Income Tax Relief 2017 Malaysia

Starting from year of assessment 2017 the lifestyle tax relief includes individual with a monthly income of rm3 600 and above said choong hui yan a tax consultant from simways formulation.

Income tax relief 2017 malaysia. Rm 63 000 rm 1 400 rm 9 000 rm 4 400 rm 48 200. Of course these exemptions mentioned in the example are not the only one. All you need to do is to click under individual then tax relief. In effect this reverts to the previous position such that intellectual property services such as trade mark industrial designs and patent.

Income attributable to a labuan. Medical expenses for parents. 2 order 2017 was gazetted to provide a special income tax exemption for companies limited liability partnerships trust bodies executors of estates and receivers under subsection 68 4 of the income tax act 1967 the act. 5 000 limited 3.

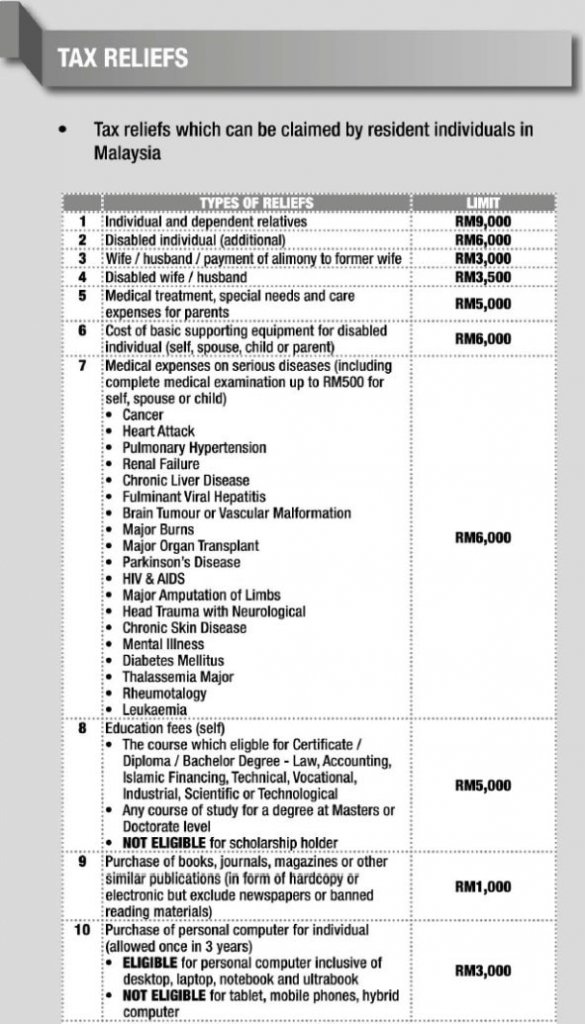

Malaysian government imposes income tax rebates for resident individual as below for 2017. In fact the full list of tax relief for resident individual is available at irb website. Self and dependent special relief of rm2 000 will be given to tax payers earning on income of up to rm8 000 per month aggregate income of up to rm96 000 annually. The amount of tax relief 2017 is determined according to government s graduated scale.

The minister of finance has granted withholding tax exemption wht on payments to non residents that fall within section 4a i and ii of the income tax act in respect of offshore services via the income tax exemption no. Income tax about income about tax tax rebate 2017. Income tax offices. Which is why we ve included a full list of income tax relief 2017 malaysia here for your calculation.

For additional details you might be interested to check out malaysian tax booklet by pwc. Malaysian government imposes various kind of tax relief that can be divided into tax payer self dependent parents and many more with the purpose to reduced the burden of tax payers. Amount rm 1. For year of assessment 2016 and before only individuals with a monthly income of rm3 800 and above would have enough chargeable income to utilise the rm1 300 or rm4 300 tax relief.

On 10 april 2017 the income tax exemption no. Tax relief refers to a reduction in the amount of tax an individual or company has to pay. Finally i hope the above will guide you in your 2017 tax planning especially on tax relief. Pwc 2016 2017 malaysian tax booklet income tax scope of taxation income tax in malaysia is imposed on income accruing in or derived from malaysia except for income of a resident company carrying on a business of air sea transport banking or insurance which is assessable on a world income scope.

A much lower figure than you initially though it would be. Medical expenses for parents. This relief is applicable for year assessment 2013 and 2015 only.