Income Tax E Filing Portal Link Aadhaar Card

Some of these facilities are an sms service the e filing income tax portal and through itr.

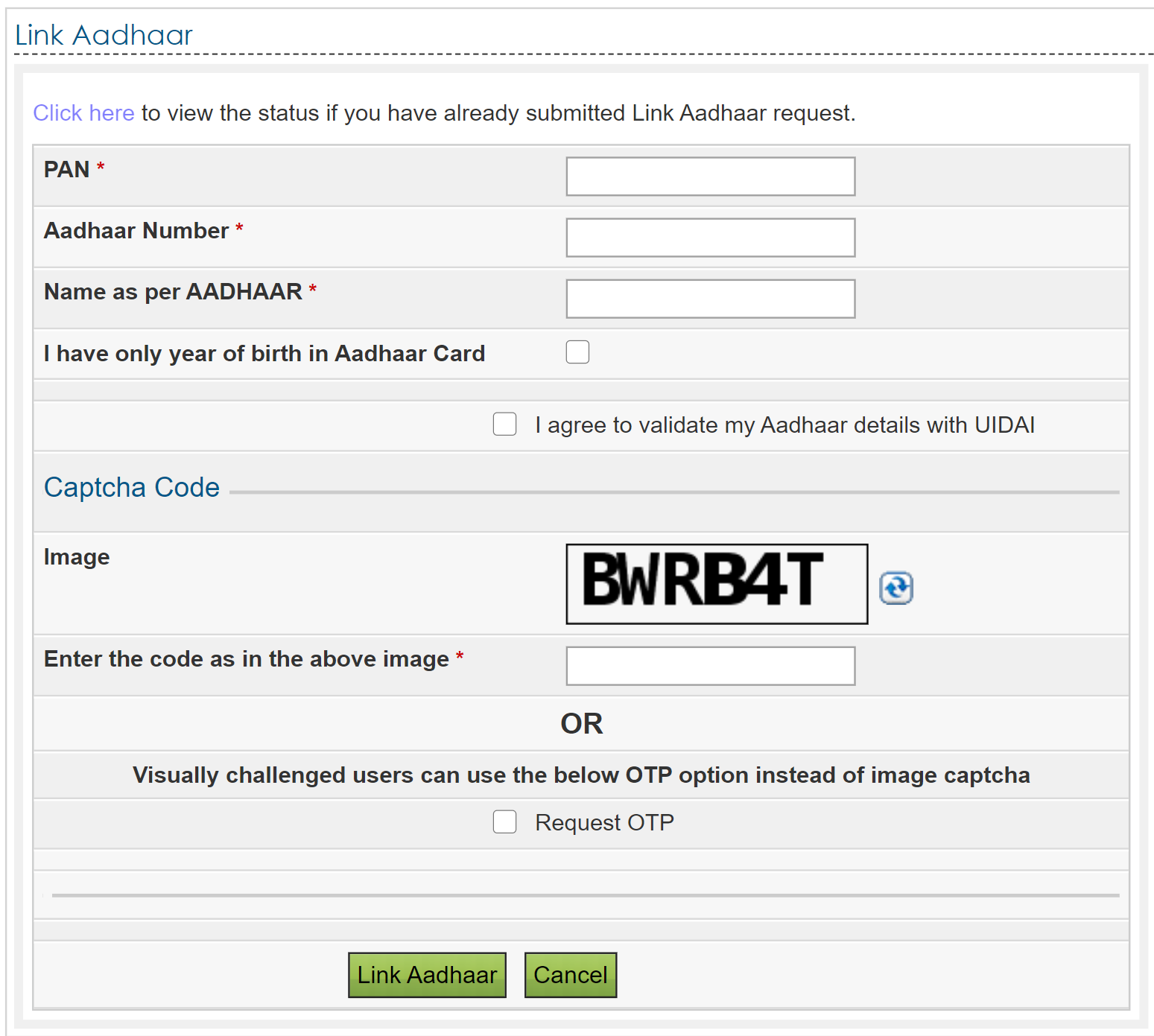

Income tax e filing portal link aadhaar card. Pan aadhaar number name and captcha code. Until recently to verify your itr filed online you had to download the itr verification itr v from the e filing portal once the return is filed and send a signed copy of it to centralised processing centre cpc bengaluru to confirm your income tax return. For the purpose of e filing income tax returns an individual has to follow the below steps to link aadhaar with pan. The government of india has made it mandatory for all the individuals to link their aadhaar card with pan card for filing the income tax return.

Step 2 click on link aadhaar under the quick links section. In 2014 income tax department has identified additional 22 09 464 non filers who have done high value transactions. As per the aadhaar act 2016 section 139aa of the income tax act it will not be applicable for individuals who do not reside in india. If you are not registered with the e filing portal use the register.

The income tax department has on its website incometaxindia gov in listed various ways for the income tax assessees to link their aadhaar with pan. Pan card aadhar card link last date. Once done the pan number aadhaar number and name must be filled. Step 3 the individual will be directed to the link aadhaar page.

This is to inform that by clicking on the hyper link you will be leaving e filing portal and entering website operated by other parties. Please ensure that aadhaar number and name as per aadhaar is exactly the same as printed on your aadhaar card. Without logging in income tax e filling portal this is the easiest way for linking your aadhaar card with pan card step 1 go to https incometaxindiaefiling gov in and select link aadhaar option under services. In 2013 income tax department issued letters to 12 19 832 non filers who had done high value transactions.

But now this step can be eliminated from the process of filing returns. Step 4 enter the following fields correctly. Now the transaction for the income tax return will not proceed without pan and aadhaar is linked. Log on to e filing portal at https incometaxindiaefiling gov in.

The income tax department has made it mandatory for all the taxpayer to link aadhaar with pan card. Such links are provided only for the convenience of the client and e filing portal does. Income tax returns itr once filed need to be verified. Link aadhaar card with pan card online or through sms e filing portal how to link aadhaar with pan card online or sending sms operating under the income tax department of india pan card has been the key solution for tailing financial transactions.

If a person furnishes a pan card which is not linked to aadhaar they may be fined up to rs 10 000 under section 27b of the income tax act. Different ways in which you can link your aadhaar card with your pan number. So if you don t link your aadhar till now then you can simply do the same by today only.