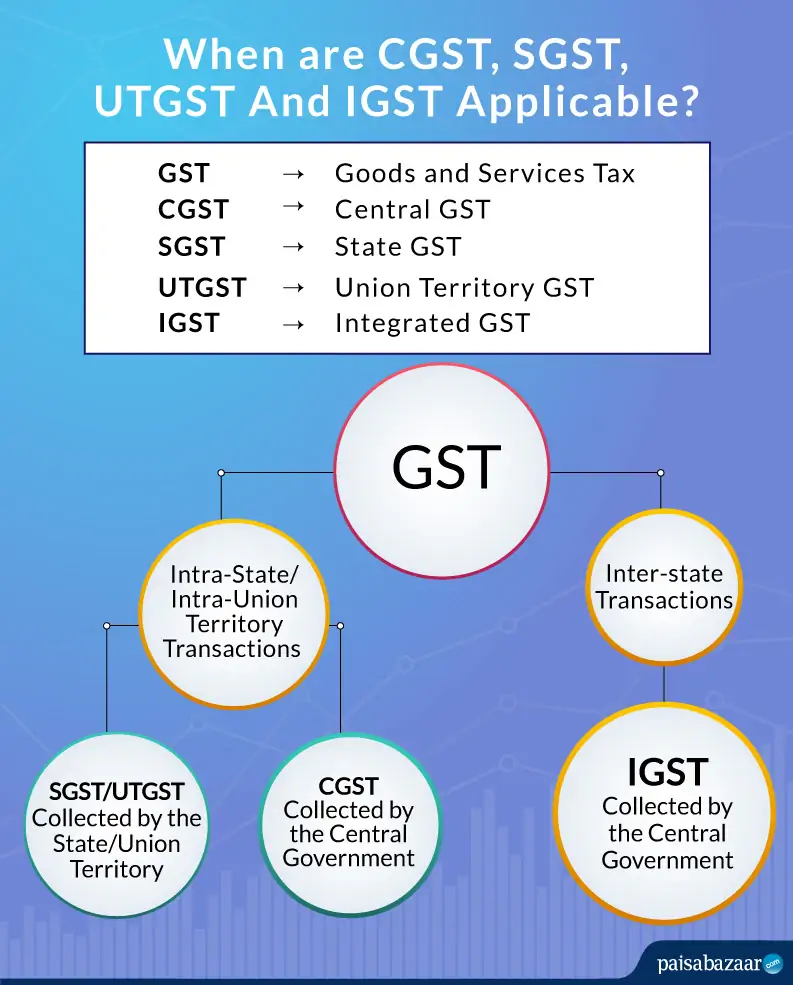

Good and service tax meaning. As per section 2 55 of cgst act goods and services tax practitioner means any person who has been approved under section 48 to act as such practitioner. Service tax is a tax levied by the government on service providers on certain service transactions but is actually borne by the customers it is categorized under indirect tax and came into existence under the finance act 1994. Most canadian businesses are responsible for collecting remitting the gst or hst on taxable goods and services. Goods and services tax gst is an indirect tax or consumption tax used in india on the supply of goods and services.

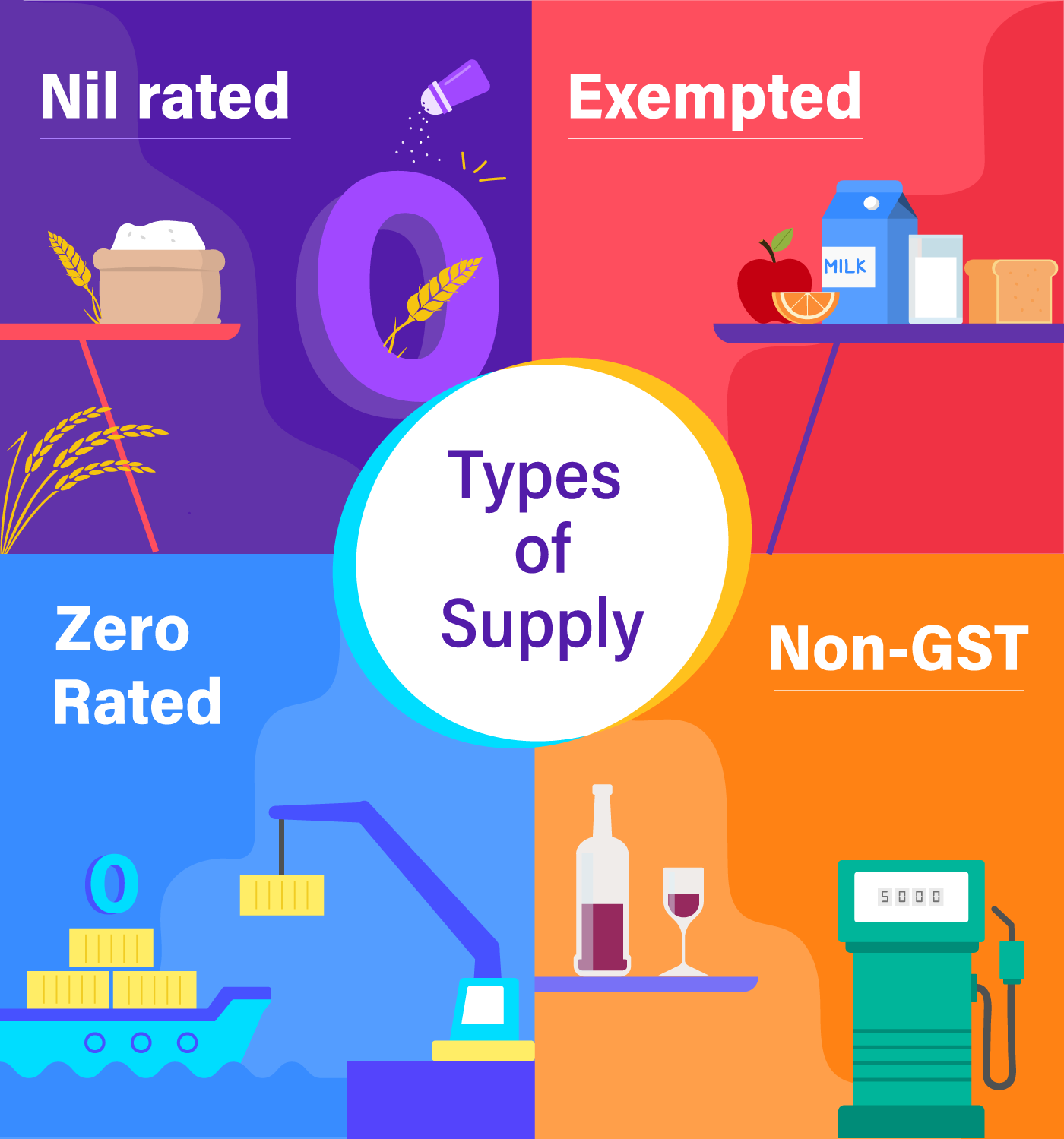

Comprehensive because it has subsumed almost all the indirect taxes except a few state taxes. The goods and services tax gst is a 5 tax on the supply of most goods and services in canada. Gst or goods and services tax is a tax that customers have to bear when they buy any goods or services such as food clothes electronics items of daily needs transportation travel etc. The gst is paid by consumers but it is remitted to the government by the.

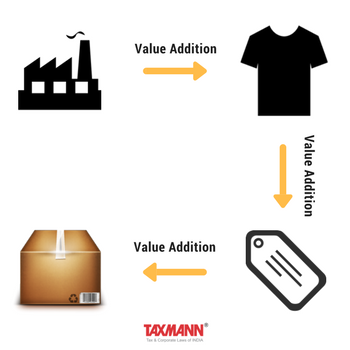

It is charged in every province either separately or as a part of the harmonized sales tax hst. In other countries gst is known as the value added tax or vat. The goods and services tax gst is a value added tax levied on most goods and services sold for domestic consumption. Goods and services tax gst is a value added tax or consumption tax for goods and services consumed in new zealand.

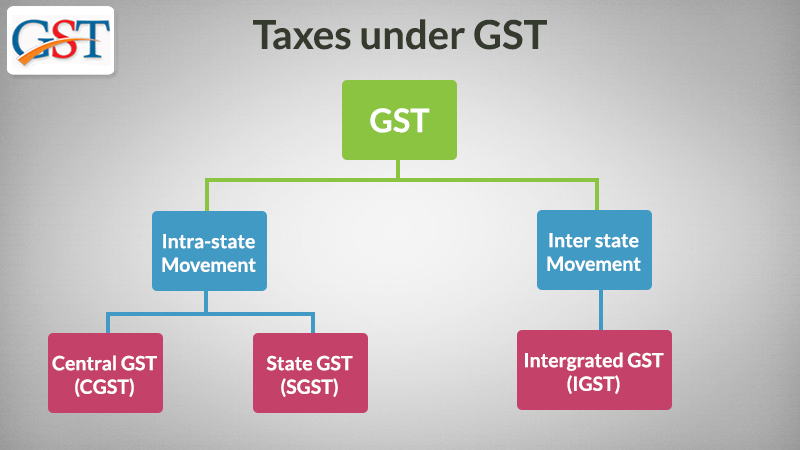

This revenue is essential for funding nationwide projects and expenditures that serve the public interest. It is a comprehensive multistage destination based tax. It is a destination based tax. Gst will subsume central excise law service tax law vat entry tax octroi etc.

Gst is a single tax on the supply of goods and services. Gst in new zealand is designed to be a broad based system with few exemptions such as for rents collected on residential rental properties donations precious metals and financial services. Personalized financial plans for an uncertain market. The goods and services tax gst is a federal sales tax and provides revenue to the governments about 160 countries in which it is implemented.

Gst goods and services tax is the biggest indirect tax reform of india.