Tax Avoidance And Tax Evasion Examples

Contribution towards retirement benefits in most of the countries the contribution made towards retirement benefits are deducted from gross income before arriving at taxable income.

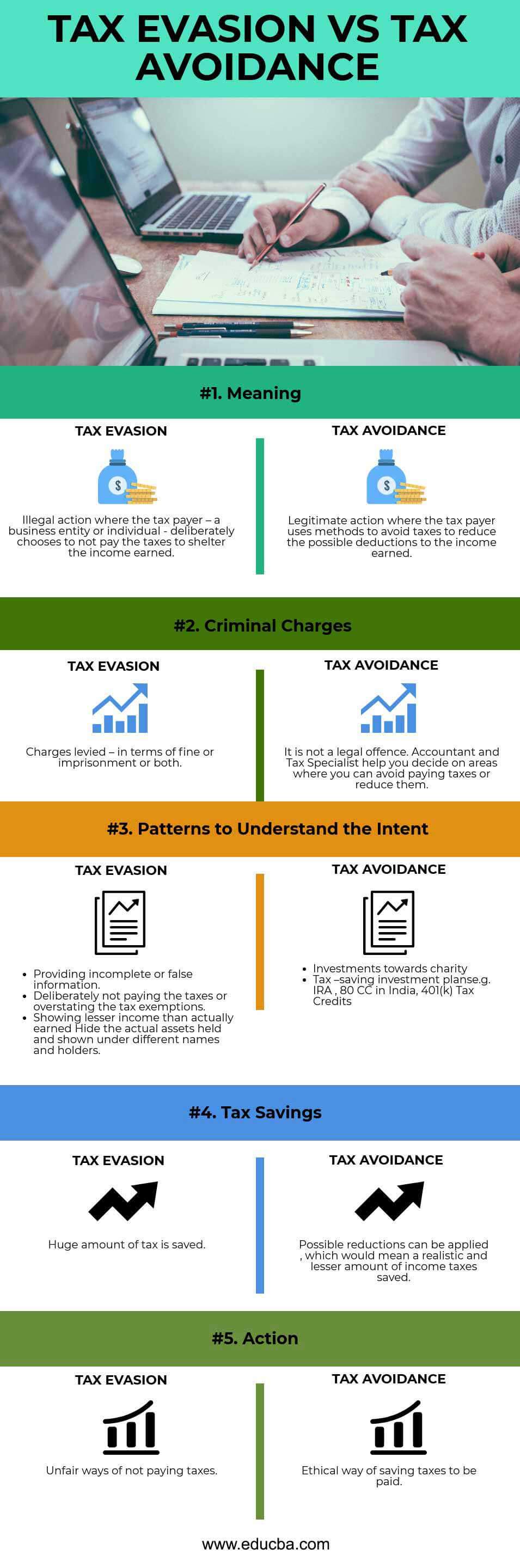

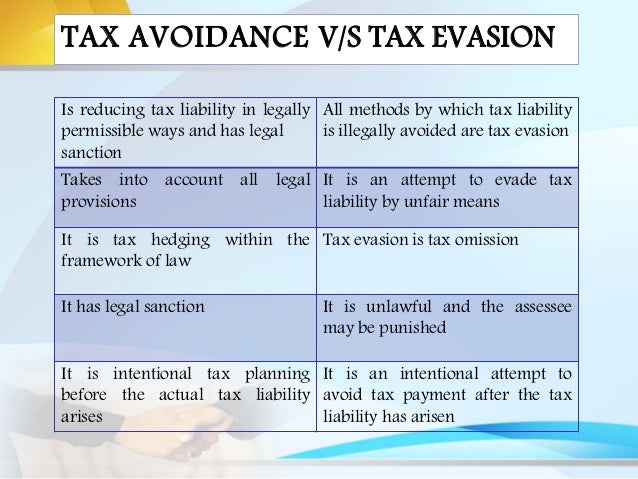

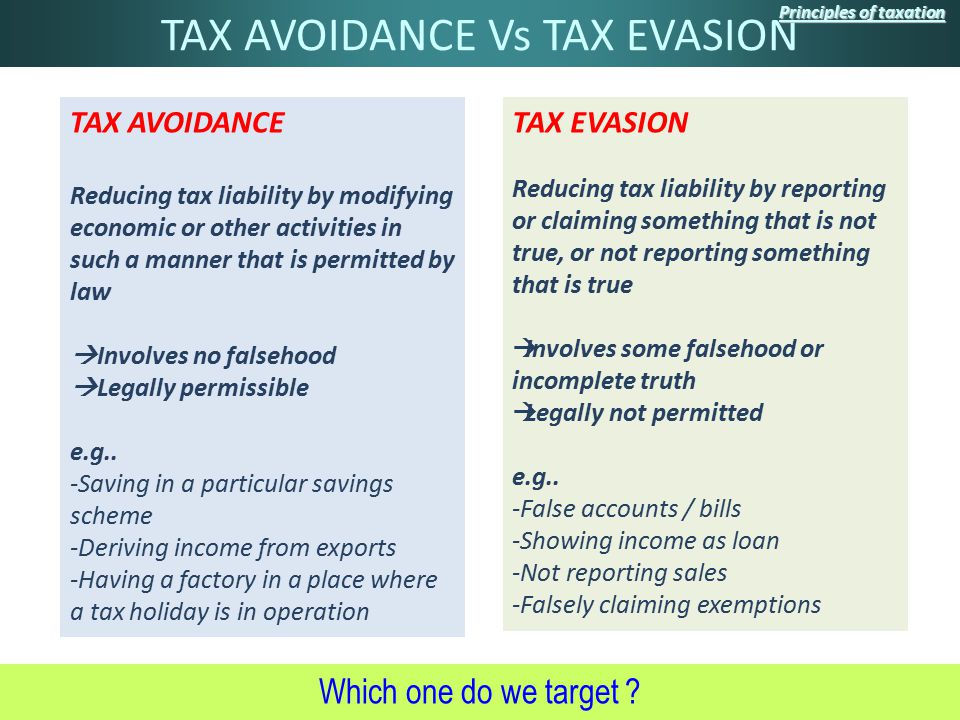

Tax avoidance and tax evasion examples. Tax avoidance is the minimization of taxes by using loopholes in the law and other tax reducing techniques that are approved by the irs. However if the assets are hidden after a tax liability has become due and owing this is an attempt to evade payment. Tax avoidance arrangement a tax avoidance arrangement normally involves an arrangement that is artificial contrived or has little or no commercial substance and is designed to obtain a tax advantage that is not intended by parliament. Tax avoidance refers to hedging of tax but tax evasion implies the suppression of tax.

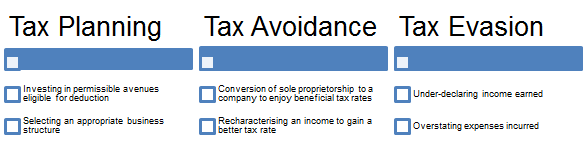

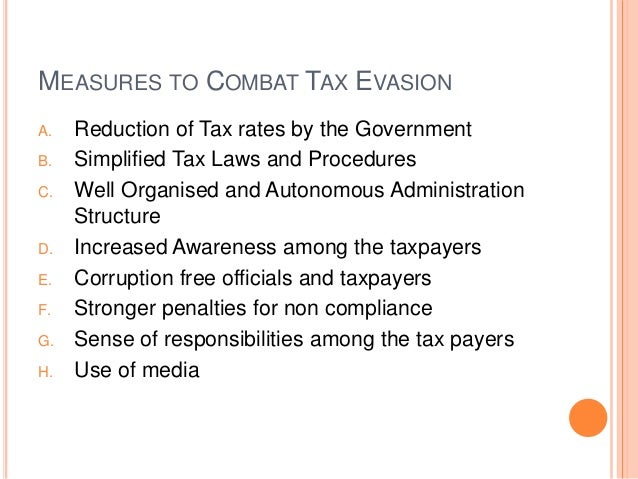

All the methods are different and interchangeable. Basically tax avoidance is legal while tax evasion is not. Tax evasion occurs when the taxpayer either evades assessment or evades payment. An unlawful act done to avoid tax payment is known as tax evasion.

Examples of tax evasion are untrue financial reporting window dressing of financial accounts hiding assets and income claiming false deduction avoiding payment of taxes due etc. In most cases this may be more properly described as tax evasion although this is dependent on the individual circumstances. Basically tax avoidance is legal while tax evasion is not. Components of tax avoidance.

For example in the united states one can contribute up to 19 000 to a 401 k if you re under 50. Tax liability of an individual can be reduced through 3 different methods tax planning tax avoidance and tax evasion. The terms tax avoidance and tax evasion are often used interchangeably but they are very different concepts. For example if someone transfers assets to prevent the irs from determining their actual tax liability there is an attempted to evade assessment.

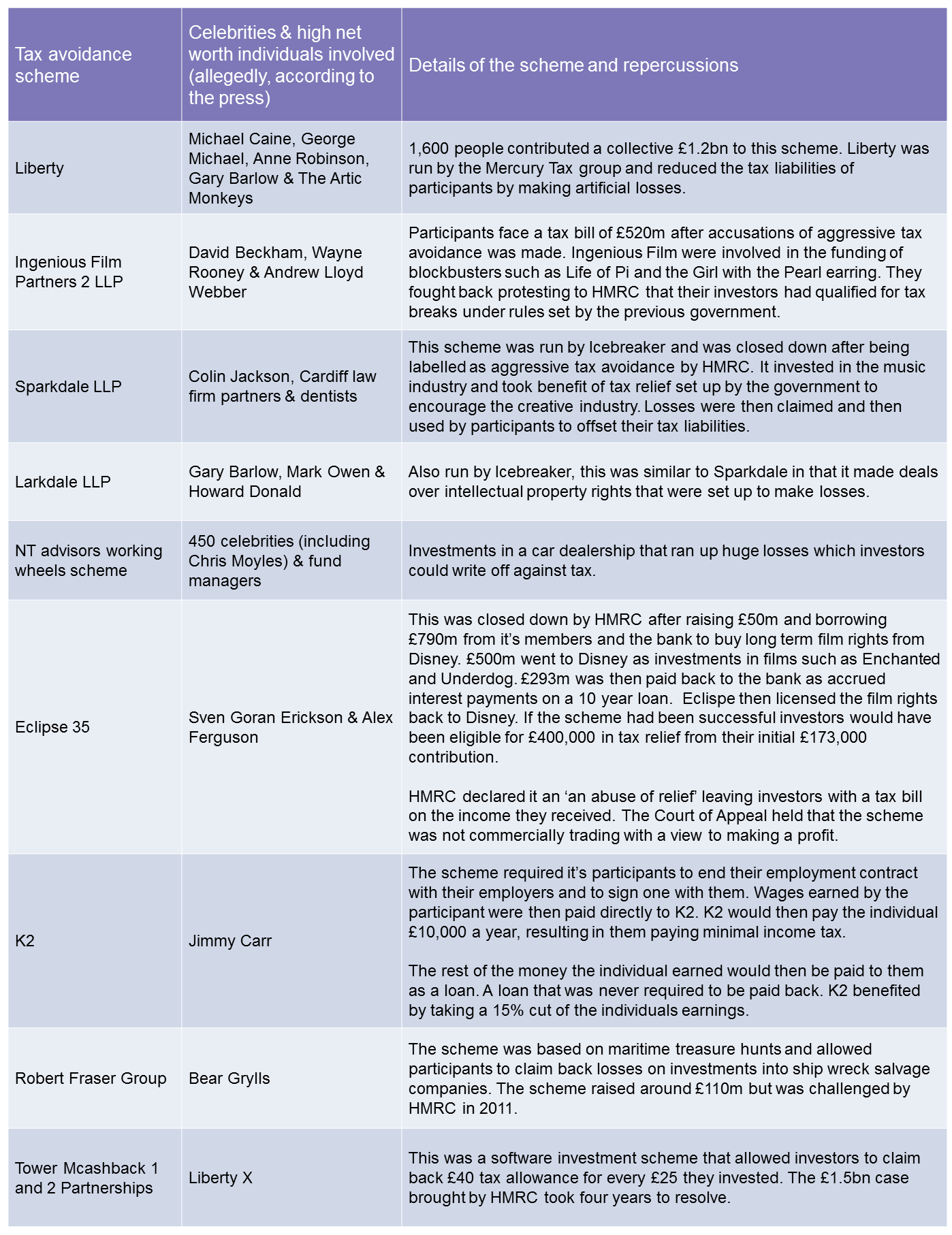

Perhaps the most popular example of tax avoidance is operated by companies where directors receive their income as directors loans and then either do not repay such loans to the company or write them off at the year end. Tax avoidance use the loopholes weakness in tax statutes to reduce or avoid tax liability but tax evasion is the intentional use of fraudulently practices to pay less tax or not to pay tax at all. Businesses get into trouble with the irs when they intentionally evade taxes. Tax planning and tax avoidance are the legal ways to reduce tax liabilities but tax avoidance is not advisable as it manipulates the law for one s own benefit.

/tax-avoidance-vs-evasion-397671-v3-5b71dfc846e0fb0025e54177.png)