Tax Planning Tax Avoidance And Tax Evasion Pdf

/tax-avoidance-vs-evasion-397671-v3-5b71dfc846e0fb0025e54177.png)

Pummy wadhawan bba 4th sem meaning of tax planning tax planning is an art and the exercise of arranging financial affairs of tax payers so as to reduce or delay the tax payment which would be necessary if the words if tax laws were to be followed in the obvious manner.

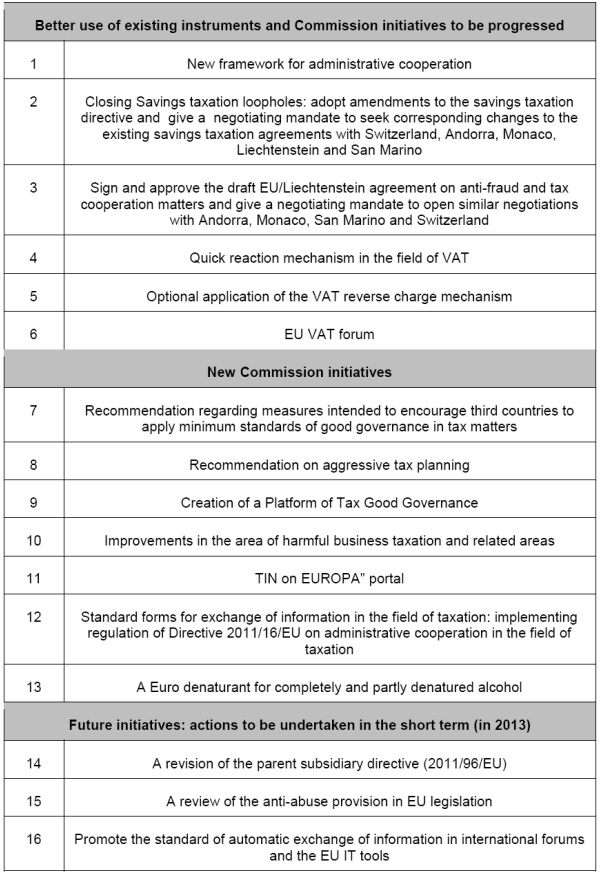

Tax planning tax avoidance and tax evasion pdf. The purpose of this thesis is to review the causes of and solutions to tax avoidance. In this article bbcincorp will clarify meaning features as well as differences between tax evasion tax avoidance and tax planning. Basic framework of tax laws in india residential status of a company and incidence of tax corporate tax planning. Z this course will enable the learners to do effective tax planning to reduce tax liability of companies.

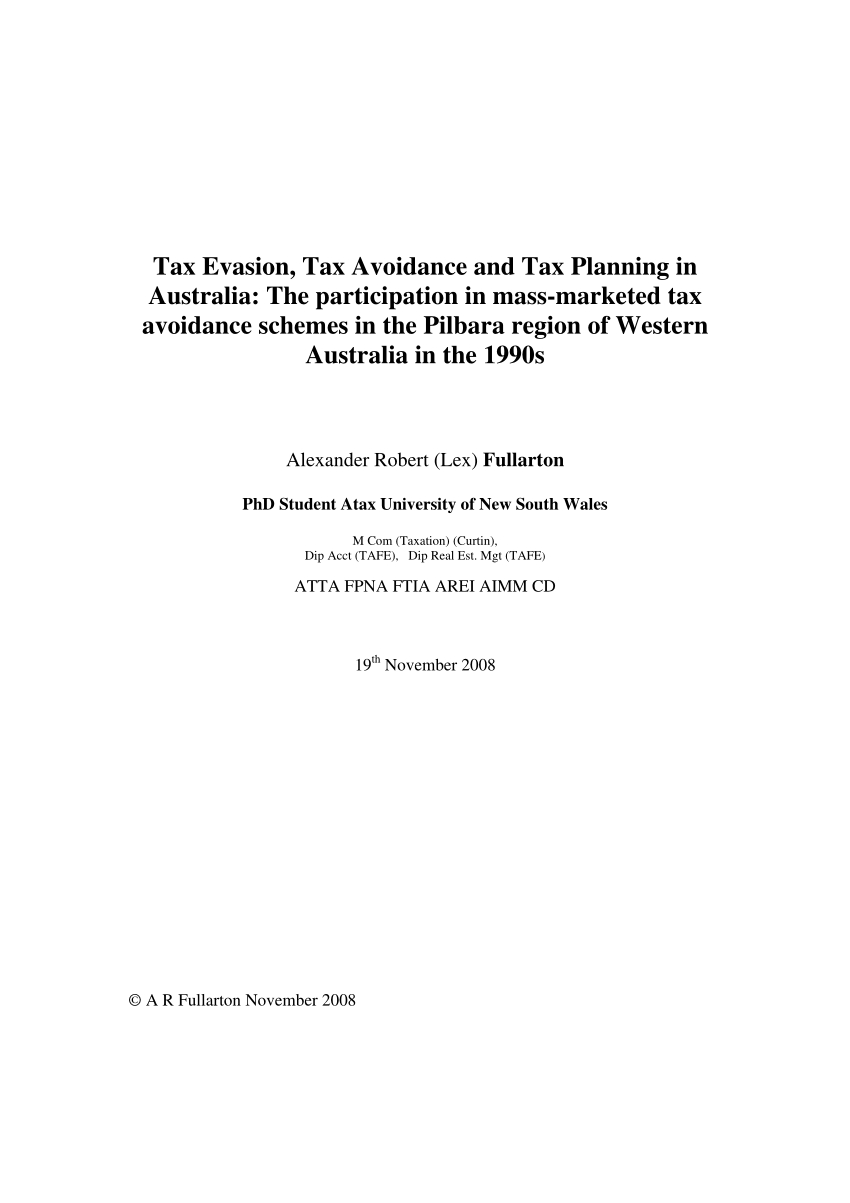

The participation in mass marketed tax avoidance schemes in the pilbara region of western australia in the 1990s. Tax avoidance tax avoidance is legal but it is immoral and illegitimate. Tax planning tax avoidance dan tax evasion pdf. Different people have different understanding and definitions of tax avoidance.

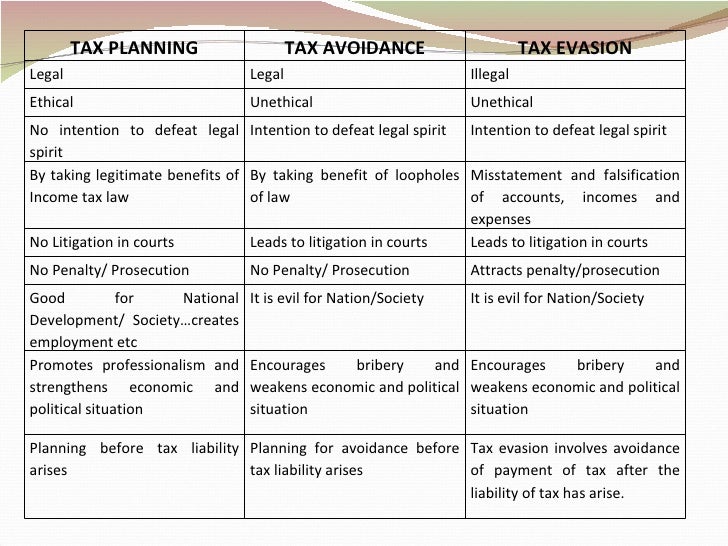

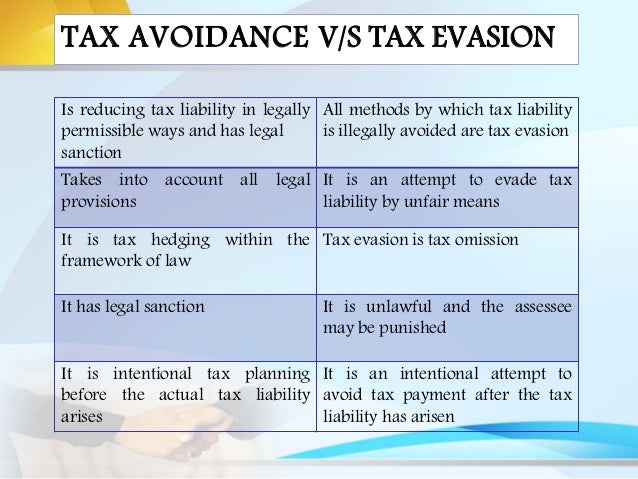

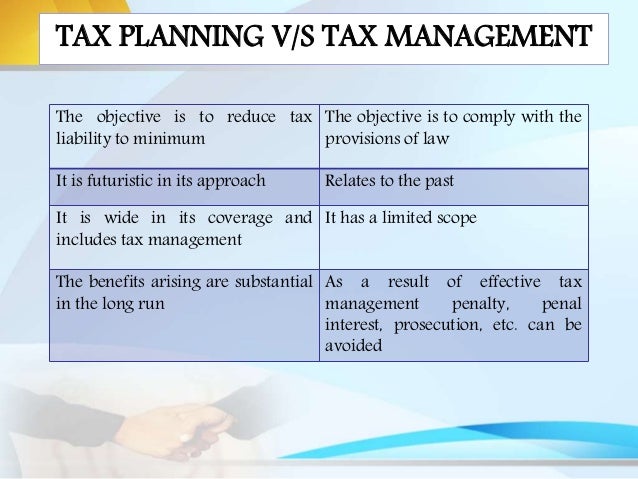

Tax planning tax management 2. Tax evasion is the general term for efforts by individuals corporations trusts and other entities to evade taxes by illegal means. Difference between tax planning and tax avoidance tax planning tax planning is legal and moral. Tax liability of an individual can be reduced through 3 different methods tax planning tax avoidance and tax evasion.

Tax planning and tax avoidance are the legal ways to reduce tax liabilities but tax avoidance is not advisable as it manipulates the law for one s own benefit. It is harmful to the society and nation. Meaning tax evasion and tax avoidance. Tax avoidance and the interpretation of sections bg 1 and ga 1 of the income tax act 2007.

Tax avoidance is attracting more and more attention from the public. Tax evasion tax avoidance and tax planning are common terms when it comes to taxpayers manners for tax reduction. Tax evasion tax avoidance and tax planning in australia. The regulatory responses and taxpayer compliance revenue law journal 2011.

Tax avoidance tax evasion and tax planning. The thesis assesses various definitions.