Pioneer Status And Investment Tax Allowance

Tax relief period may be extended for a further 5 years for certain.

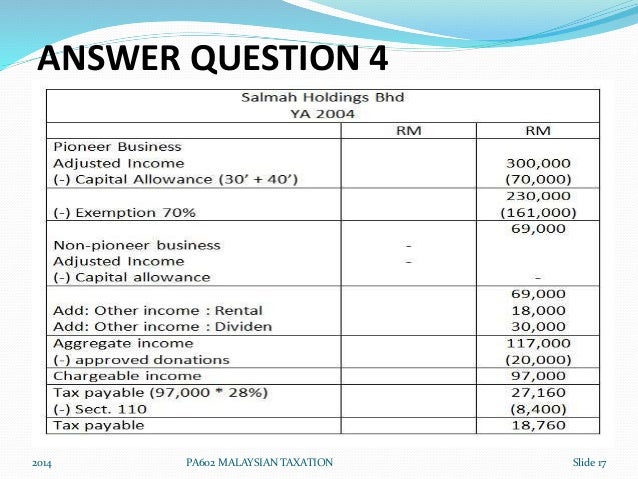

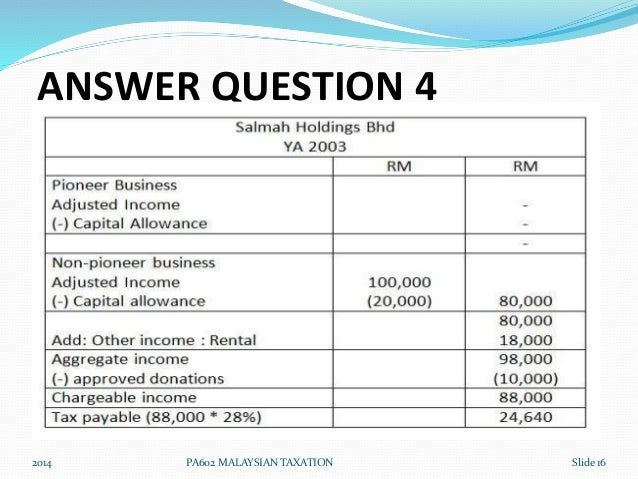

Pioneer status and investment tax allowance. Candidates must first study closely the source authority for these incentives ie the relevant laws and the respective irb public rulings or guidelines where available to obtain a good general understanding. Pioneer status often provides a 70 exemption of statutory income for a period of 5 years but it is possible to extend both the quantum and the period of the exemption. Pioneer status or investment tax allowance. While pioneer status is an income based tax incentive investment tax allowance is a capital expenditure based one that generally provides for a.

Exempt and non exempt income ita is a capital expenditure based incentive which is given by way of an exemption of income. A application for pioneer status certificate guidelines. Form pia 86 ps 96 application for pioneer certificate form pia 86. A company approved with a pioneer status certificate can enjoy income tax exemption between 70 100 of statutory income for 5 to 10 years whereas for investment tax allowance a company can get allowances between 60 100 on qualifying capital expenditure incurred within a period of 5 to 10 years.

Pioneer status and investment tax allowance are two of the main tax incentives available in malaysia. Income is computed in the normal way down to statutory income level at which point the eligibility for exemption can be determined. Iii pioneer status iv investment tax allowance and v reinvestment allowance. A company approved with a pioneer status certificate can enjoy income tax exemption between 70 100 of statutory income for 5 to 10 years whereas for investment tax allowance a company can get allowances between 60 100 on qualifying capital expenditure incurred within a period of 5 to 10 years.

Ii differences between pioneer status and investment tax allowance. Tax exemption of statutory income for five years. Application for pioneer status received on or after 1 1 1991 but before 1 11 1991. Form pia 86 ita r d 95 iii application for the determination of effective date for investment tax allowance incentive contract r d and r d company b2.

Pioneer status often provides a 70 exemption of statutory income for a period of 5 years. The alternative to pioneer status incentive is usually the investment tax allowance ita. Pioneer status ps is an incentive in the form of tax exemption which is granted to companies participating in promoted activities or producing promoted products for a period of 5 or 10 years.