Goods And Services Tax Network Upsc

It is a single tax on supply of goods and services in its entire product cycle or life cycle i e.

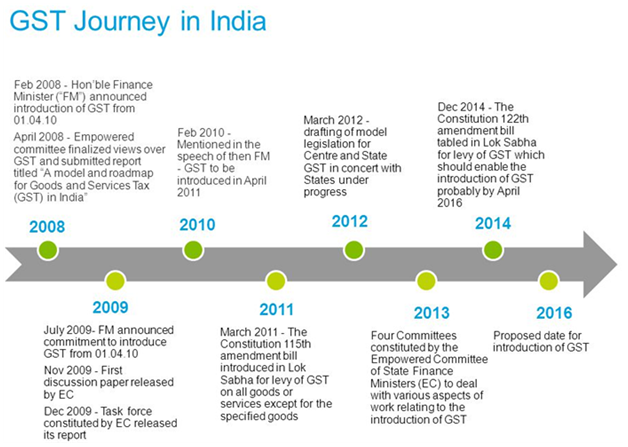

Goods and services tax network upsc. A proposal to introduce a national level goods and services tax gst by april 1 2010 was first mooted in the budget speech for the financial year 2006 07. Goods and service tax network gstn is a non government private limited company which was given a non recurring grant by the government. From manufacturer to the consumer. Goods and services tax gst collections rose 10 2 per cent to an eight month high of rs 1 05 lakh crore in october for sales in september.

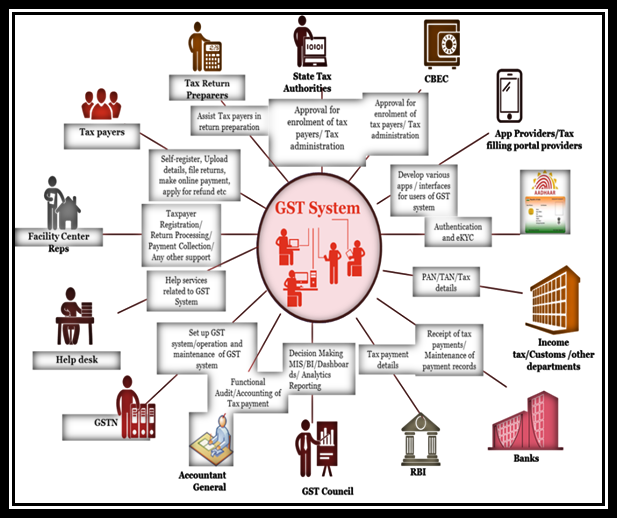

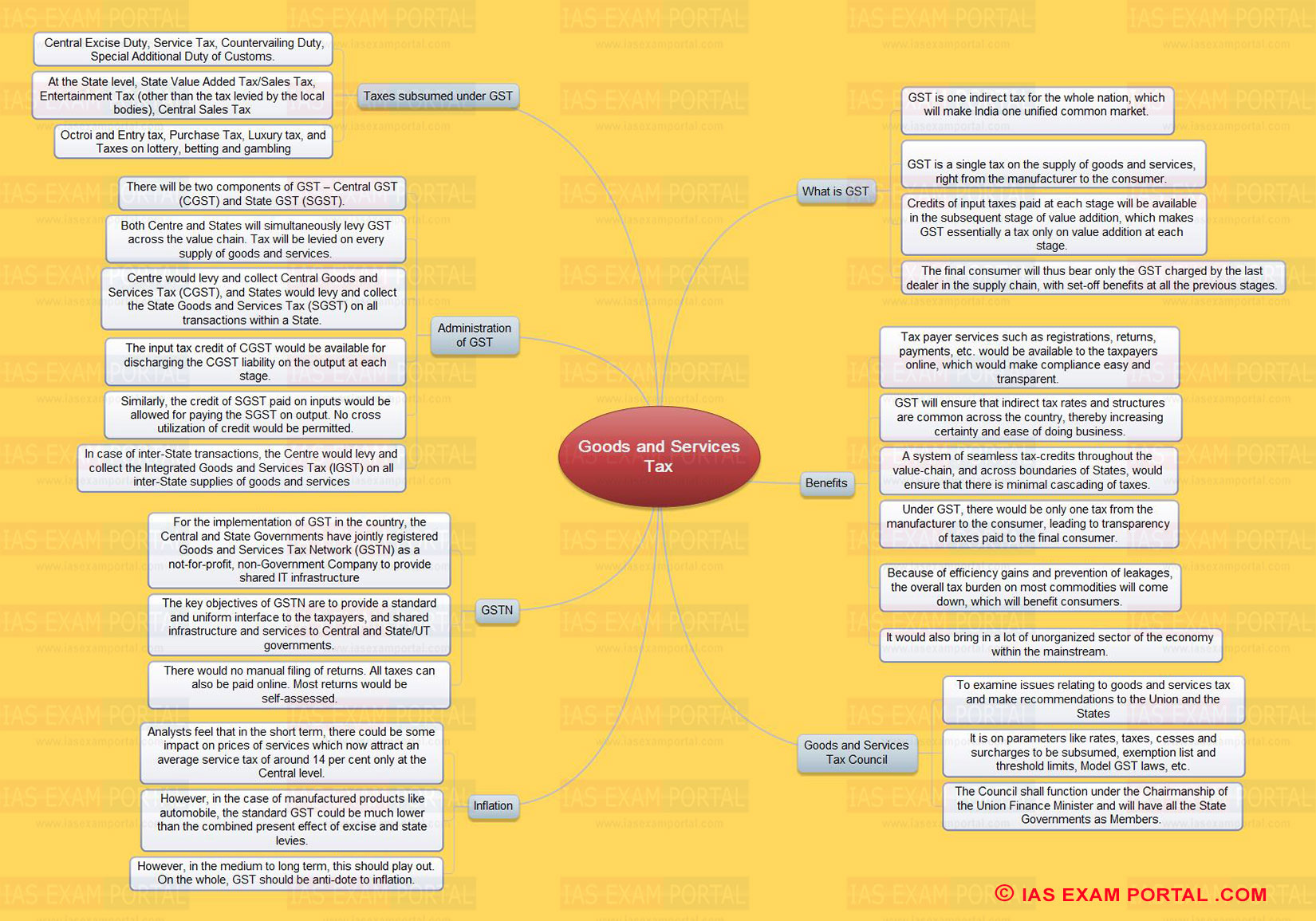

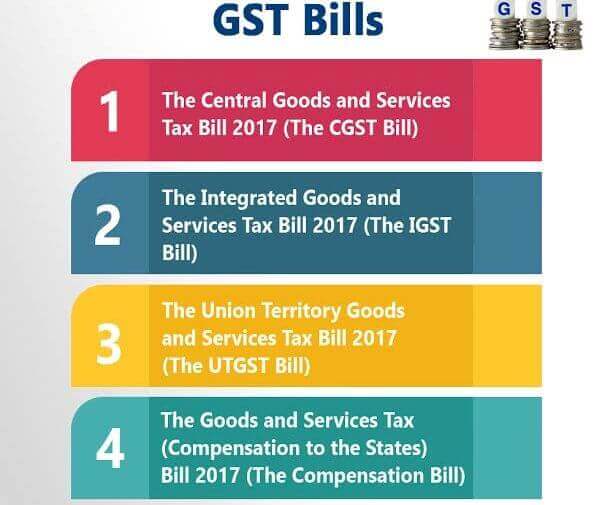

In 2003 the kelkar task force on indirect tax had suggested a comprehensive goods and services tax gst subsuming central state taxes and interstate taxation based on vat principle. In case of inter state transactions the centre would levy and collect the integrated goods and services tax igst on all inter state supplies of goods and services gstn for the implementation of gst in the country the central and state governments have jointly registered goods and services tax network gstn as a not for profit non government company to provide shared it infrastructure. Gstn goods and services tax network. Essay on goods and services tax upsc.

Key factors for this collection are the easing of covid restrictions low base effect and proposed deadline for claiming input tax credit and reconciliation for businesses for 2019 20. It has 49 equity held by center and the states and remaining 51 held by private lenders like hdfc icici etc. Gst is an indirect comprehensive multi stage destination based tax levied on each value addition of the goods and services it came into effect on 1st july 2017 after the implementation of one hundred and first amendment of the constitution of india it is a comprehensive tax that replaces many indirect taxes levied by the central and the state government.